F&O Manual | Indices trade flat; Nifty finds immediate support zone at 22,100-22,000

Representative image

Indian benchmark indices are trading flat amid mixed global cues and high volatility. For the day, experts anticipate Nifty to trade with a positive bias. On the downside, a substantial Put strike is observed at 22,000 and 22,100, which is expected to act as an immediate support area.

Major gainers on the Nifty include Hindalco, JSW Steel, Tata Steel, M&M, and ICICI Bank. On the flip side, the losers are Hero MotoCorp, Infosys, TCS, Tech Mahindra, and Apollo Hospitals.

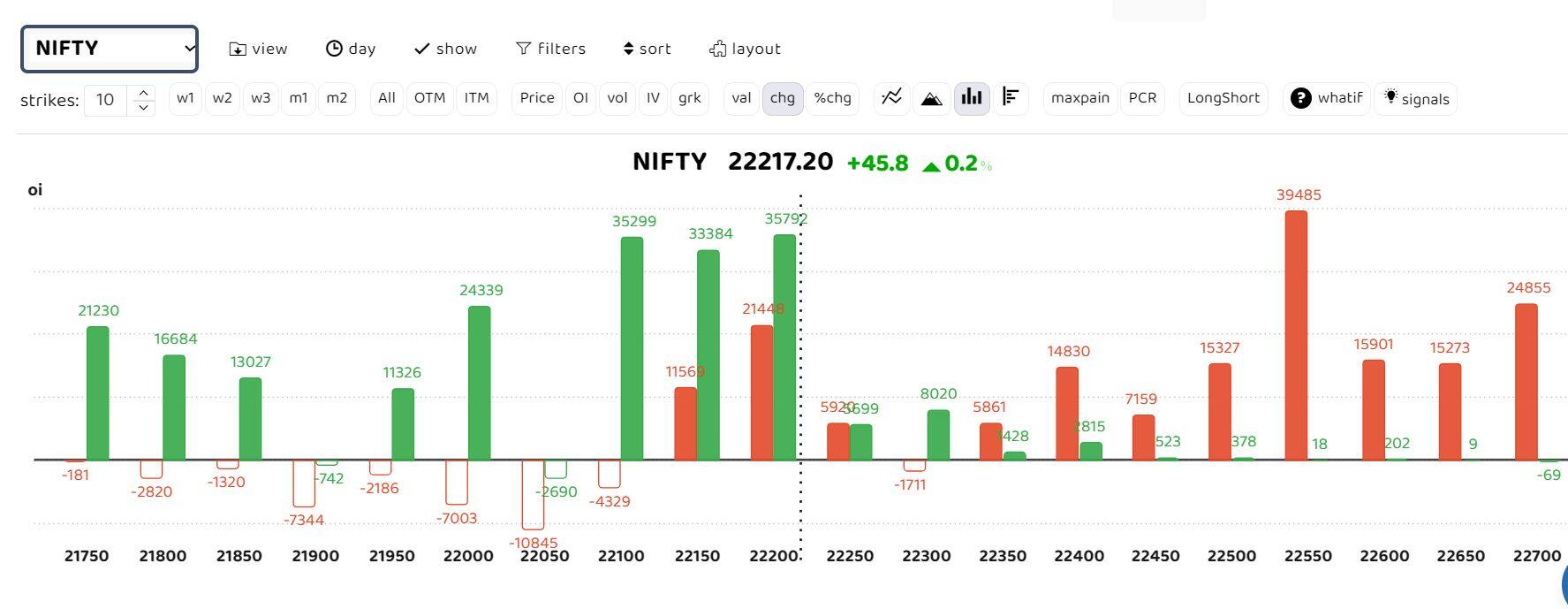

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Open interest data suggests significant Call writing between the 22,200-22,300 strikes, while put writers have increased positions in the 22,000-22,100 strikes. This implies that the expected range for the upcoming sessions could be between 22,050 on the downside and 22,400 on the upside.

Sudeep Shah, DVP and Head of Technical and Derivative Research Desk at SBI Securities, commented, “As long as the index remains above the support zone of 22,070-22,100, the current upward movement could extend towards 22350-22380. Below 22070, the index may witness a correction towards the 21,870-21,950 zone. If the index moves above 22,380, the current momentum is likely to strengthen further towards 22,550-22,600.”

