Despite high valuations, realty stocks still attractive; DLF king of the pack: Nuvama

Housing demand in the top-7 cities remains healthy with absorption growing at 24 percent yoy in CY23

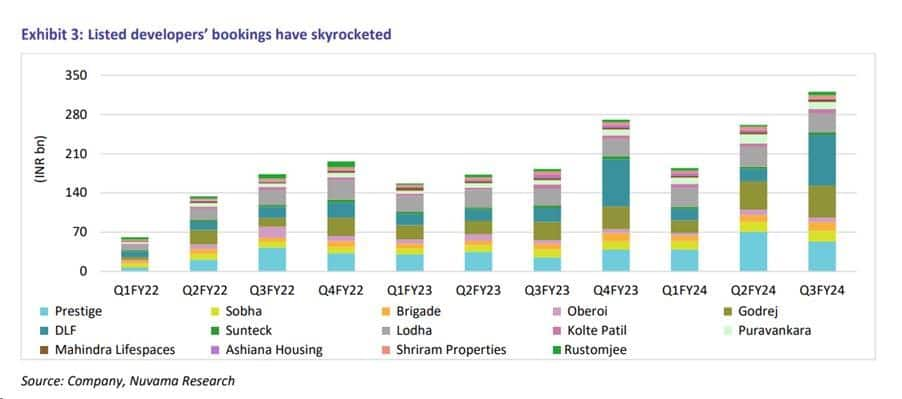

The strong pre-sales growth of realty developers has resulted in the Nifty Realty Index surging 120 percent since March 2023. Despite concerns about valuations, brokerage firm Nuvama remains bullish on the real estate sector, citing further potential in the medium term. Nuvama’s top bets in the sector include DLF, Prestige and Brigade, with DLF being referred to as the “king of the pack.”

The Nifty Realty Index has rallied in the year, driven by several factors such as the housing upcycle, listed realty developers posting strong pre-sales growth, and the RBI pausing rate hikes. This has led to concerns about whether realty stocks are too expensive. Many stocks are now trading at a premium to NAVs in line with previous upcycle.

Valuations on the Expensive Side?

The Nifty Realty Index has rallied in the year, driven by several factors such as the housing upcycle, listed realty developers posting strong pre-sales growth, and the RBI pausing rate hikes. This has led to concerns about whether realty stocks are too expensive. Nuvama addressed this by stating, “Deep-dive cash flow analysis indicates that the previous upcycle witnessed strong pre-sales growth but cash flow generation was absent due to high working capital requirements across companies. This, coupled with industry consolidation and market share gains, makes us believe that valuations, compared with the previous upcycle, are not expensive on a relative basis.”

Key growth triggers for the Realty sector going ahead

Nuvama highlighted several key growth triggers for the realty sector:

i) RERA-driven consolidation is creating growth opportunities for organized players.

ii) Housing demand is expected to remain robust in the near term.

Story continues below Advertisement

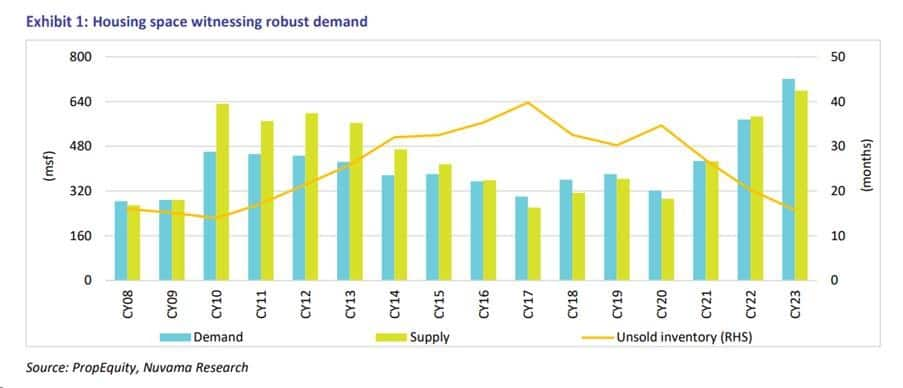

Highlighting the housing upcycle, Nuvama said, “Demand in the top-7 cities remains healthy with absorption growing at 24 percent year on year in the calendar year 2023. In addition, launches continue to trail demand, leading to unsold inventory levels falling to 16 months at the end of calendar year 2023.”

Also read: How to keep your portfolio in green even when market turns red: A blueprint from experts

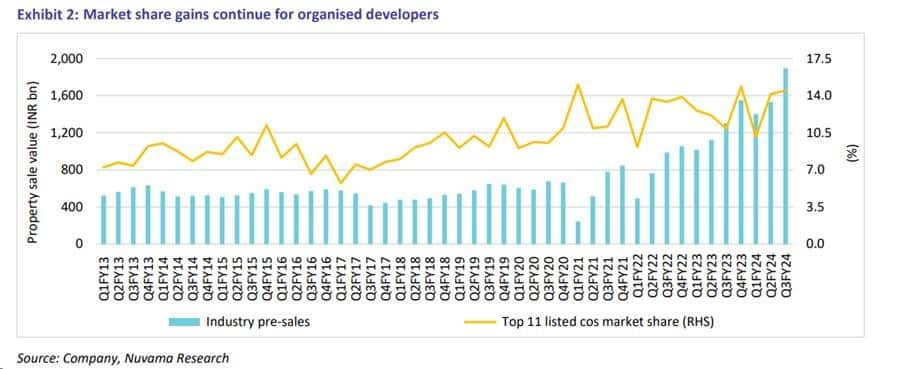

iii) Launches from listed developers will gain traction as they continue to gain market share.

As per Nuvama, listed developers have continued to gain market share, enabling them to clock healthy bookings.

iv) Cash flows are expected to remain healthy.

v) Potential interest rate cuts may further boost realty stock performance.

Interest rates historically have had a negative correlation with realty stock performance. With the RBI pausing rate hikes, realty stocks have zoomed. While realty stocks have surged in recent quarters, Nuvama believes that a potential interest rate cut may help sustain this strong run.

“The surge in realty stocks over the past couple of quarters may cap upside in the near term. Nevertheless, these stocks offer an opportunity from a medium-term perspective given attractive valuations and industry consolidation,” Nuvama noted.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.