Metal stocks recover. Here’s how derivative analysts are positioning the sector

Metal stocks are holding steady around crucial levels, even as the broader market faces selling pressure.

The metal segment has made a sharp recovery backed by strong volumes, with Nifty metal trading at around 7,900 from the lows of Rs 7,600 on March 14.

Though the index was trading lower from the previous day on wide-spread selling on March 19, analyst said metal stocks have found support near their critical levels amid selling pressure.

In the short term, short covering may lead to a rebound in the sector, analysts said.

On March 18, Nifty Metal gained significant momentum, rising 2.5 percent in a day, with a sharp recovery in Tata Steel, Vedanta, Jindal Steel and Power, and Steel Authority of India.

A long build-up was seen in Tata Steel, with prices scaling significant highs and a robust addition in Open Interest (OI).

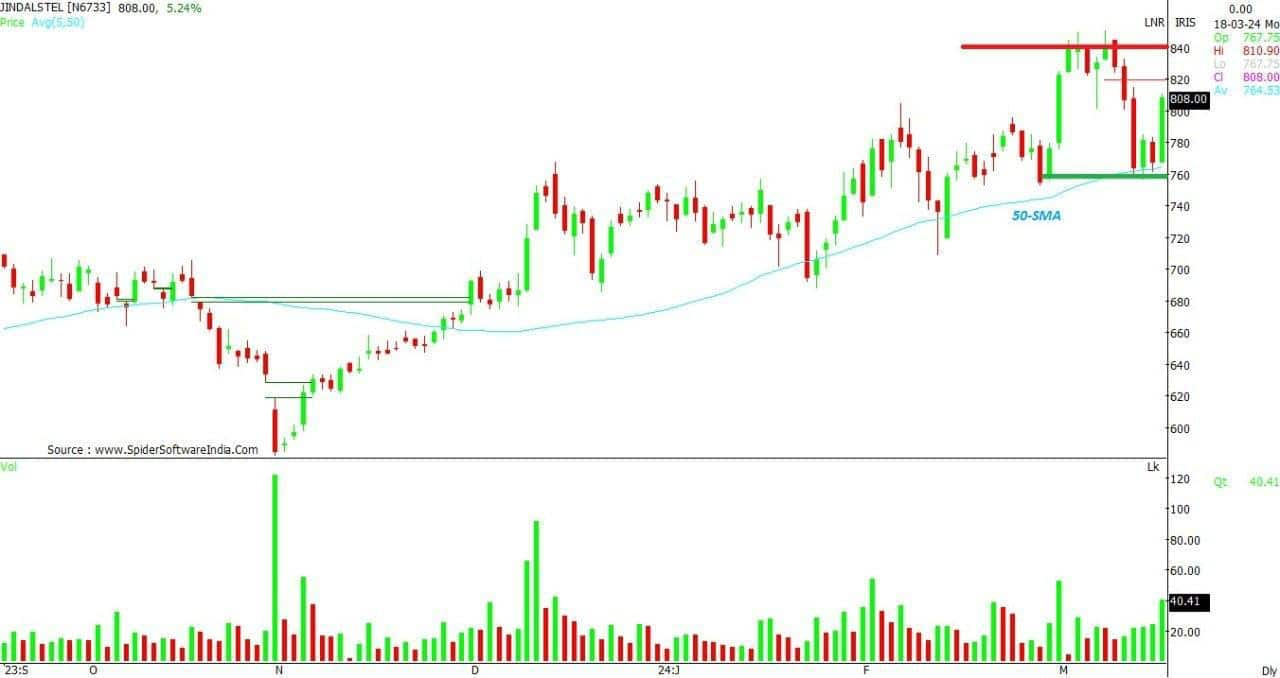

Jindal Steel and Power was up close to 5 percent, with over 2 crores OI and nearly a 2 percent jump. Looking ahead, derivative analysts are positioning the metal sector as follows:

Nifty Metal

According to Arun Kumar Mantri, Founder of Mantri Finmart, “The overall sector has also outperformed the benchmark index Nifty in the month of March and may see further recovery in the markets, well supported by metal counters. We expect the sector to carry positive momentum in the coming trades, with Jindal Steel, Tata Steel, and Hind Copper outperforming their peers, where good long additions were witnessed in the past few sessions.”

