F&O Manual | Indices rebound from red to trade flat, crucial support likely at 21,800

Representative image

The benchmark Indian indices traded flat with negative global cues weighing on the local market on March 14, a day after being marooned by a sudden rush to book profits.

If the Nifty defends the 21,800 mark at close and survives above 22,050 (weekly closing), then it may resume a consolidation trading range between 21,800 and 22,200 for a few days, according to experts.

At 10:26am, the Sensex was up 66.93 points or 0.09 percent at 72,828.82, and the Nifty was up 33.80 points or 0.15 percent at 22,031.50. About 2,194 shares advanced, 1,005 declined, and 71 traded unchanged.

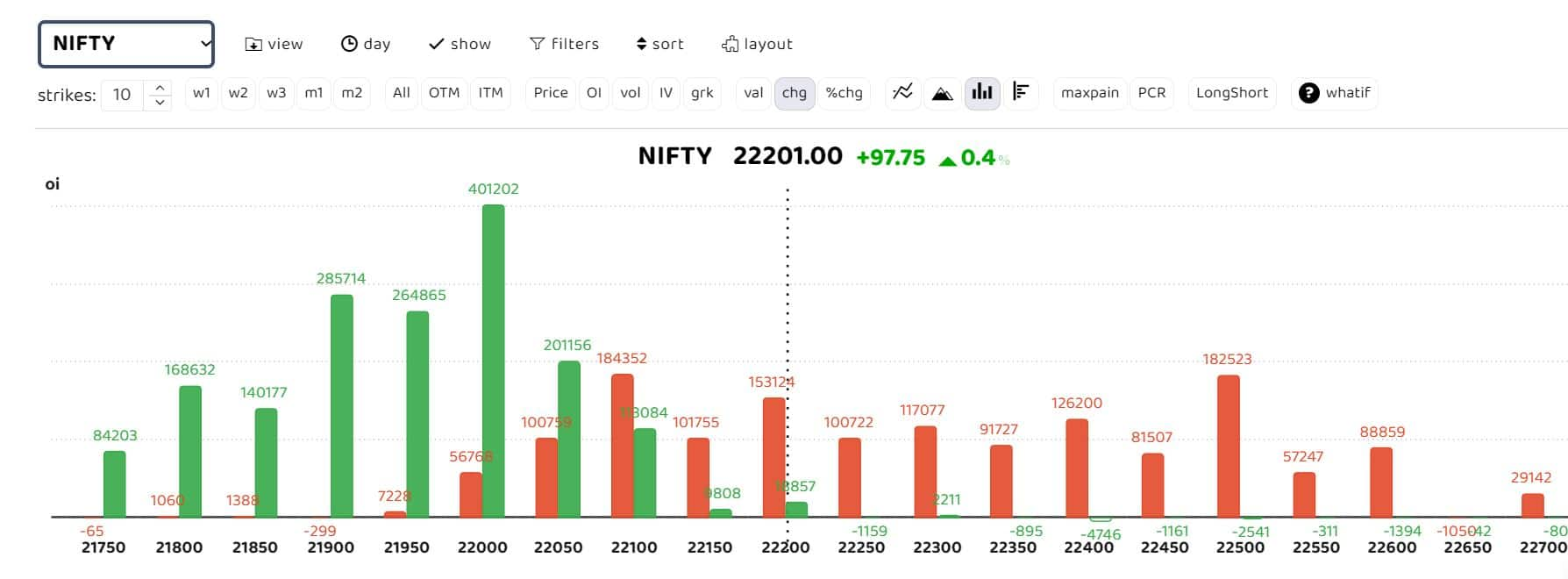

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Option data suggests key straddle positions are being formed at the 22,100 and 22,050 strikes. “If the Nifty defends 21,800 today and tomorrow and survives back above 22,050 (weekly closing), then it may resume a consolidation trading range between 21,800 and 22,200 for a few days,” Soni Patnaik, assistant vice-president of derivatives research at JM Financial, said.

Patnaik’s derivative strategy

Long strangle in Nifty on March 28 expiry: Buy 21,800 PE in the range of 100/120 and buy 22,200 CE in the range of 150-170. The total combined premium is 270 points. Stop-loss is at 220 in combined premium (risk of 50 points) and target is at 380-400 points in combined premium (110 points).

Rationale: If volatility continues (India VIX rises) and the Nifty breaks beyond either of the levels of 21,800 or 22,200, then a one-sided movement can be seen either at 21,400-21,200 or at 22,800-23,000.

Story continues below Advertisement

Bank Nifty

“An open interest perspective, Bank Nifty March futures have decreased by nearly 1 percent, while the cumulative Open Interest of the current, next, and far series has surged by 2.12 percent, indicating an overall short build-up,” Sudeep Shah, DVP and head of derivative and technical research at SBI Securities, said.

“On the Options Front, Bank Nifty PCR stands at 0.67 levels. Significant call writing was observed at the 47,000-47,500 strikes and 47,000-46,500 puts, suggesting a range of 47,400 to 46,450 for the forthcoming sessions.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.