F&O Manual |Indices trade range bound; analysts advise avoiding buy on Nifty dips

At 10:38 hrs IST, the Sensex was down 85.73 points or 0.12 percent at 72,557.70, and the Nifty was down 34.60 points or 0.16 percent at 21,988.70

The Indian benchmark indices are trading in a rangebound manner, with the Nifty hovering around its psychological mark of 22,000.

Nifty snapped its four-week winning streak and ended with losses of more than 2 percent. As per ICICI Securities, experts believe 22,200 levels on higher side to act as immediate hurdle and aggressive longs should be avoided till Nifty is not able to sustain above these levels.

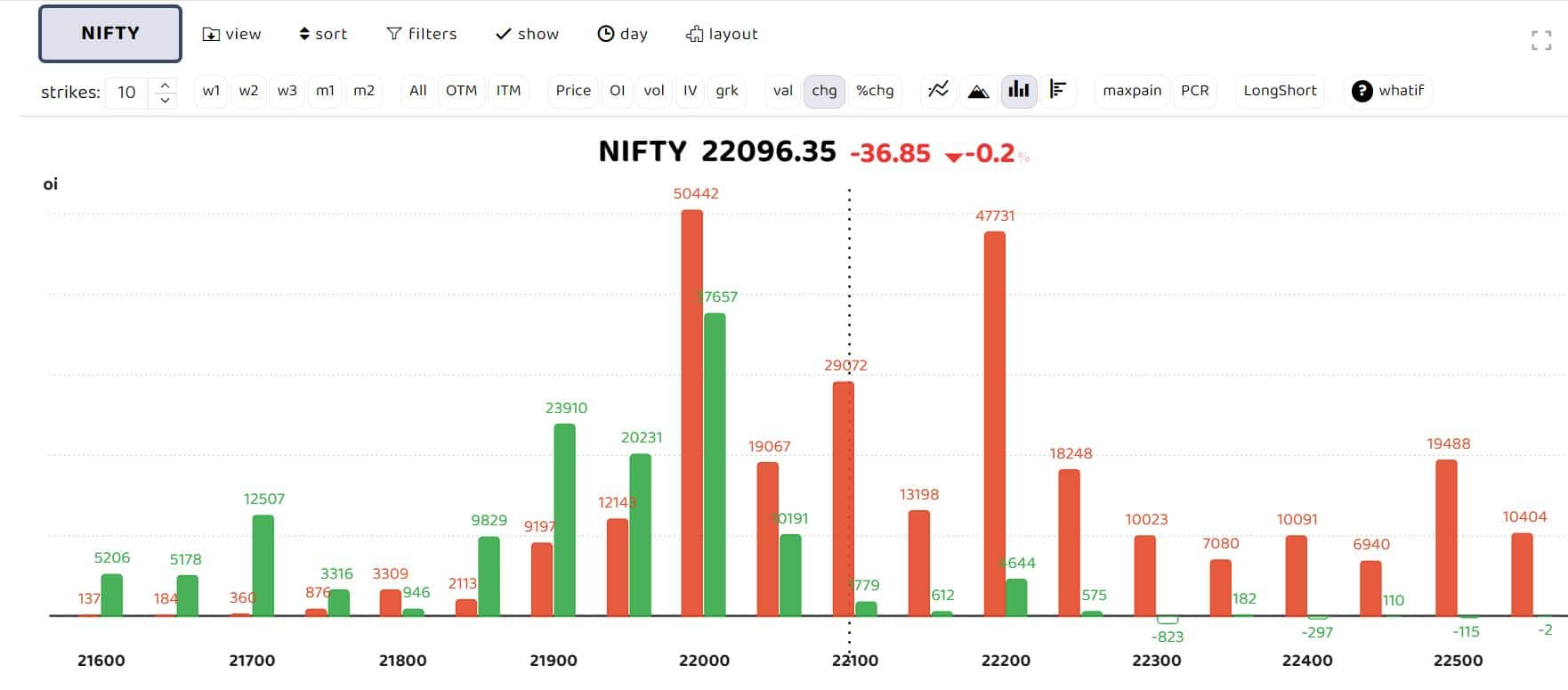

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data shows significant Call writing visible at At-the-money and Out-of-the-money strikes, indicating selling pressure at higher levels. Meanwhile, the Put base appears to be building at the At-the-money 22,000 strike for the coming week. According to Raj Deepak Singh, derivative analyst at ICICI Securities: “Considering that Nifty has repeatedly defended the 22,000 levels, a move below these levels may further weaken the market in the coming week. Additionally, Nifty leverage remains high in futures, and aside from retail traders, other market participants are mostly net shorts in the index.”

