Dalal Street Week Ahead | Last week of Q3 earnings, inflation numbers to keep traders busy

Market likely to be rangebound in coming days

Indian equity markets ended lower for the week ended February 10 amid high volatility as the US Fed and RBI diminished hopes of early rate cuts. Going ahead, last leg of Q3 FY24 earnings, January inflation numbers of India and the US could keep markets volatile, believe analysts.

In this week gone by, Nifty shed 71.3 points or 0.32 percent to finish at 21,782.5, while BSE Sensex fell 490.14 or 0.67 percent to end at 71,595.49. Despite the selloff in broader markets on Friday, Nifty Midcap 100 closed 0.85 percent higher for the week while Nifty Smallcap 100 fell 0.05 percent.

On the sectoral front, Nifty PSU Bank index added 5 percent, Nifty Healthcare index gained 4.4 percent, Nifty Oil & Gas index rose nearly 4 percent, Nifty Pharma index up 3.9 percent, Nifty Pharma index up 3.6 percent and Nifty Media index up 3 percent. Nifty Bank fell 0.73 percent.

While PSU banks gained on back of expected treasury gains on government binds, private banking stocks fell on liquidity concerns after RBI policy meet. In big stock-specific moves, ITC fell 6 percent as foreign investor British American Tobacco announced its intend to sell some stake.

“Caution prevails in the market ahead of the release of US, UK, and Indian inflation data next week, while the US 10 yr yield is inching higher,” Vinod Nair, Head of Research, Geojit Financial Services said.

Here are 10 factors to watch out for:

Earnings

Over 1000 companies would be announcing their Q3 FY24 results in the coming week, thus ending the earnings season. Among the major ones announcing results are Mahindra & Mahindra, Eicher Motors, Hindustan Aeronautics, Mazagaon Dock Shipbuilders, and Phoenix Mills.

Story continues below Advertisement

Other companies announcing results are Anupam Rasayan, Cera Sanitaryware, Galaxy Surfactants, Edelweiss Financial Services, Khadim India, Samvardhana Motherson International, Bharat Electricals, Coffee Day, Borosil, and others.

India inflation

The Ministry of Statistics and Programme Implementation will announce Consumer Food Price Index (CPI) numbers for January on February 12. India’s retail inflation likely eased to a three-month low of 5.09 percent in the month, according to economists polled by Reuters.

The Reserve Bank of India in its monetary policy committee meeting held last week maintained its 5.4 percent inflation projection for FY24. The central bank governor, Shaktikanta Das highlighted that headline inflation moderated to an average of 5.5 percent during April to December 2023, from 6.7 percent during the whole of 2022.

US inflation

U.S. Bureau of LaborStatistics’ revised inflation figures for 2023 will be released on February 12. It aims to reflect how prices behaved over the year more accurately than the monthly announcements. “This is something the Fed are watching, and Governor Waller explicitly mentioned these revisions in his speech last month, so it’ll be an important one for the timing of any rate cuts,” Deutsche Bank strategist Jim Reid said.

U.S. inflation data for January will also come on February 13. Economists expect the overall CPI reading to come in at 2.9 percent on an annual basis in January, down from 3.4 percent in December 2023.

Primary market action

Among mainboard IPOs, Appejay Surendra Park Hotels will get listed on the exchanges on February 12. Rashi Peripherals, Jana Small Finance Bank, and Capital Small Finance Bank will get listed on the bourses on February 14. Entero Healthcare Solutions will close its subscription on February 13. Vibhor Steel Tubes will close its subscription on February 15.

In SME IPOs, Rudra Gas Enterprise and Ape Solar Enterprise will close its subscription on February 12. February 16 and February 19 is the last day for investors to subscribe to Polysil Irrigation Systems and Wise Travel India respectively.

FII flows

Foreign institutional investors (FIIs) sold equities worth of Rs 5,871.45 crore in the week gone by, while domestic institutional investors (DIIs) have provided support by buying equities worth Rs 5,325.76 crore.

