MF Stress Test: Curiously, fund which looks most stressed shows least NAV damage from recent market rout

Market experts said that the regulator has been concerned about mutual funds’ ability to redeem units instantaneously after past events saw debt funds asking for redemptions to be stopped as liquidity dried up in debt markets following the IL&FS financial crisis in 2018.

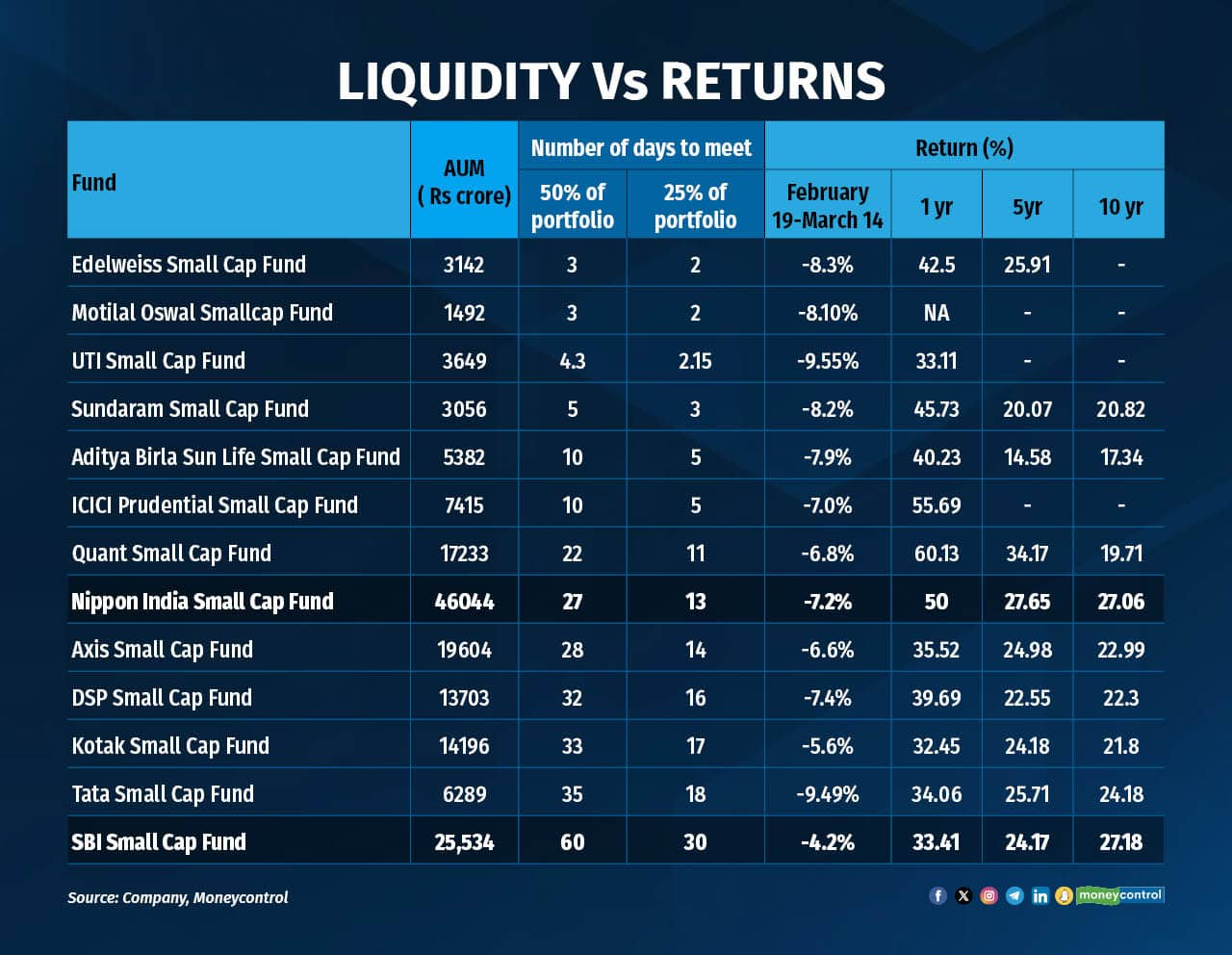

In what may seem like a dichotomy, SBI Mutual Fund’s Smallcap Scheme, which reported the most illiquid portfolio, has seen the least damage to Net Asset Value (NAV) in the small-cap rout that hit the market over the past three weeks.

Also read: MF stress test: India’s biggest small-cap fund can sell off its 50% portfolio in 27 days

Since February 19, 2024, when smallcaps peaked to March 14, 2024, the fund’s NAV fell the least—by 5.4 percent–among all smallcap funds’ NAVs. SBI Mutual Fund’s Small Cap Fund reported that it would take 60 days to liquidate 50 percent of its portfolio and 30 days to liquidate 25 percent of its portfolio, based on the methodology defined for the Stress Test by the Association of Mutual Funds in India (AMFI). In comparison, the other funds have reported a range of 3 to 42 days, and 92 to 21 days respectively.

SBI MF’s Smallcap Fund along with Nippon India Fund has been the best performing fund over long time periods with both delivering an astounding annual return of 27 percent over a 10-year period. Nippon India also happens to be the largest fund in the smallcap universe with assets under management (AUM) of Rs 46,000 crore; SBI’s Small Fund is the second largest with a corpus of Rs 25,500 crore. Nippon, despite being significantly larger, said 50 percent of its portfolio could be liquidated in 27 days while 25 percent of its corpus could be liquidated in 13 days, much better than what SBI’s Smallcap Fund declared.

This is primarily due to the two fund’s contrasting strategies: SBI runs a fairly concentrated portfolio with 55 stocks with top 10 holdings constituting 15 percent of net assets while Nippon has spread its bets across nearly 200 stocks with its positions in individual stocks not exceeding 2 percent. In the fall since February 19, Nippon’s fund recorded a fall of 7 percent.

The idea behind the Stress Test is to assess the ability of a fund to meet redemption pressure if market conditions turn adverse and unitholders queue up to redeem their holdings. Being open-ended products, mutual funds are seen as liquid cash even though equities are widely known to be highly volatile and are subject to market risk.

Also read: SEBI mutual fund stress test: Quant MF says smallcap fund to take 22 days for 50% liquidation

Story continues below Advertisement

Market experts said that the regulator has been concerned about mutual funds’ ability to redeem units instantaneously after past events saw debt funds asking for redemptions to be stopped as liquidity dried up in debt markets following the IL&FS financial crisis in 2018.

Although short-term performance makes very little sense while evaluating equity funds, which are meant to be long-term investment vehicles, the rout in the past three weeks have seen number of stocks with high speculative interest fall precipitously; good quality stocks have held up much better, analysts said. In an interview on March 13, Harsha Upadhyaya, CIO of Kotak AMC, said that the good quality stocks that their team would have liked to buy have not fallen much.

Moneycontrol has been reporting that the recent rout in small caps has been driven by nervousness in the market following ED raids on the market operator Harish Tibrewal and associates, and unwinding by traders and operators because of heightened regulatory vigil.

The largest fall during the market fall from February 19 to March 14 was seen by LIC Mutual Fund’s Smallcap scheme at 11.5 percent, followed by ICICI Prudential Smallcap Fund and HSBC Smallcap Fund. LIC MF’s scheme is yet to report its Stress Test results. ICICI Prudential Smallcap Fund reported 10 days to liquidate 50 percent of its portfolio and 5 days to liquidate 25 percent. It has delivered a return of 55 percent over the past year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.