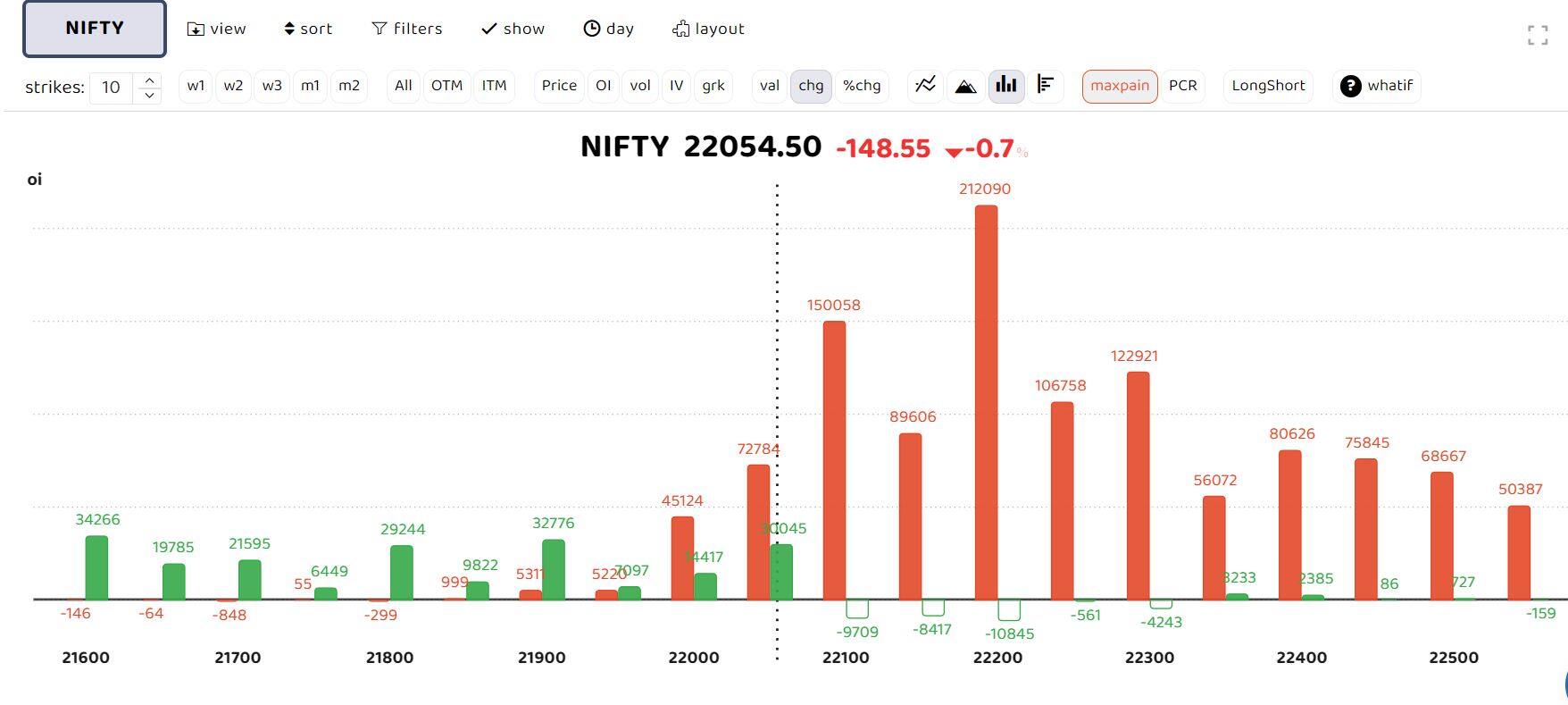

F&O Manual | Indices under selling pressure, Nifty faces resistance near 22,250

At 12:14 hrs IST, the Sensex was down 485.86 points or 0.66 percent at 72,609.36, and the Nifty was down 158.20 points or 0.71 percent at 22,040.10. About 656 shares advanced, 2578 shares declined, and 54 shares unchanged.

The Indian benchmark indices were trading in the red on February 28 afternoon after a sideways opening. The indices appear to be in a consolidation phase, awaiting a fresh trigger for the next bull rally.

The Nifty encountered selling pressure in 22,000-22,250 range, making it a significant resistance zone. The index needs to go past and close above the level for a new uptrend, experts said.

