F&O Manual | Nifty shows bearish engulfing pattern, downside likely till 21,830

The Magnificent Seven are more than a stock basket.

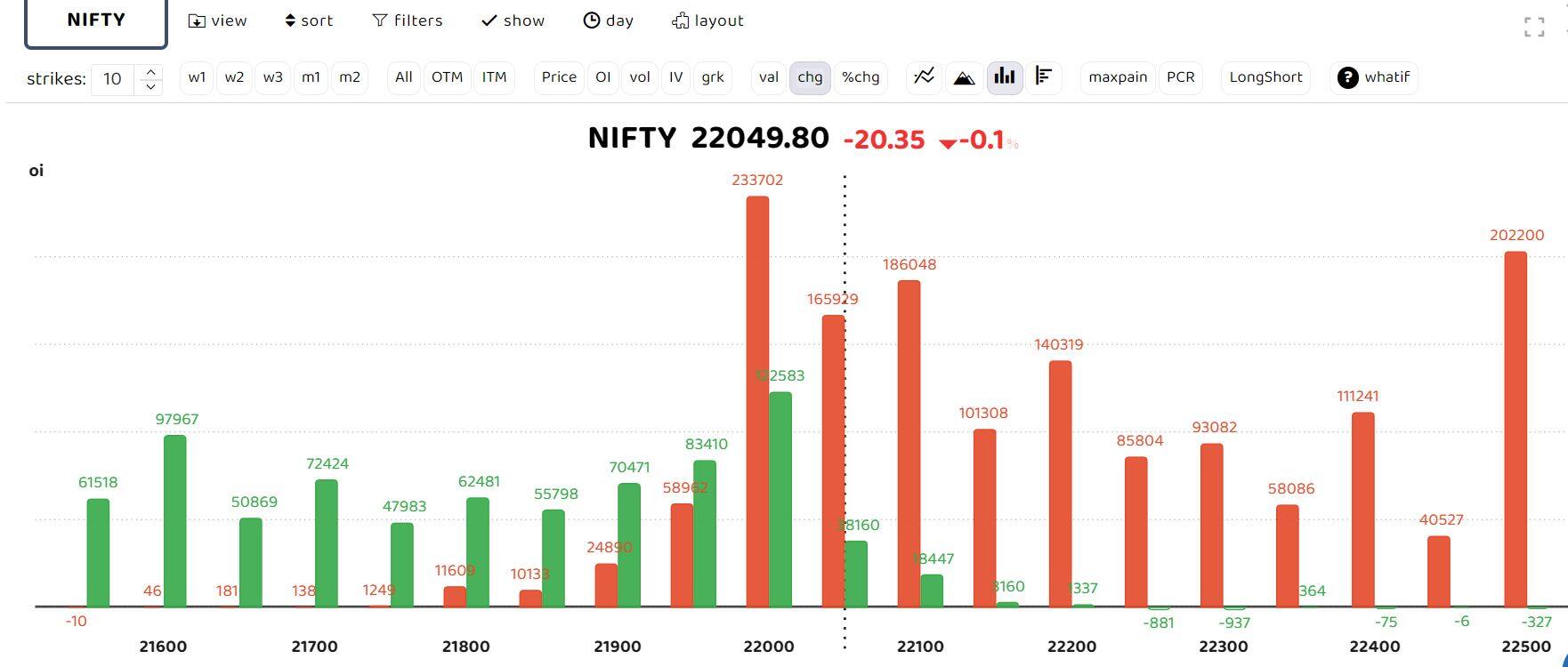

The benchmark Indian indices traded in the red after a flat opening on February 22. The Nifty has formed a bearish engulfing pattern on the daily charts after failing to sustain the levels reached a day before around the all-time high. The indices are anticipated to find support in the 22,000-22,030 zone.

According to experts, a correction might be observed if the index falls below 21,980, with the potential downside extending to the 21,890-21,830 zone.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Meaningful call writing was seen in the 22,100-22,200 strikes, while put writing took place in the 22,000-21,900 strikes. This suggests that the expected trading range for the upcoming sessions could be between 21,900 on the downside and 22,300 on the upside.

