F&O Manual | Selling pressure drags indices lower; Nifty trading around crucial support of 21,850

At 12:20 hrs IST, the Sensex was down by 652.69 points or 0.90 percent at 72,095.73, while the Nifty was down by 213.80 points or 0.97 percent at 21,841.90.

Indian benchmark indices were trading lower on March 19 as strong selling pressure has dampened the bullish sentiment. Nifty is currently trading around the crucial support zone of 21,850-21,880, marked by a rising trend-line and the 50-Day EMA zone, which has been defended multiple times in the last 3-4 weeks. According to experts, any sustained movement below the level of 21,850 will likely trigger further selling pressure, pushing the index down to the 21,750-21,680 level.

At 12:20 hrs IST on Tuesday, Sensex was down by 652.69 points, or 0.9 percent, at 72,095.73, while the Nifty was down by 213.80 points, or 0.97 percent, at 21,841.90. Among the stocks, 1,056 advanced, 2,204 declined, and 91 remained unchanged.

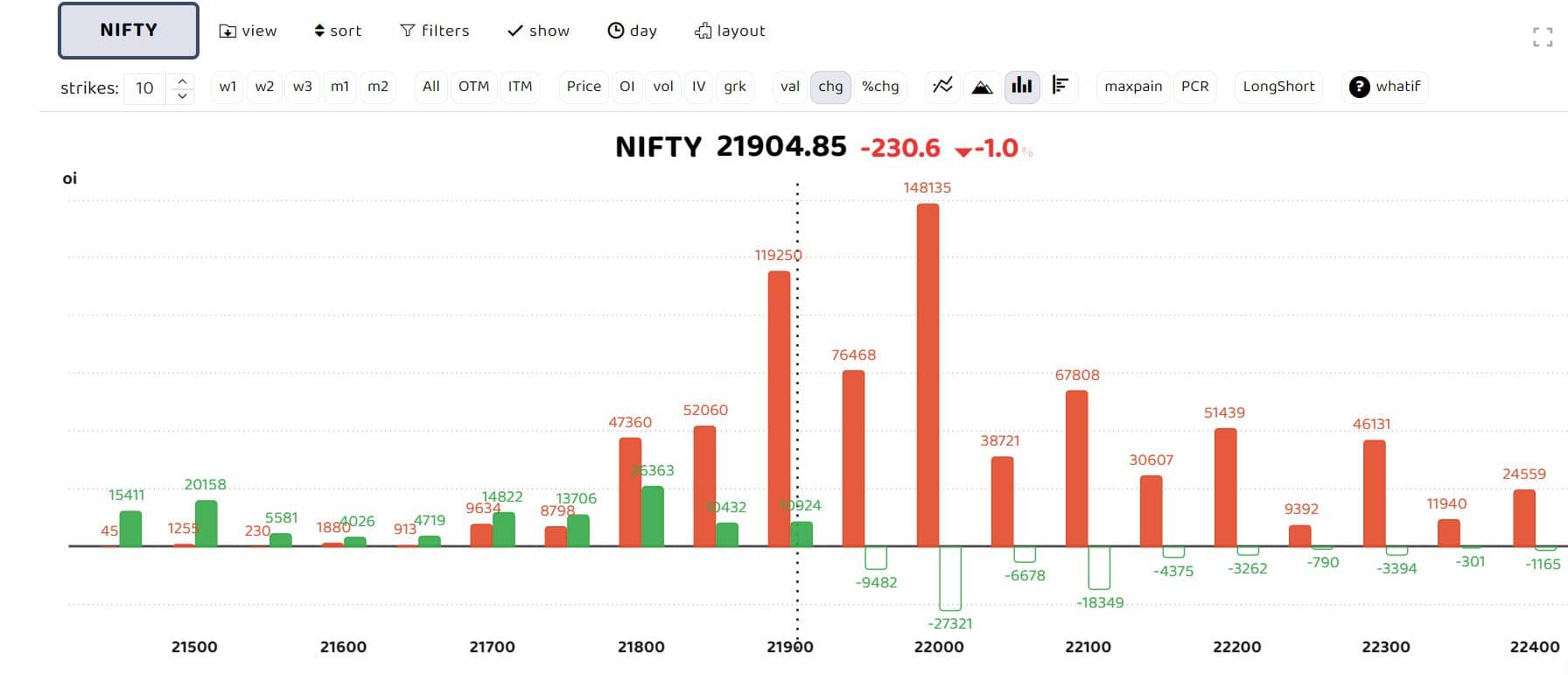