V K Vijayakumar, chief investment strategist at Geojit Financial Services said, “The main trigger for FII selling is rising bond yields in the US. In the last fortnight of January, FPIs were massive sellers in financials. For long-term investors, there is value in banking stocks now.” He also said that FPIs were buyers in IT and telecom, which explains the resilience of the leading players in these segments.

Oil Prices

Oil prices settled higher by about 6 percent for the week amid mounting worries about supply from the Middle East. Brent crude futures settled at $82.19 a barrel. U.S. West Texas Intermediate crude futures settled at $76.84 a barrel. As India’s oil import dependency is over 80 percent, rising crude prices is a worry for the nation.

Technical view

For Nifty, the next support is at 21,650 and a breach of it can lead to a correction towards 21,400. On the upside, key hurdles are placed at 22,000-22,100, according to Arvinder Singh Nanda, Senior Vice President, of Master Capital Services.

For Bank Nifty, the 50-day Simple Moving Average (SMA) stands as a robust resistance points at 46,300 and the crucial support of the 200-day Moving Average (DMA) is situated at 44,800. “A breach below these levels could potentially test the 44,000 mark in the upcoming trading session,” Om Mehra, Technical Analyst, SAMCO Securities said.

F&O Cues

Options data indicated that 22,000 is expected to be a key hurdle for the Nifty 50 on the higher side, with key support at 21,500 as decisive breaking on either side of this range can decide the next course of action. Till then, the index is likely to remain in this range.

As per the weekly options data, the maximum Call open interest was seen at 22,000 strike, followed by the 23,000 strike, and 22,700 strike, with meaningful Call writing at 22,700 strike, then 22,500 and 22,200 strikes. On the Put front, 21,500 strike owned the maximum open interest, followed by 21,000 & 20,500 strikes, with writing at 21,500 strike, then 20,500 and 21,700 strikes.

Meanwhile, the India VIX, the fear index, remained on the higher side for fifth consecutive week indicating the possibility of higher volatility in the coming days. The VIX jumped 5.1 percent to 15.45, from 14.7 levels on the week-on-week basis.

