F&O Manual | Nifty slips below the 22,000 mark, crucial support at 21,900

Representative image

The Indian equity benchmarks were trading lower on March 15 morning on mixed global cues, drop in IT names and continued selling in mid and smallcaps as mutual funds began sharing stress test results.

At 11.23 am, the Sensex was down 577 points points or 0.8 percent at 72,520, and the Nifty was down 203 points or 0.92 lower at 21,944.

The Nifty is expected to trade in a broad range where 21,950-21,900, where the crucial support is.

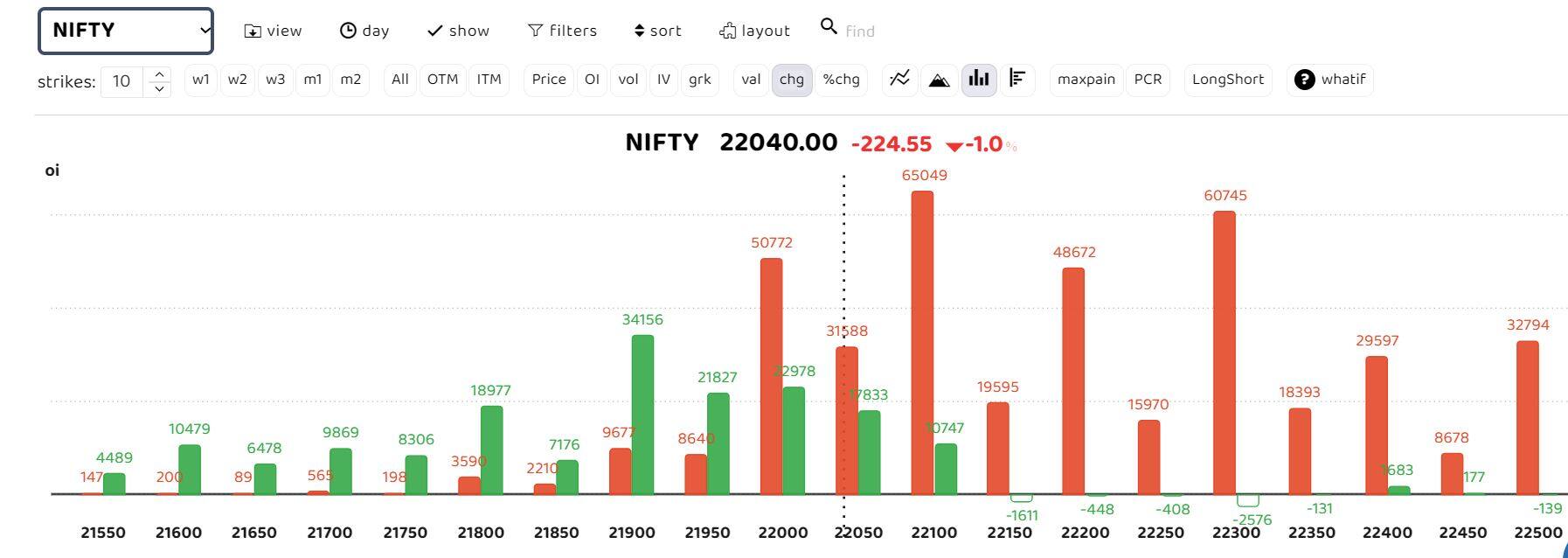

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

The options data suggests that call writers are active.

While the indices are on a slippery wicket, 21,850-21,900 will act as crucial support for the index being a rising trend-line support zone. Any sustainable move below 21,850, will lead to further selling pressure on the Nifty, which can drop to 21,680-21,600, Sudeep Shah, head of derivative and technical research at SBI Securities said.

On the upside, 22,200-22,230 will act as an immediate hurdle. “Any sustainable move above the level of 22,230 will lead to an extension of pullback rally up to the level of 22,450-22,530 level in the short term,” he said.

“The market breadth is negative and indices are also trading with a negative bias. The Nifty is expected to trade within a broad range, where 21,950-21,900 will be important support to watch,” Ruchit Jain, lead research at 5 Paisa said.

Story continues below Advertisement

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.