“Significant call writing was observed across the 22100-22200 strikes, and put writing was noted in the 22000-21900 strikes, implying that the range for the upcoming sessions could be 21900 on the downside and 22300 on the upside,” Sudeep Shah, DVP and head of technical and derivative research at SBI Securities, said.

“The negative stance taken by Fed officials regarding the swiftness of rate cuts does not seem to sit well with the market. Nifty broke the crucial support of 22,000 following yesterday’s bearish engulfing candle. However, this bearish sentiment may not persist for long. The sharp decline in Nifty is likely a knee-jerk reaction, and the downside move may be limited,” Sheersham Gupta, director and senior technical analyst at Rupeezy, said.

“The immediate support for Nifty is at 21,850, where its 20-EMA also resides, followed by 21,750. For bullishness to return to the markets, Nifty will need to close above 22,000.”

Story continues below Advertisement

Follow our live blog for all market action

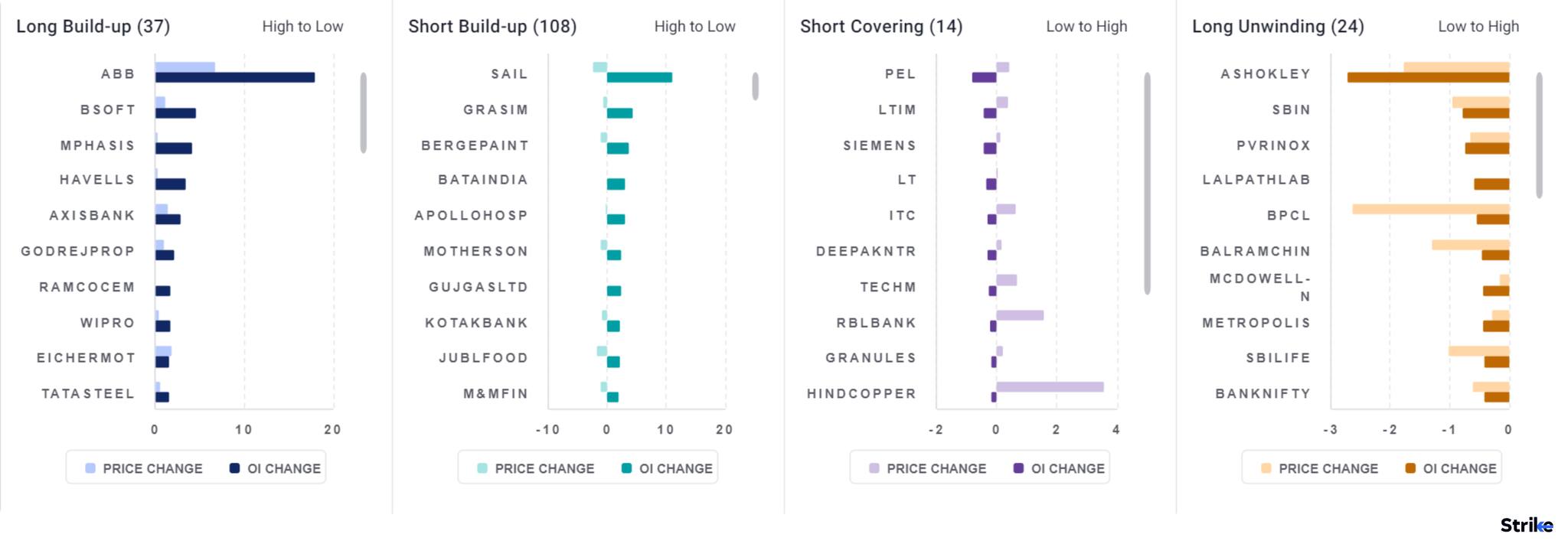

Among individual stocks ABB, Birla Soft, Mphasis and Axis Bank witness long build-up. While short build up is observed in SAIL, Grasim, Bata India and Apollo Hospital.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.