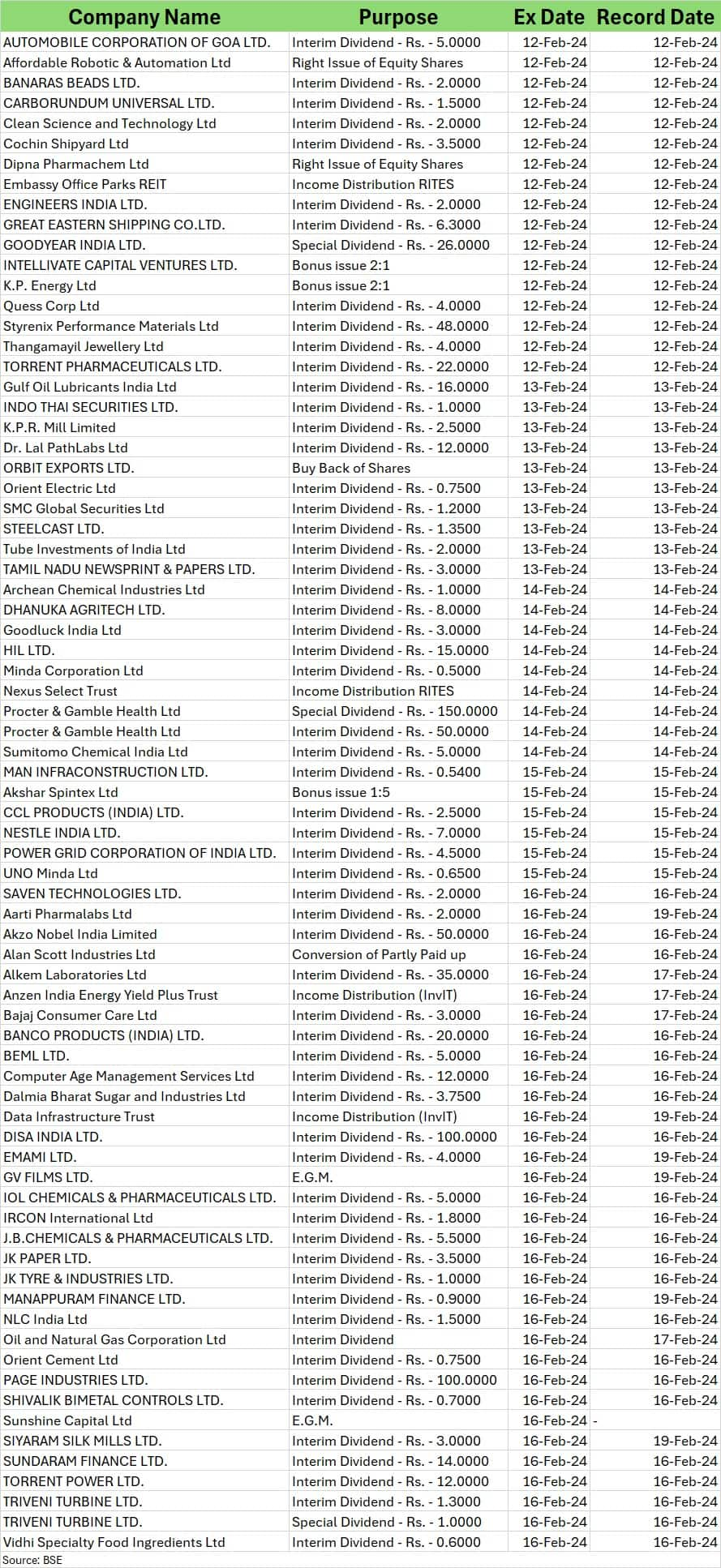

Corporate Action

Here are key corporate actions taking place in the coming week:

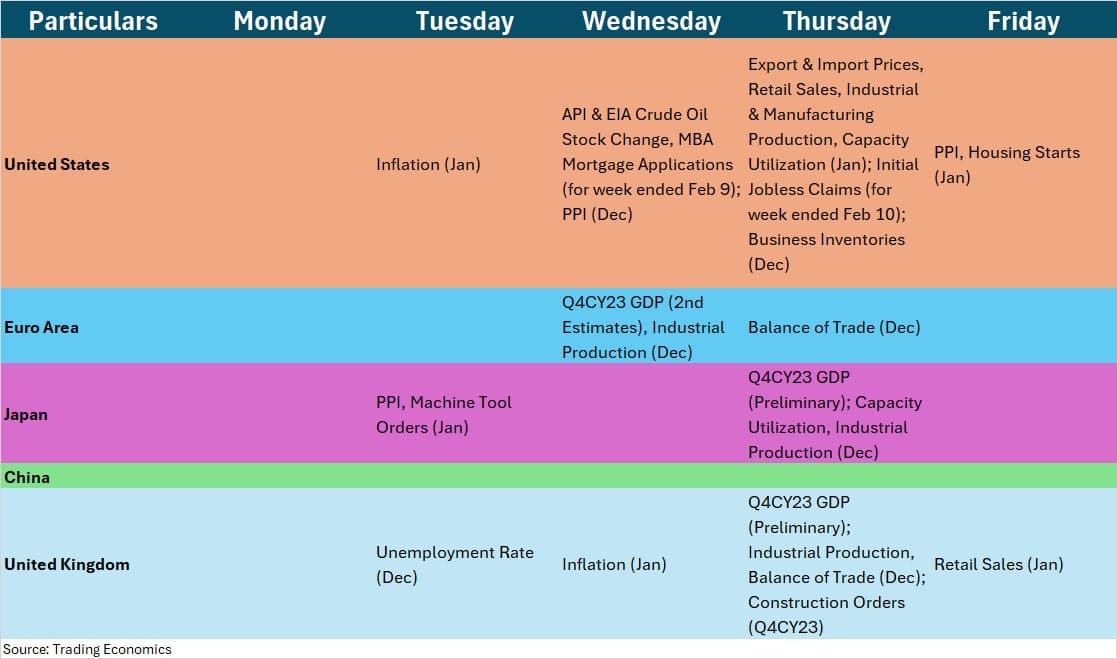

Global Economic Data

Here are key global economic data points to watch out for next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.