March series standouts: 3 stocks that are defying average volumes

.

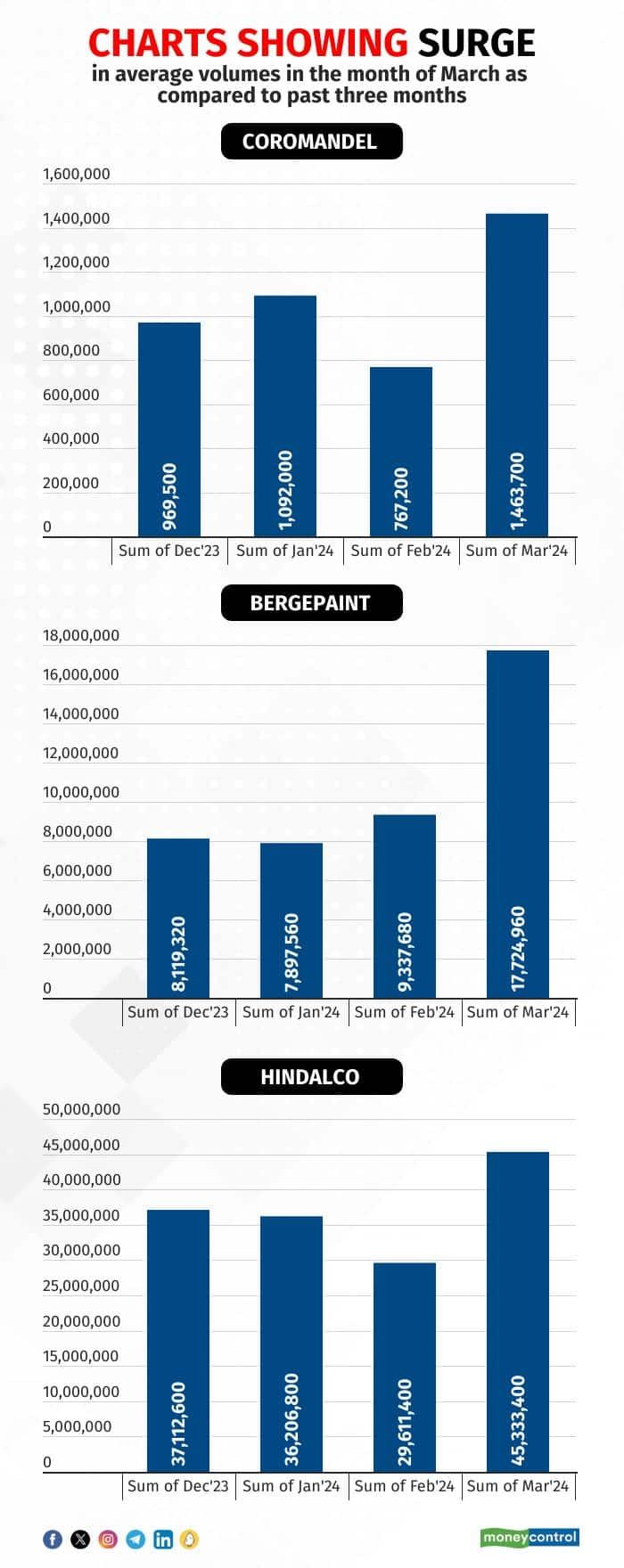

The benchmark Indian indices traded flat as sideways momentum continued after last week’s rally which saw the Nifty scale a new high above 22,300. Volume-based activity data indicates strong activity in scrips such as Coromandel, Berger Paints, and Hindalco.

According to Rajesh Srivastava, a derivatives trader, volume data at the beginning of the March Series reveals that counters of Coromandel, Berger Paints, and Hindalco have experienced a surge in volume compared to the three-month average, suggesting that these stocks will be in focus in the March series.

Graphs below depict how volumes on these scrips have shown a rise at the start of the month series.

Data source: Rajesh Srivastava

Data source: Rajesh Srivastava

In terms of price action, here’s what Avdhut Bagkar, derivatives and technical analyst at StoxBox, has to say about each of the scrip:

Hindalco Industries Ltd

Shares of Hindalco Industries have violated key supports of the 50-day simple moving average (SMA) and 100-day SMA at 559 and 530.70. The price action symbolises a negative bias. To mark the upward trend, the stock must sustain over 100-day SMA to visualise the underlying bullish build-up. The major breakout is over 559, its 50-day SMA. On the downside, the 200-day SMA placed at 485 serves as the bolstering mark.

Coromandel International Ltd

Story continues below Advertisement

The price action is hovering around the 200-day SMA placed at 1,083, symbolising accumulation scenario. This momentum needs to break out over 1,125 to embark on the fresh up-move. Until that happens, a closing basis support of 1,050 should indicat smart reversal moves. A significant breakout over 1,050 would entice bulls to ride the breakout rally, leading a move to 1,200.

Berger Paints India Ltd

Despite crossing above-average volumes lately, the price action is unable to hold the momentum over the hurdle of the 610 mark. While 560 -540 continues to witness accumulation, only a definite outlook would emerge once the price action takes out 610 mark. Thereafter, a move towards 650 cannot be ruled out.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.