Six MFs completely exited Paytm stock; six cut stake sharply in Feb

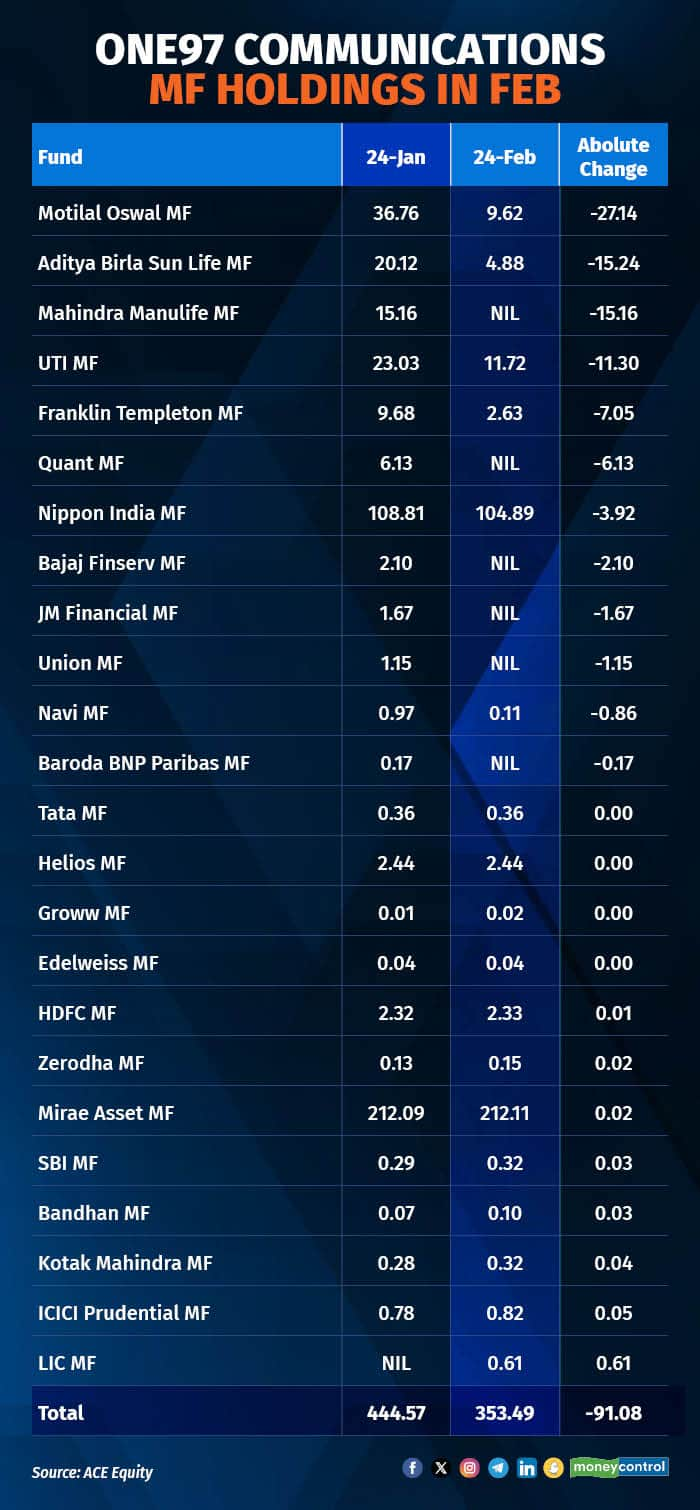

Currently, 18 mutual funds hold Paytm shares valued at Rs 1,426 crore, down from 24 mutual funds in January with a value of Rs 3,384 crore.

Six mutual funds fully exited One97 Communications Ltd, the owner of Paytm, while six reduced their stakes sharply in February. In absolute terms, MFs sold over 91 lakh shares valued at Rs 380 crore. This move followed a significant drop in the stock due to regulatory actions by the RBI.

Currently, 18 mutual funds hold Paytm shares valued at Rs 1,426 crore, down from 24 mutual funds in January with a value of Rs 3,384 crore.

Mahindra Manulife Mutual Fund (15.16 lakh shares), Quant Mutual Fund (6.13 lakh shares), Bajaj Finserv MF (2.1 lakh shares), JM Financial MF (1.67 lakh shares), Union MF (1.15 lakh shares), and Baroda BNP Paribas MF (17,000 shares) have completely divested from Paytm stock.

Motilal Oswal MF led the selling spree with 27.14 lakh shares valued at Rs 113 crore, followed by Aditya Birla Sun Life and Mahindra Manulife MF, each selling over 15 lakh shares worth Rs 63 crore. Other mutual funds, including UTI, Franklin Templeton, Quant, and Nippon, offloaded shares worth around Rs 47 crore, Rs 29 crore, Rs 26 crore, and Rs 16 crore, respectively.

In February, Paytm stock plummeted over 50 percent as the Reserve Bank of India considered revoking the license of Paytm Payments Bank Ltd. The regulator cited multiple lapses, including transactions beyond limits, raising money-laundering concerns. With the central bank ordering a halt to much of its business, Paytm faces mounting troubles as a once-celebrated fintech startup. Despite assurances that the company and its founder aren’t under investigation by the anti-money laundering agency, investor concerns persist.

Recently, Macquarie downgraded One 97 Communications, to “underperform,” slashing the target price to Rs 275 from Rs 650. Analyst Suresh Ganapathy cites a serious risk of customer exodus post Reserve Bank of India’s restrictions on its payments bank, threatening monetization and the business model. The new target price is 33 percent lower than the previous closing price. Ganapathy increases loss estimates by 170 percent /40 percent for FY25E/26E, anticipating a 60-65 percent decline in revenues due to lower payments and distribution revenue.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Story continues below Advertisement