More than 200 small-cap stocks decline 10-40%, drive markets 2% into red

Cautiousness towards mid and small caps continued to drag the market sentiment.

After trading in the green for four weeks in a row, the market ended in the red with the benchmark indices shedding 2 percent each and posting one of the biggest weekly losses on March 15, driven by a rout in midcap and smallcap stocks and mixed data points.

In this week, BSE Sensex lost 1,475.96 or 0.99 percent to end at 72,643.43 and Nifty50 shed 470.25 points or 2.09 percent to finish at 22,023.30.

Among sectors, the Nifty Realty index shed 9.4 percent, Nifty Media index 8.3 percent, Nifty PSU Bank 8 percent, and the Nifty Metal index fell 6.8 percent. The Nifty Information Technology index, however, added 1 percent.

Foreign institutional investors (FIIs) sold off equities worth Rs 816.91 crore, while their domestic peers (DIIs) continued to support the market, infusing Rs 14,147.5 crore.

“Cautiousness towards mid and small caps continued to drag the market sentiment, dampening the broader market. However, moderation in global commodity prices and the upward revision of India’s GDP for FY25 are poised to highlight robust domestic demand, potentially supporting a rebound once the broader market attains stability,” said Vinod Nair, head of research at Geojit Financial Services.

“We anticipate continued bargain opportunities in mid- and small-cap stocks, whose valuations are underpinned by strong fundamentals.”

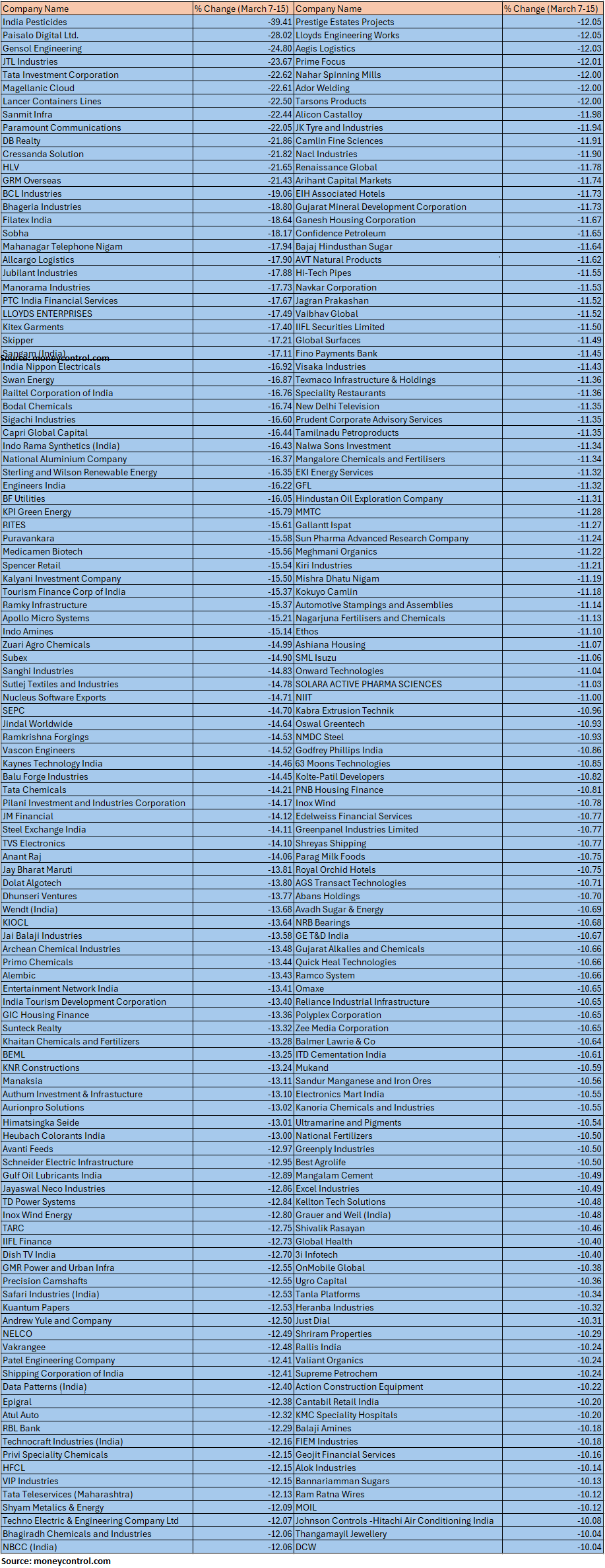

The BSE Smallcap index posted its biggest weekly losses since December 2022 as it plunged 6 percent in the week ended March 15. Among losers, India Pesticides, Paisalo Digital, Gensol Engineering, JTL Industries, Tata Investment Corporation, Magellanic Cloud, Lancer, Containers Lines, Sanmit Infra, Paramount Communications, DB Realty, Cressanda Solution, HLV and GRM Overseas losing between 20 percent and 40 percent.

Story continues below Advertisement

On the other hand, gainers included Hercules Hoists, Astec Lifesciences, Cigniti Technologies, HEG, ZF Commercial Vehicle Control Systems India, Reliance Infrastructure, Poonawalla Fincorp and Novartis India.

Where is Nifty50 headed?

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

On the daily charts, Nifty has managed to hold on to the support zone of 21900 – 21860. The 40-day exponential average (21970) absorbing the selling pressure. So, until this zone is held, we can expect the upside momentum to resume.

In terms of levels, 22215 – 22250 is the immediate hurdle zone while 21900 – 21860 is the crucial support.

Rupak De, Senior Technical Analyst, LKP Securities

The Nifty closed below the rising trendline, bringing market sentiment back into a state of weakness. The momentum indicator suggests bearish momentum in the near term.

Immediate support is situated at the 50DMA, currently at 21,900, which is expected to provide support for the Nifty.

A decisive drop below 21,900 could lead to a sharp decline in the index. On the upside, resistance is observed in the range of 22,200-22,250.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.