HDFC Life breaks out of consolidation, signals accumulation

HDFC Life closed at Rs 633.00 up 0.65 points on March 18

HDFC Life Insurance has broken out of consolidation with increased volume activity. Brokerages ICICI Securities and Axis Securities have a a “buy” call on the insurer, which is their top technical pick for this week.

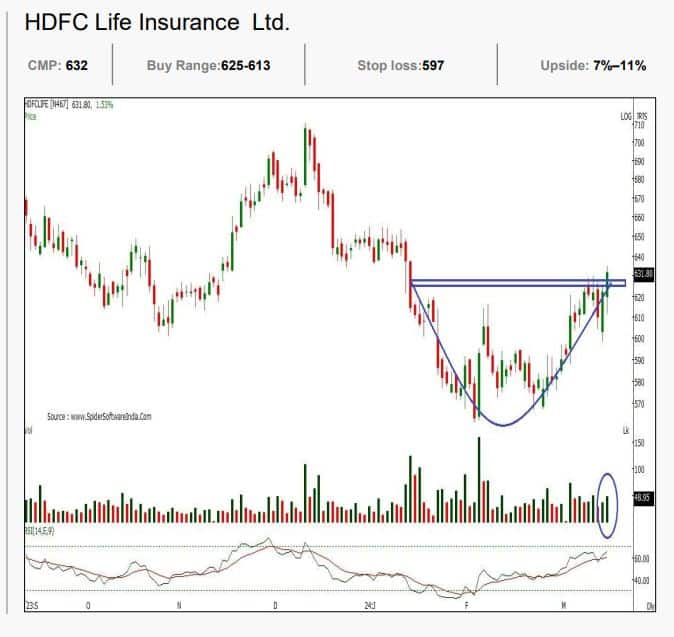

Technical chart of HDFC Life insurance showing consolidation breakout| Source: Axis Securities

Technical chart of HDFC Life insurance showing consolidation breakout| Source: Axis Securities

HDFC Life has displayed significant resilience in the recent market volatility and has outperformed the markets.

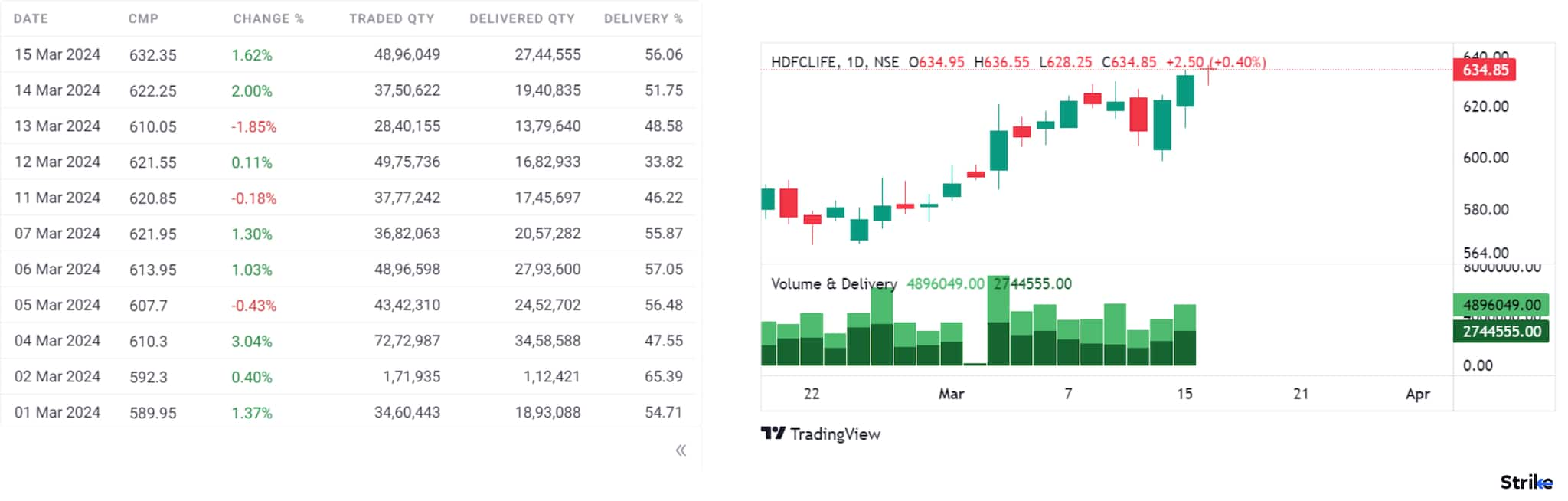

According to ICICI Securities, the stock began the series with one of the highest open interests in the last nine months. “Throughout the series, the outperformance was evident amid significant closures, indicating ongoing short covering in the stock. Additionally, the stock has closed above its maximum Call base of 630 strike, suggesting a potential extension of the move,” it said.

The short-covering momentum may drive the stock towards Rs 670 in the upcoming sessions, it said. The brokerage recommend buying HDFC Life March futures in the range of Rs 627-631 with a target price of Rs 672 and a stop loss of Rs 604.9.

Volume and delivery of HDFC Life Insurance

On the daily chart, HDFC Life has broken out of a consolidation phase, marked by a ‘Rounded Bottom’ pattern at the 629 level.

Story continues below Advertisement

According to Axis Securities, “The heightened volume activity during the breakout indicates increased participation, reflecting substantial interest in the stock’s upward momentum.”

The stock is maintaining its position above the 20, 50, 100, and 200 Simple Moving Averages (SMAs), indicating a positive bias . The daily Relative Strength Index (RSI) is also in bullish mode, suggesting an upside potential to the 665-685 levels, with a holding period of three-four weeks, Axis Securities said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.