Bank Nifty trades sideways. Here’s how analysts are positioning today’s expiry

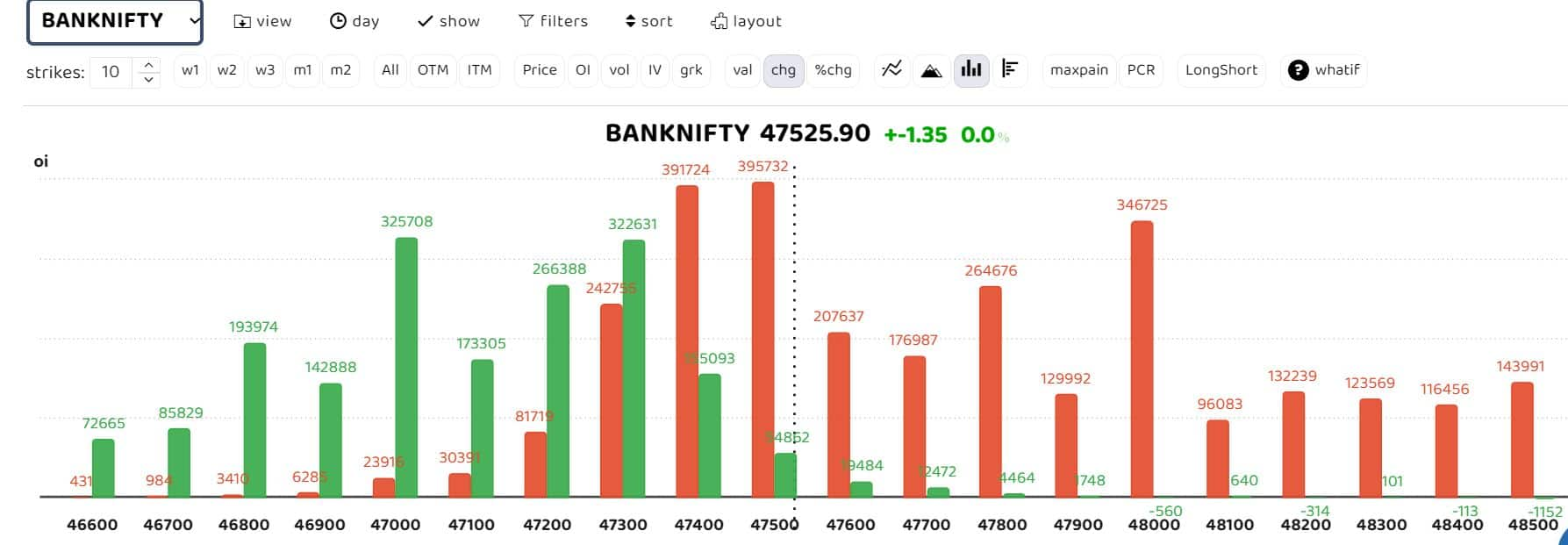

Data indicates that the 47,000-47,100 range serves as a robust support zone, with high conviction among put writers. Conversely, 47,500 marks the primary resistance level, with active call writers.

Bank Nifty erased early gains to trade flat with sideways momentum in the morning session on March 13, the weekly expiry day for the 12-pack banking index.

At 11.17 am, Bank Nifty was trading at 47,230.45, down 0.11 percent from the previous close.

Analysts expect Bank Nifty to trade between 47,000 and 47,500 levels during the day as Put and Call strikes holds sizeable open interest.

Bars in red indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

Data suggests that 47,000—47,100 remains strong support zone with put writers having high conviction, while 47,500 remains first resistance where call writers are active.

“Short covering may evolve if the index crosses 47,500 decisively, while the 47,000 mark is expected to be held in the today’s trade. The positional range of the banking index is pegged in between 46,800-48,000 for the coming few sessions with bias on the bullish side from current juncture,” Arun Kumar Mantri, Founder of Mantri Finmart, said.

Also read: Nifty expected to trade rangebound to positive, crucial support at 22300

Story continues below Advertisement

Bank Nifty is in a tight range. “I would look for going long if it sustains above 47,500 comfortably. If it breaks down below 47,180 and sustains there, I would look for sell-on-rise opportunities. For now it’s in a no-trade zone,” derivatives trader Shijumon Anthony said.

Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox said Bank Nifty weekly expiry is witnessing a sideways trend, between the range of 47,500 and 47,050.

“An aggressive move over 47,500 could see the price heading in the direction of 48,000 mark. However, a definitive breach of 47,050 would trigger fresh sell-off, leading index towards 48,750 -46,800 levels,” Bagkar said.

He favoured a bullish entry in 47,500 CE once 47,500 spot is maintained for 15 minutes; on the contrary side, a violation of 47,050 would signal an entry in 47,000 PE.

“Risky traders may opt for Long Strangle of 47,600 CE and 47,100 PE, with maximum risk of 1000, with unlimited profit,” added Bagkar.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.