Options data indicates that call writers are dominant for the day. Sudeep Shah, DVP and Head of Derivative and Technical Research at SBI Securities, said: “Nifty 21,850-21,880 serves as crucial support for the index, being a rising trend-line support zone and the 50-Day EMA zone, which has been defended multiple times in the last 3-4 weeks. A sustained move below the level of 21,850 will likely result in additional selling pressure, pushing the index towards the 21,750-21,680 level.”

Also read: Metal stocks recover. Here’s how derivative analysts are positioning the sector

Shah further said: “On the upside, the zone of 22,200-22,220 will act as an immediate hurdle for the index. Any sustained move above the level of 22,220 will extend the pullback rally up to the level of 22,450-22,530 in the short term.”

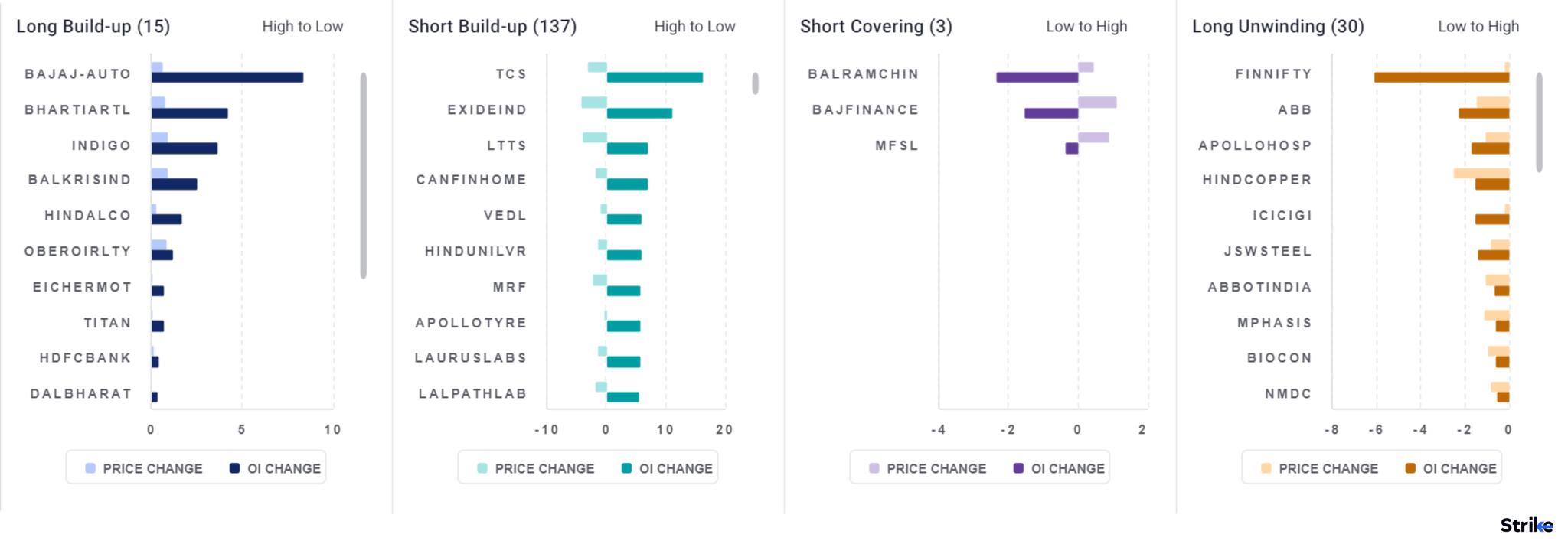

Among individual stocks long build up can be seen in Bajaj auto, Bharti Airtel, Indigo and Hindalco while short build up is observed in TCS, Exide Industries and MRF.

Story continues below Advertisement

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.