F&O Manual | Indices trade lower; Nifty positive bias above crucial support at 21,650

At 10:53 hrs IST, the Sensex was down 358.45 points or 0.50 percent at 71,237.04, and the Nifty was down 118.10 points or 0.54 percent at 21,664.40.

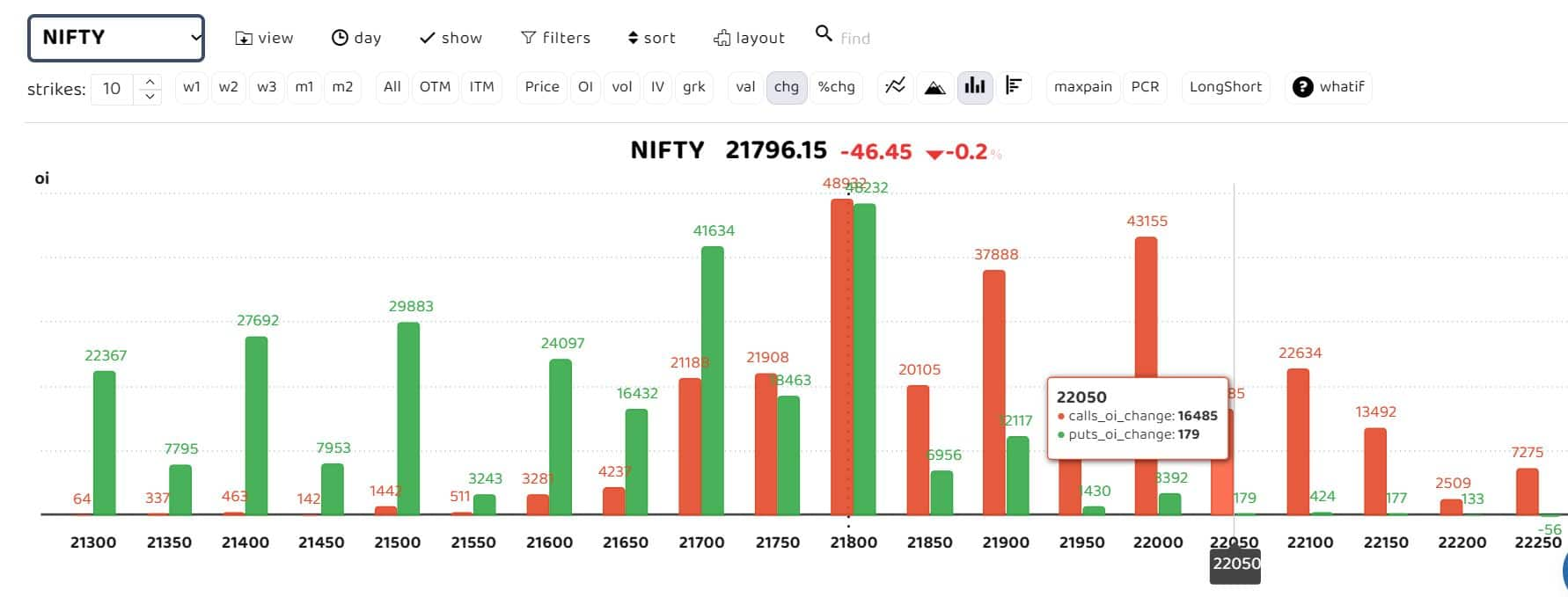

Indian benchmark indices went down in volatile trade on February 12. For the Nifty 50, a significantly higher Call base is positioned at the 22,000 strike for the upcoming weekly settlement, while no major Put base is in sight. Experts observe that the Nifty has reverted from the 21,650-21,700 levels on multiple occasions; only a move below these levels may lead to further weakness.

The volatility index, VIX, reading was up 2 percent to 15.88, suggesting that the uncertainty will stay on for some time. According to analysts, this suggests that option writers are establishing positions in anticipation of a price range between 21,500 and 22,100.

“Considering most events and results from heavyweights are now concluded, the current high volatility suggests exercising caution. Therefore, a move below the 21,650 levels may prompt additional declines in headline indices,” ICICI Securities said.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests that 21,800, 21,750, and 21,700 form the key straddle positions. “The 21,500 put and the 22,000 call options have the highest open interest. While writing at the 21,500 put gained traction, deep out-of-the-money calls from 22,200 to 22,700 strikes saw fresh open interest additions, hinting at speculative buying bets,” Akshay Bhagwat, senior vice-president of derivatives research at JM Financial, said. “The VIX, currently at 15.88 up 2 percent, suggests that option writers are setting up positions with the expectation of a price range of 21500-22100.”

