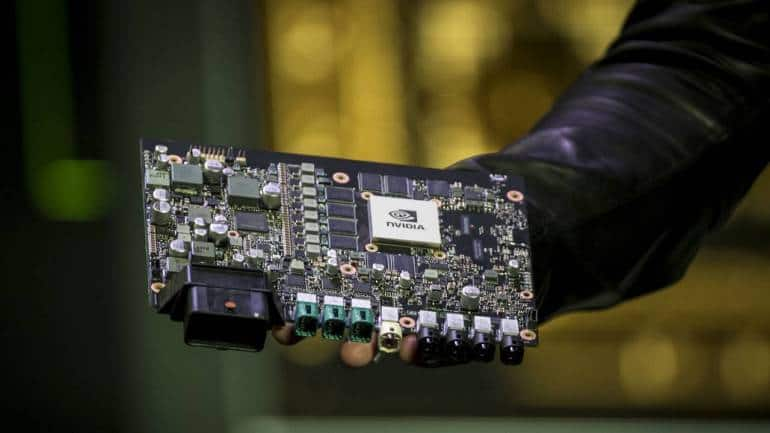

Nvidia adds $277 bn in m-cap on bumper Q4, beats Amazon to become 3rd most valuable US firm

The company has projected that its revenue for the current quarter will reach $24 billion

Nvidia shares closed 16 percent higher in the US trading last night after a stellar Q4 earnings show, topping analyst estimates by a healthy margin. Not only that, the stock price hit a record high of $785 and added a massive $277 billion in value, lifting the chip giant’s market cap to $1.96 trillion. With this, Nvidia has become the third largest company in the US by market cap, overtaking Jeff Bezos’ Amazon.

The US tech giant posted revenue of $22.10 billion for its fourth quarter, a remarkable 265 percent year-on-year increase. Concurrently, net income experienced a substantial surge of 769 percent. This impressive performance is attributed to the ongoing enthusiasm and interest surrounding artificial intelligence.

Follow our live blog for all the market action

Nvidia’s single-day surge in stock market value has set a new record on Wall Street, surpassing the previous milestone achieved by Meta Platforms. It achieved this feat following the announcement of its first dividend and strong financial results by the parent company of Facebook.

Nvidia remains optimistic about its future trajectory, with no indications of slowing down. The company has projected that its revenue for the current quarter will reach $24 billion, significantly surpassing earlier estimates.

“Fundamentally, the conditions are excellent for continued growth in 2025 and beyond,” Nvidia CEO Jensen Huang told analysts on Wednesday, adding to the bullish sentiment around the stock.

Nvidia’s significant gain has propelled it to become the third-most valuable company in the U.S. stock market, surpassing Amazon.com and Alphabet. As of now, Microsoft and Apple hold the top spots, being valued at $3.06 trillion and $2.85 trillion, respectively.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Story continues below Advertisement