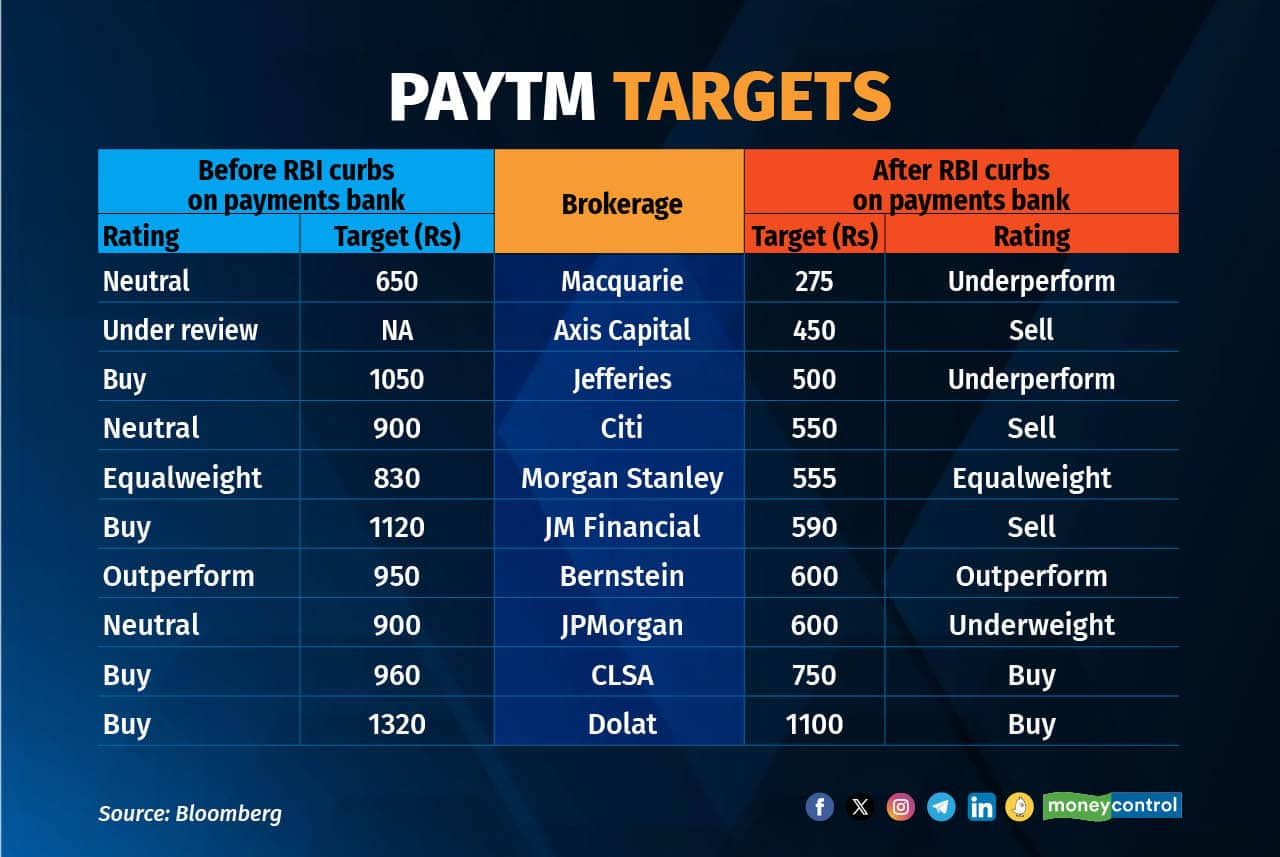

MC Markets Graphixstory: Brokerages cut Paytm’s target price by 20-60% after RBI diktat

Apart from Macquarie, the sharpest target price cut is from Jefferies. It estimates the direct impact of the RBI action on Paytm’s wallets and payments business to be around 20-30 percent of its EBITDA

It has been two weeks since the Reserve Bank of India imposed restrictions on Paytm Payments Bank (PPB). Following the diktat, foreign brokerages like CLSA, Morgan Stanley, Jefferies, Bernstein have cut their target prices for One 97 Communications (Paytm) by 20-60 percent, with Macquarie the biggest bear on the Street.

While restrictions on PPB do not directly impact the lending business, brokerages seem to be divided on the matter. Some brokerages see a huge customer exodus impacting loan distribution, while some say the impact will only be on the wallets business. PPB houses all of Paytm’s 33 crore wallets.

Macquarie on February 13 gave an “underperform” rating to the stock and cut the target price to Rs 275 from Rs 650. Macquarie’s channel checks suggest that some lending partners of Paytm are re-looking at their relationship with the company due to reputational concerns.

The broking firm sees a 60-65 percent decline in revenues for One97 Communications due to lower payments and distribution revenue.

Macquarie’s downgrade comes exactly a year after it had double-upgraded the stock from to “outperform” from “underperform”.

On the other hand, the biggest bull Dolat Capital Markets believes the company has already announced potential risk from the event which captures the worst case scenario of Rs 300-500 crore on EBITDA.

Story continues below Advertisement

“In our view most of this pain would be front- ended and might see significant volatility in performance in Q4 FY24 and Q1 FY25 financial performance,” it said in a note.

Also Read: RBI consults NPCI, NETC, BBPS ahead of FAQs on Paytm to minimise consumer disruption

Apart from Macquarie, the sharpest target price cut is from Jefferies. It estimates the direct impact of the RBI action on Paytm’s wallets and payments business to be around 20-30 percent of its EBITDA. The brokerage also feels that a reputational impact on lending partnerships can take a 20-25 percent toll on Paytm’s EBITDA.

Jefferies has a target price of Rs 500 on the stock, down from Rs 1,050.

The stock’s last closing price was Rs 380 on the NSE. The stock is now down over 50 percent in the past two weeks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2007594509-ba97533a0736449eb4661aa3324f7d5b.jpg)