Price-volume action in banking stocks signal resurgence; PSU lenders outperform

Representative image

The Nifty Bank index saw an upsurge this week, driven by fresh triggers for a rally banking stocks, and eventually leading to a breakout on largecaps and a resurgence of up-move in PSU banks.

Despite strong selling pressure on stocks of public sector undertakings on February 6, state-run banks showed resilience and relative outperformance, aided by robust trading volumes.

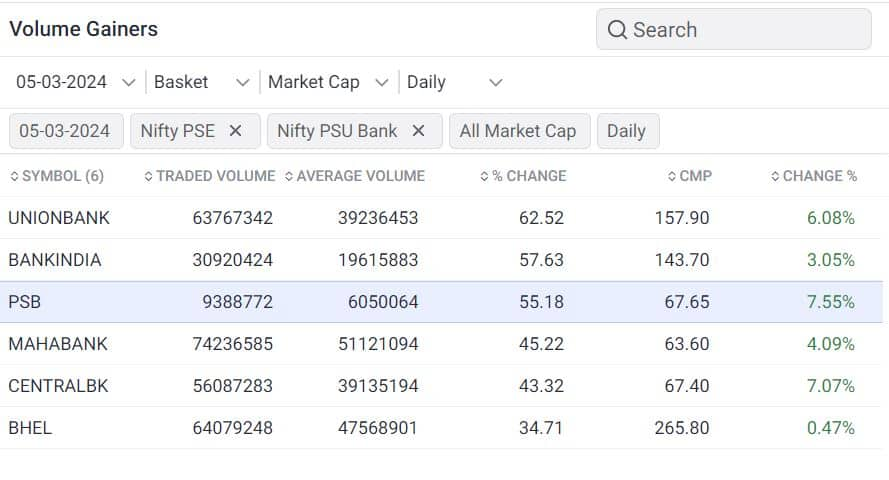

The chart below illustrates that Union Bank, Bank of India, Central Bank, PSB, and Maharashtra Bank stand out as the top volume gainers in the Nifty PSU index on March 6.

On Tuesday, shares of public sector banks witnessed a significant surge, accompanied by strong volumes, resulting in a 5 to 9 percent increase in share prices. Volumes traded surpassed the average of the last 10 sessions.

“Stocks such as Central Bank of India, Bank of India, Indian Overseas Bank, Bank of Maharashtra, UCO Bank, and Union Bank of India denote resilient price action, with the Relative Strength Index (RSI) indicating more room for upside. Union Bank of India and Canara Bank have scaled new 52-week highs, while State Bank of India hit a historic peak. The price action suggests further upside of nearly 7-10 percent in the following sessions,” Avdhut Bagkar, technical and derivative analyst at Stoxbox, said.

“Technically, PSU bank stocks look very strong on daily and weekly charts, and these stocks can outperform going forward. Breakout occurred long back, and the stocks are resuming their uptrend. Our top picks in the PSU banking space are SBI, Canara Bank, and Bank of Baroda. The momentum is strong, and volumes are reasonable in these counters or stocks,” said Tejas Shah, vice-president of technical research at JM Financial.

Story continues below Advertisement

Stock-specific levels for PSU banks

“Union Bank of India has a breakout over the 157-mark, leading a rally to 175 from a medium-term perspective. An unrelenting move over 600 shall propel Canara Bank to a new all-time high of 620, followed by the 640 level. To embark on the new journey, Indian Overseas Bank, Bank of Maharashtra, and UCO Bank must surpass crucial hurdles of 73, 64, and 43 respectively. Stocks on breakout could easily garner 7-10 percent upside,” said Bagkar.

Also read: Bank Nifty hits 48,000 on expiry day, crucial support now at 47,700

Large-cap banks levels to watch out

“Bank Nifty has broken the high of the HDFC Bank result day, which is a very good breakout. It had been underperforming for quite some time, and now with the backing of heavyweight banking stocks, sector rotation is likely to zero in on Bank Nifty for the next round. The probability is very high for the index to clear the all-time high of 48,363 and move higher in the near term,” Shijumon Anthony, a derivatives trader, said.

Anthony shares his views on stock-specific price action…

HDFC Bank

After hitting the bottom at 1,363 on February 14, HDFC Bank started seeing some buying interest. Still, for being a buyer in this stock, I would like to see it closing above 1,481, from where it can take off real quick.

ICICI Bank

It’s already on a breakout and the invalidation point on the downside is 1,038 on a closing basis. It’s in uncharted territory for which trailing the stop is a better option than defining the target.

Kotak Bank

The worst performer in the banking index is near a dangerous point – 1,626 – below which there can be good momentum on the downside. It’s been consolidating with a negative bias for nearly four years. So, I would be a buyer only above the all-time high, which is too far. Not thinking of a long position in this stock anytime soon.

Axis Bank

Another strong stock that is on a breakout. My invalidation point is 1,020 on a closing basis.

SBI

A recent fresh breakout made the stock the most bullish one in the Banking index. My invalidation point is 737 on a closing basis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions