F&O Manual | Bulls send indices higher, Bank Nifty sees strong resistance at 47,000

.

The benchmark indices continue to trade higher as the bullish momentum continued in the market. The Nifty surpassed its previous swing high, scaling above 22,125 and forming a higher-top, higher-bottom pattern in the past four sessions. The key support zone for the indices is seen at 22,100-22,125, with resistance at higher levels around 22,250-22,270.

Bank Nifty, on the other hand, has effectively maintained its short-term moving averages of 10 and 20 DEMA, positioned around 46,000. According to experts, the expected range for the day is between 46,800 and 47,000 in the upcoming sessions.

In the broader market, the BSE Midcap index is trading flat, while the Smallcap index is up 0.3 percent. Among sectors, auto, IT, FMCG, metal, and oil and gas are down 0.5-1 percent, while realty, telecom, and media are up 0.5-1 percent.

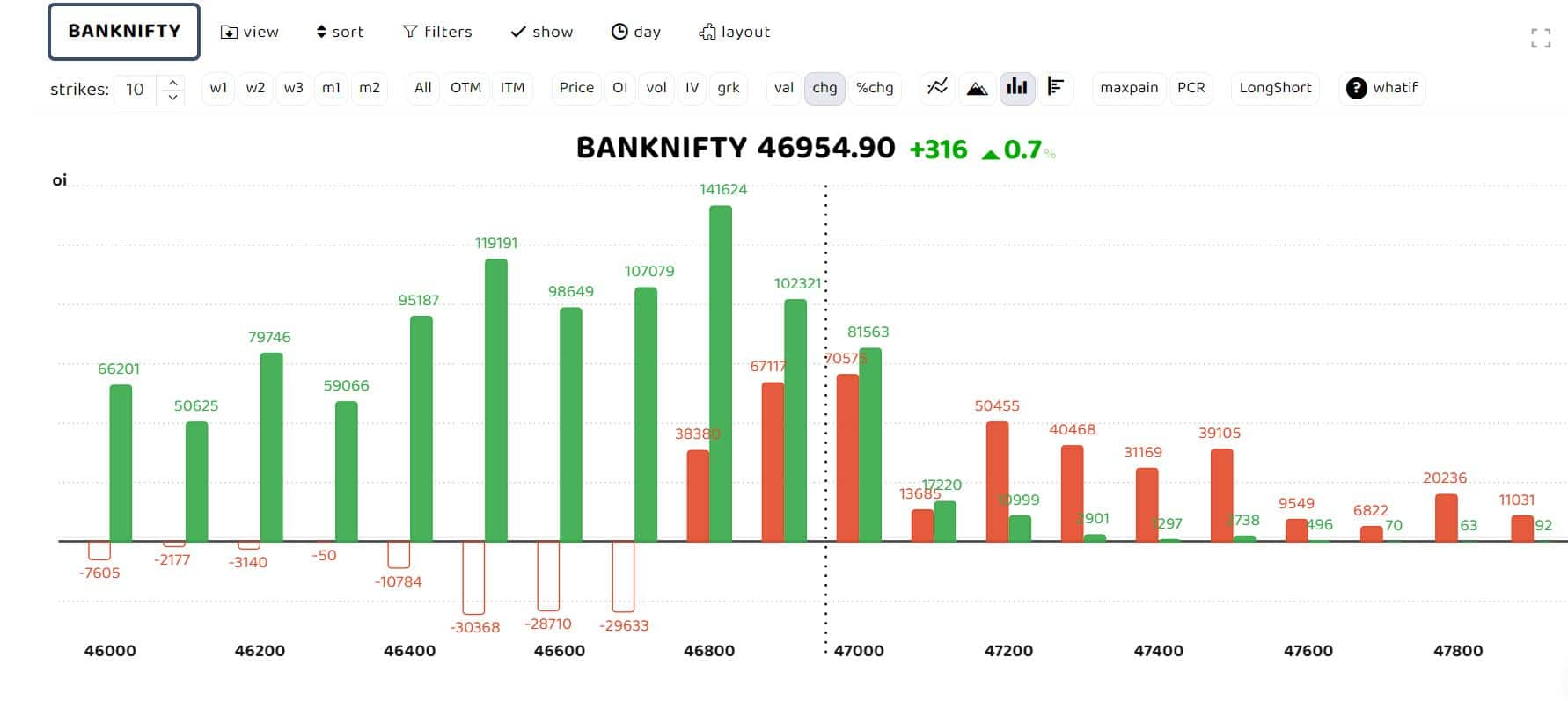

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

For Bank Nifty futures, the day ended with a 0.32 percent increase, and open interest declined by 3.59 percent. The Bank Nifty Put Call Ratio (PCR) is currently stronger at 1.16. Noteworthy call writing is observed at 47,000-47,400 strikes and 46,000-46,800 puts, indicating a range of 47,000 and 46,000 for the coming sessions.

“Bank Nifty has successfully maintained its short-term moving averages of 10 and 20 DEMA, positioned around 46,000. Additionally, the indices have formed a Higher Top Higher Bottom pattern in the past four sessions. Looking ahead, we anticipate strong support in the range of 46,000-46,200, while the 50 DMA level of 46,750-46,800 is expected to act as near-term resistance,” Sudeep Shah, head of derivative and technical research at SBI Securities, said.

Nifty levels

Story continues below Advertisement

“The 22,000 put and the 23,000 call draw highest open interest. Fresh open interest additions to strikes 2 points from At-The-Money (ATM) 22,100 were noted at 22,000 and 22,100 puts, which were double the open interest in calls. A PCR of 1.25 at an Implied Volatility (IV) of 15.9 signals possible put buying in near strikes from ATM,” Akshay Bhagwat, senior vice-president of derivative research at JM Financial, said.

Bhagwat’s as a day trading view advises caution, at resistance. “A fall below 22,100 can see a trigger for long liquidation again.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.