Bank Nifty recovers, goes past crucial hurdle of 46,600

Bank Nifty futures added fresh shorts last week, mainly in the April series.

Bank Nifty recovered from a steep slide in the morning to trade higher in the afternoon on March 18. According to experts, 46,250-46,500 is the demand zone and is expected to provide strong support to the 12-stock index.

Last week, the banking index erased the gains of previous three weeks to end near 46,500 levels, down more than 2.5 percent.

At 13.26 pm , Bank Nifty was trading at 46,600.05, up 0.012 percent from the previous close.

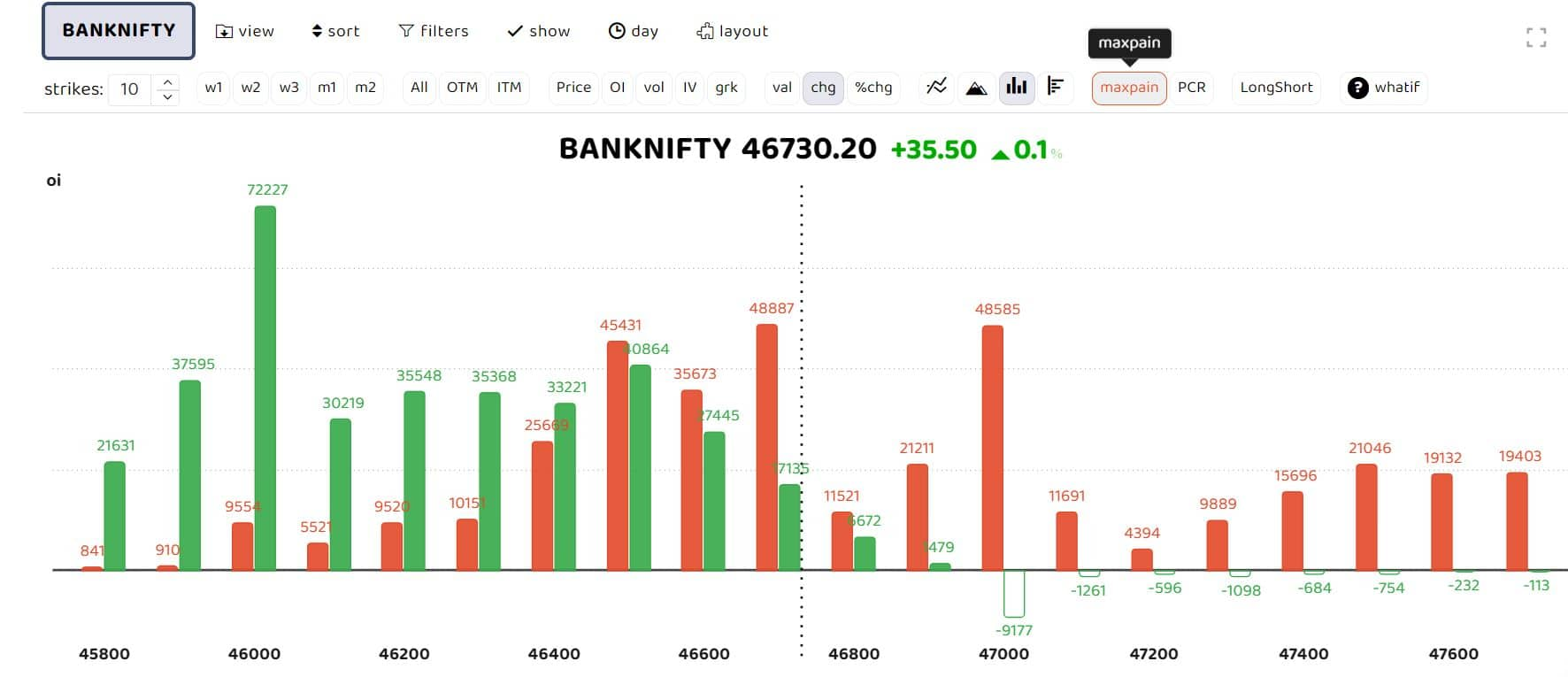

Bars in red indicate changes in open interest (OI) of call writers, while the green show the change in OI of put writers

Bars in red indicate changes in open interest (OI) of call writers, while the green show the change in OI of put writers

The index successfully surpassed the immediate hurdle in the 46,500-46,600, indicating a bullish outlook for the remainder of the day, Avdhut Bagkar, a Derivatives and Technical Analyst at StoxBox said.

“Conservative traders may consider buying opportunities in the 46,400 CE once the spot price sees a healthy dip towards the 46,500-46,450 range. Riskier traders may choose a Bull Call Spread strategy in the 46,500 CE and 47,000 CE to capitalize on the positive bias. The price action for today remains on bull side and any recovery in Nifty PSU Bank could trigger robust sentiment, ” Bagkar said.

Also read: F&O Manual |Indices trade range bound; analysts advise avoiding buy on Nifty dips

The 46,250-46,500 zone, which coincides with the 50-DMA, is the demand zone and is expected to provide strong support to the index, Sheersham Gupta, Director and Senior Technical Analyst at Rupeezy, said.

Story continues below Advertisement

On the daily timeframe, Nifty Bank seems to be forming a bullish rejection candle. However, the short-term trend for the index is yet to turn bullish, as indicated by key momentum indicators and moving averages, he said.

A definitive shift to bullish sentiment would occur only if the index crosses 47,000, however, the current stance appears indecisive, Gupta said.

Short-term view

According to ICICI Securities, aggressive Call writing has been observed at at-the-money (ATM) and out-of-the-money (OTM) strikes, particularly at the 47,000 Call strike with the highest option concentration. Conversely, there are no major Put options except at the ATM strike of 46,500.

Bank Nifty futures accumulated fresh shorts, especially in the April series, throughout last week. The total open interest in Bank Nifty is nearly at a one-year high, indicating a significant increase in fresh shorts. ICICI Securities advises considering fresh long positions in Bank Nifty only if it moves above 47,000.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.