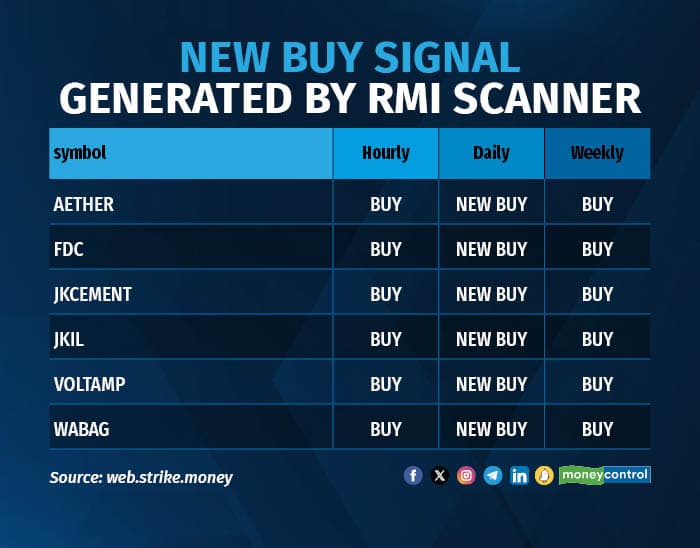

These 6 stocks generate ‘buy’ signal on RMI scanner: Do you own any of them?

Momentum Stocks

The Nifty lost 99 points to close at 20122 levels. In the February 26 trading session, we saw SBI Life Insurance, Adani Ports, Adani Enterprises, Sun Pharma, Dr Reddy’ Laboratories and Cipla close within 1 percent of their respective 52-week highs.

Price Volume breakout was seen in Data Patterns, Adani Energy Solutions, Sobha, PB Fintech, Infibeam Avenues, Bharat Dynamics and Mahindra Holidays.

We find some shares generating a ‘new buy’ signal on the daily time frame, according to the RMI scanner. The Rohit Momentum Indicator (RMI) generates buy and sell signals. It is a non-range bound indicator.

Aether Industries: Aether shares are down by nearly 1.47 percent on a year-to-date basis. At the current market price, the market cap of Aether Industries is Rs 11,457 crore and is trading at a PE multiple of 88. Aether Industries Limited is a manufacturer of specialty chemicals.

Fairdeal Corporation (FDC): FDC shares are up by more than 22 percent on a year-to-date basis. FDC (Fairdeal Corporation) Ltd Limited is among India’s leading fully integrated pharmaceutical companies.

JK Cement: JK cement shares are up by more than 15 percent on year to date basis. At current market price the cement manufacturer company is trading at a PE multiple of 49.

JKIL: JKIL shares are trading higher by more than 16 percent on year-to-date basis. J Kumar Infraprojects Limited is engaged in the business of execution of contracts of various infrastructure projects, including transportation engineering, irrigation projects, civil construction and piling work.

Story continues below Advertisement

Voltamp Transformers: The shares of Voltamp Transformers are up by more than 32 percent on a year-to-date basis. Voltamp Transformers Ltd is a Baroda-based company and is mainly into manufacturing of various types of oil-filled power and distribution transformers of various classes.

Va Tech Wabag: The shares of Va Tech Wabag are up by more than 26 percent on year-to-date basis. Va Tech Wabag Ltd is engaged in the business of water treatment field. Its principal activities include design, supply, installation, construction and operational management of drinking water, waste water treatment, industrial water treatment and desalination plants.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.