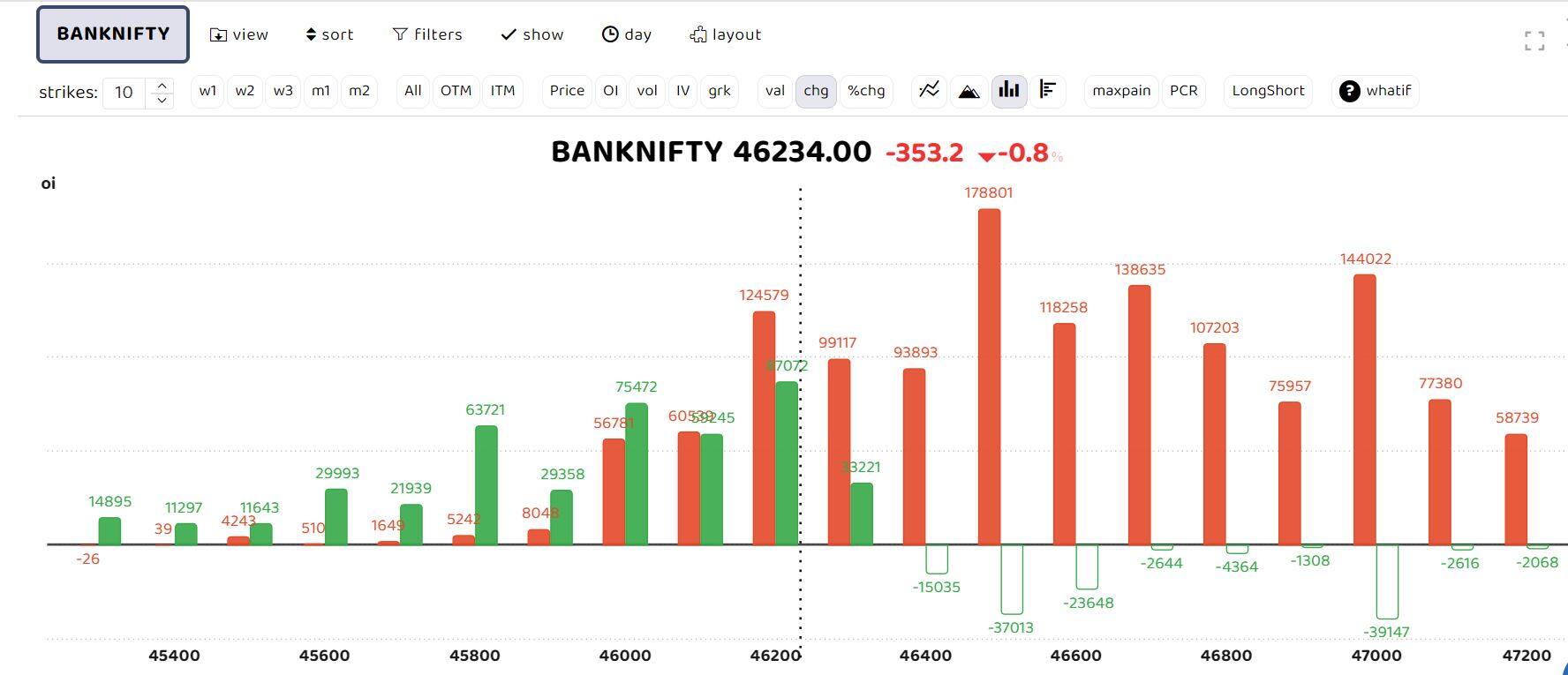

Bank Nifty, too, traded down. According to experts, as long as the banking index closes above 46,000, the outlook will remain positive. On the downside, support is identified between 46,300 and 46,400, while the index is likely to face resistance at 46,800-46,900 and 47,350-47,400.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Option data suggest that call writers are dominant. As per Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox, “Nifty 50 index continues to observe selling pressure around 22,000-22,250 levels, which appears to be a selling pressure zone. To signal a new uptrend, the price action must deliver promising close over this hurdle for 2-3 sessions. When that happens, fresh upside towards 22700, and 23000 cannot be ruled out.”

Traders should avoid taking over leverage position and stay clam until a clear picture emerges. “Option data implies shifting of momentum to PE, with the 22300 strike price witnessing strong concentration. If the index continues to struggle, the price action may favour bearish bias and index may slide towards its next support of 21734, its 50-simple moving average (SMA), ” Bagkar added.

Bank Nifty

The red bars indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

The red bars indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

Story continues below Advertisement

Bank Nifty underperformed the Nifty but its short-term trading chart setup will remains positive as longs as it stays above 46,000. As per Tejas Shah, vice-president, technical research, JM Financial, “As long as Bank Nifty is trading above 46,000 on a closing basis, the outlook remains positive. Exponential moving average which is currently placed at 46,250 levels. On the downside, the support zone lies at 46,300-400 / 46,000 while the resistance is seen at 46,800-900 / 47,350-400.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.