F&O Manual | Indices swing between gains and losses; Bank Nifty to expire in 46,000-46,500 range

At 11:56 hrs IST, the Sensex was up 0.20 percent at 72,153.03, and the Nifty was up 0.16 percent

Indian equity benchmarks were choppy on March 20, swinging between gains and losses even as bearish momentum continued to intensify.

At 11.56 am, the Sensex was up 140.98 points, or 0.20 percent, at 72,153.03 and the Nifty was up 35.50 points, or 0.16 percent, at 21,853.

The Bank Nifty underperformed the Nifty with the State Bank of India and Axis Bank under continued selling pressure on the expiry day.

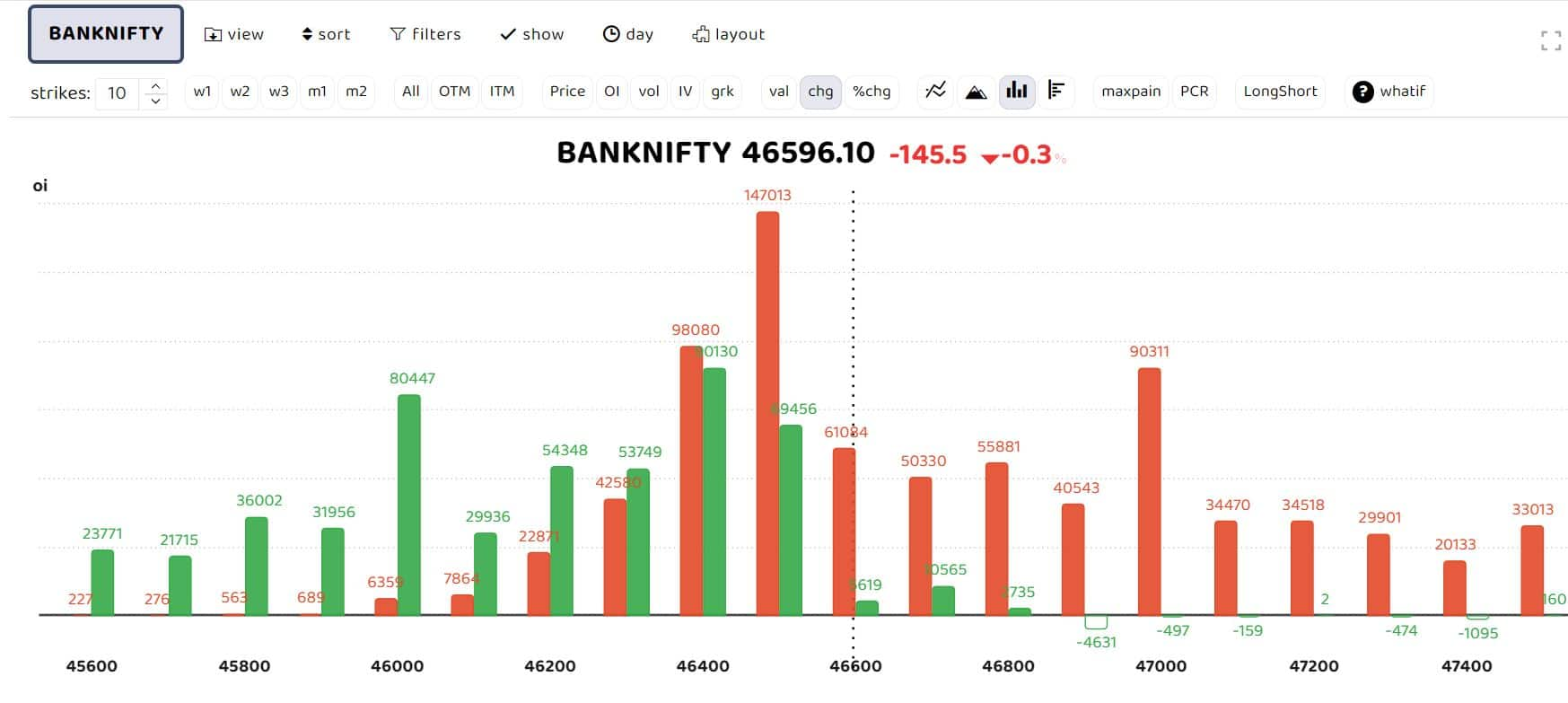

For the expiry day, 46,500 Call strike holds noteworthy open interest (OI), which is expected to act as immediate resistance area. On the downside, 46,000 is expected to act as support.

Structurally, the index has been undergoing a broader consolidation since December, setting the stage for the next upward move, ICICI Securities said. During the phase, the index consistently formed higher lows near the 52-week exponential moving average (EMA), indicating the continuation of the structural uptrend, it said.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

“Bank Nifty is relatively underperforming the Nifty. For today’s expiry, 46,500 Call strike holds noteworthy OI, which is expected to act as immediate resistance area. On the downside, 46,000 is expected to act as support,” ICICI Securities said.

Story continues below Advertisement

On the technical front, it expects the banking index to hold the week’s low of 46,000 and initiate a technical bounce from oversold levels.

“Notably, Bank Nifty retraced 80 percent of its preceding six-session rally over eight sessions, and we expect it to establish a higher bottom around the support of 46,200-46,000,” it said.

On the upside, 47,200 presents a key resistance level, being the 50 percent retracement of the recent seven-session decline.

The next significant support for Bank Nifty is around 46,200, which is expected to hold due to the confluence of the rising 100-day EMA and the 80 percent retracement of the six-session rally (45,662-48,161), the brokerage said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.