“With significantly higher premiums in Nifty, upside movements may be limited in the upcoming week. Therefore, a move above 22,200 is crucial for initiating a fresh uptrend, ” added Singh.

Avoid Buy on Dips

According to Soni Patnaik, Assistant Vice President of Derivative Research at JM Financial, “The crucial support level for Nifty is in the range of 21,900 to 21,850, and any break below this range could lead Nifty to test 21,500 to 21,400. The weekly closing was slightly below 22,050 and it was unable to comfortably close above 22,050 to 22,100, so caution is advised. The indecisive weekly closing slightly favours bears at the moment.”

She recommends exiting long positions or hedging them and advises to avoid buying on dips. “Caution is advised if Nifty fails to surpass 22,200.”

Story continues below Advertisement

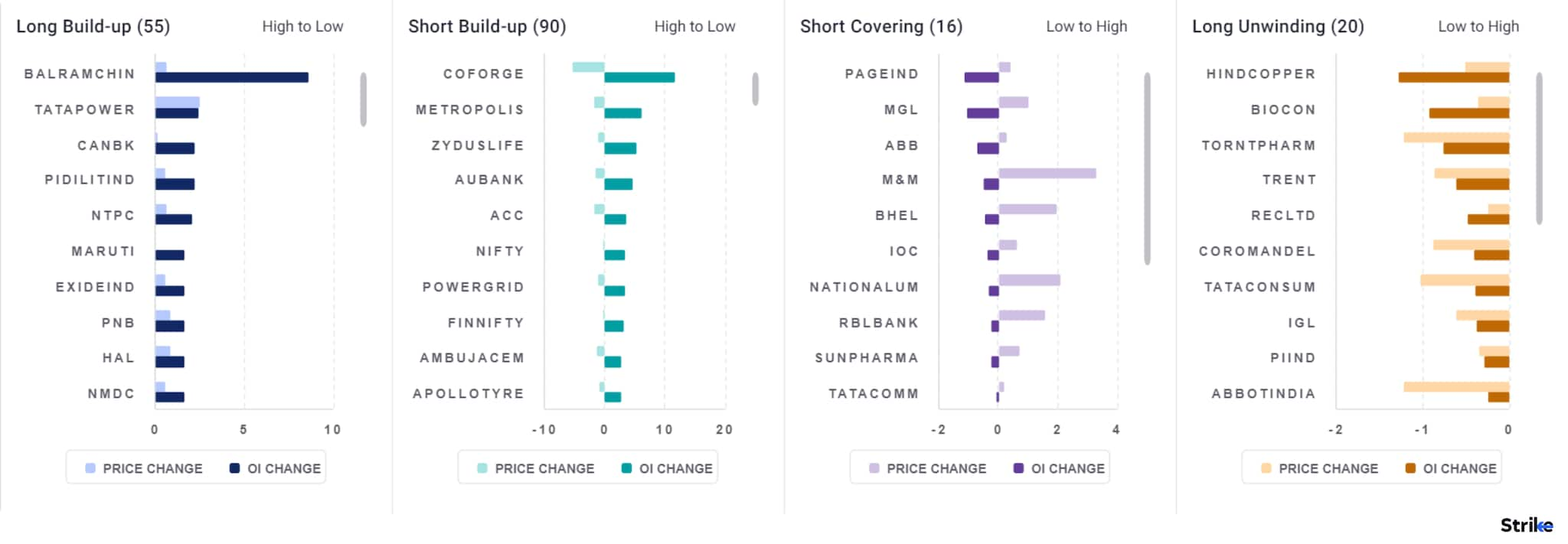

Among individual stocks, long build up can be observed in Balrampur Chini, Tata Power, Canara Bank and NTPC. While short build up is observed in CoForge, Metropolis, Zydus Life and ACC.