Bhagwat’s day trading view is positive as long as Nifty holds above 21650, with an upside target of 21,850/21,900.

“The Nifty 50 index is perceiving a weak bias on Monday, with writing pressure at 21,700 CE and 21,750 CE. On the downside, if the index breaches 21600 mark, the selling pressure may start building up longs in 21700 PE. The trend on Monday remains fragile and tilting lower,” Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

“Despite the highest open interest seen in 22,000 CE and 21,800 CE, 21,500 PE is observing concentration, implying a negative bias,” he added.

Story continues below Advertisement

Follow our live blog for all market action

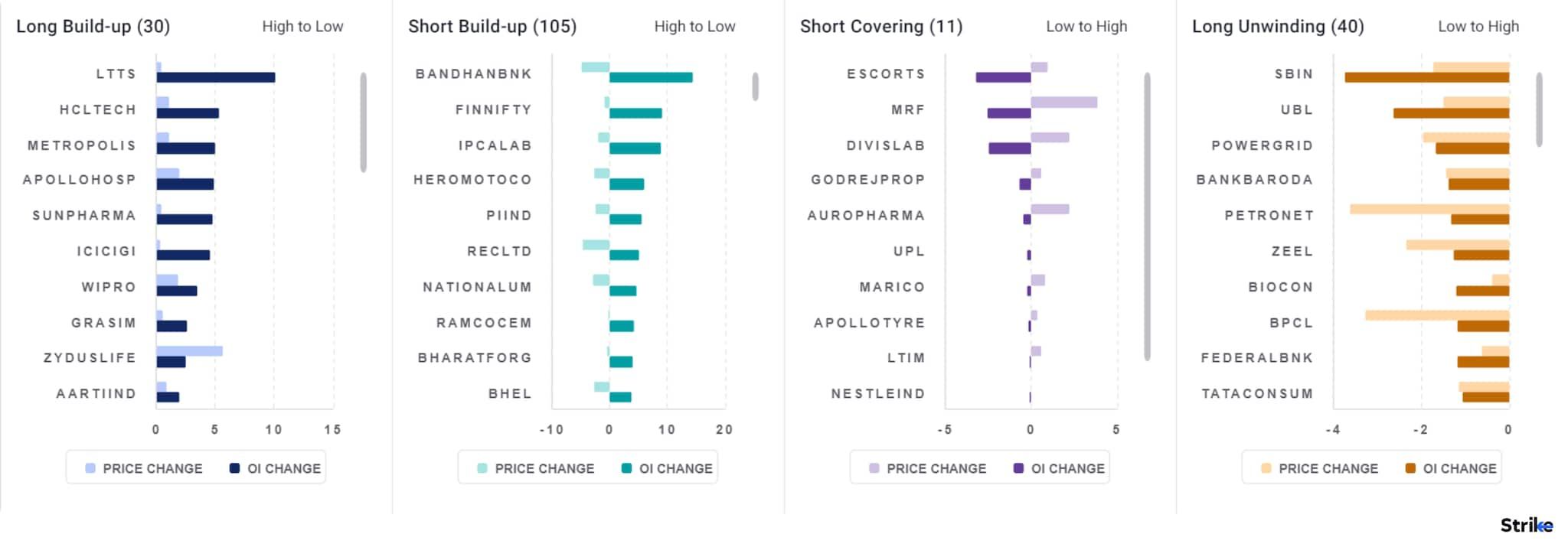

Among individual stocks, long build up is observed in HCL Tech, Metropolis, Sun Pharma. While long unwinding is seen in PSU Banking stocks like SBIN, Federal Bank and Bank of Baroda.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1296348323-44c7aca2cbb14d2f84b65b393fec649a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-171349083-062edb8f4c13435797d038746c27422f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-21669937071-728bfabe684b4c8aa17fc9c47255a740.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1338457868-a84a285627f64532a38b290e15fc48ea.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1440361960-8ba9445e90a74d6d9177d1c88bd6608b.jpg)