Story continues below Advertisement

Mantri advises a buy-on-decline strategy in the sector until the lows of March 18 are breached for the near term.

Here’s how Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox, is positioning metal stocks:

Tata Steel’s price action indicates it is heading towards the 155 mark, with immediate support staying at 145 and 140.

Jindal Steel and Power added close to 3 percent in OI with sustained positivity. The price action implies that the immediate level of 825 will be met. Here, we see short bets in 850 CE being covered as smart money enters 800 CE. The immediate hurdle comes at the 840 mark, as support emerges near 780, followed by 764, its 50-SMA.

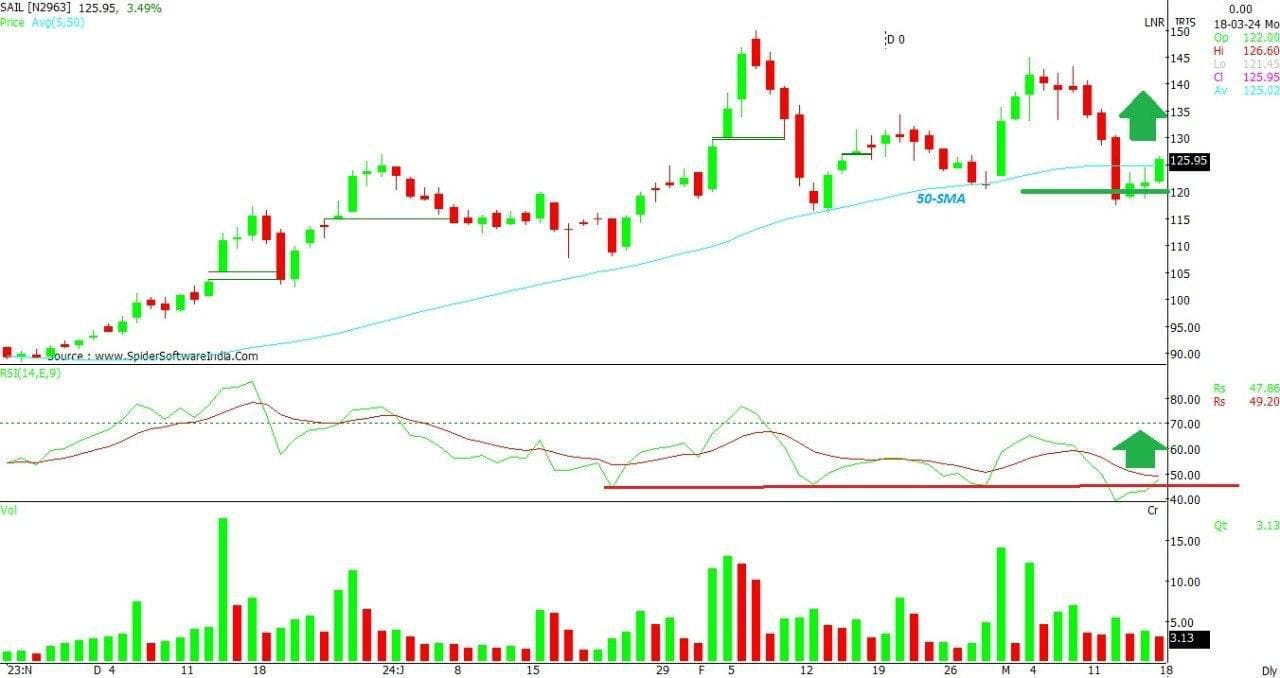

While Steel Authority of India is hovering around its 50-Simple Moving Average (SMA) placed at 125, the reversal may signal a fresh uptrend for the next session. The price action may move towards the 140 level. The Open Interest has remained flat; however, the momentum is projected to accelerate the price uptrend to 130. Support exists at the 120 level.

Vedanta is attempting to cross its 50-SMA and may reach higher levels in the upcoming sessions. The 280 PE is observing the closing of short positions despite 280 CE perceiving writing. The next hurdle comes at 285. Stability over 50-SMA would build a support area around 260-265 levels.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.