The sustainability above the breakout from the past five weeks of consolidation signifies inherent strength. “This confidence leads us to revise our target to 22,700 for the upcoming weeks, especially as the seasonal correction in an election year approaches maturity (historically, in election years, the index tends to bottom out in Feb/March, followed by a pre-election rally). Therefore, bouts of volatility should not be construed as negative; instead, adopting a buy-on-dips strategy, which has been performing well, is recommended. Throughout this process, strong support is situated at 21,600,” said ICICI Securities.

ICICI Securities further reinforces its positive bias based on the following observations:

A) The faster pace of retracement indicates a robust price structure, with Nifty retracing the decline of the past seven sessions in just four sessions.

Story continues below Advertisement

B) The heavyweight Banking index (commanding >33 percent weight) has formed a strong base at the 200-day EMA.

C) Most global equity markets are hovering around their 52-week highs, indicating buoyant global cues.

D) Steady oil prices and bond yields are likely to act as a tailwind.

The strong rebound from key support highlights elevated buying demand, leading ICICI Securities to revise the support base at 21,600, as it coincides with:

80 percent retracement of the current upmove off the mid-Feb low of 21,530, placed at 21,667.

Read more: Bank Nifty shows breakout with bullish double bottom, poised to test 48,000

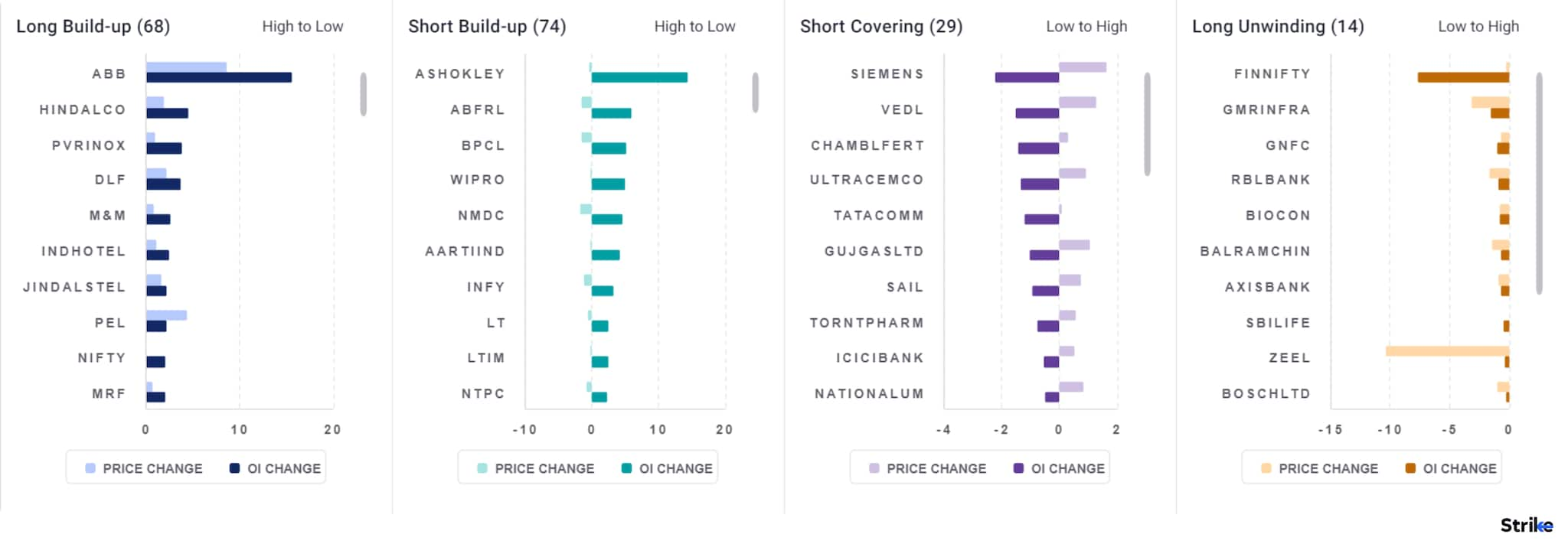

Among individual stocks, ABB India, Hindalco, PVR Inox and DLF are showing long build-up. While Short build-up is seen in BPCL, Wipro and NMDC.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2007594509-ba97533a0736449eb4661aa3324f7d5b.jpg)