More than 50 smallcaps gain up to 43% as broader indices outperform amid volatility

Among broader indices, the BSE Small-cap, Mid-cap and Large-cap indices rose 1.8 percent, 1.4 percent and 0.6 percent, respectively.

Broader indices recovered some of the previous week’s losses and outperformed the main indices in the week ended March 22. Global cues, including a rate hike from the Bank of Japan, interest rate unchanged by the Bank of England, Fed assured about rate cuts this year, and solid direct tax collection kept the market volatile.

This week, BSE Sensex added 188.51 or 0.25 percent to close at 72,831.94 and the Nifty50 index rose 73.45 points or 0.33 percent to end at 22,096.80.

Among sectors, the Nifty Realty index rose 5.4 percent, the Nifty Auto and Metal indices added 4 percent each, while the Nifty Information Technology index lost 6 percent.

Among broader indices, the BSE Small-cap, Mid-cap, and Large-cap indices rose 1.8 percent, 1.4 percent, and 0.6 percent, respectively.

During the week, Foreign institutional investors (FIIs) increased their selling as they sold equities worth Rs 8,365.53 crore, while Domestic institutional investors (DIIs) bought equities worth Rs 19,351.62 crore.

“Amidst mixed signals from global peers, investor sentiment remained volatile, influenced by uncertainties surrounding pivotal policy decisions from major central banks. The unexpected interest rate hike by the BoJ after 17 years and the ECB’s choice to maintain rates contributed to subdued market sentiment. However, the market rebounded following the Fed’s indication to proceed with three interest rate cuts this year, despite inflation remaining above the long-term target,” said Vinod Nair, Head of Research, Geojit Financial Services.

“Mid & Smallcap could recover halve as buying improved led by continued DIIs & FIIs inflows. The IT sector faced headwinds driven by the global slowdown in spending. Investors redirected attention towards the realty sector, which emerged as the top performer of the week.”

“The bounce is expected to continue in the short-term as traders punt to buy when the market is trading at oversold territory. However, concerns persisted regarding inflated valuations in mid and small-cap stocks. And large caps are expected to outperform in the medium term,” he added.

Story continues below Advertisement

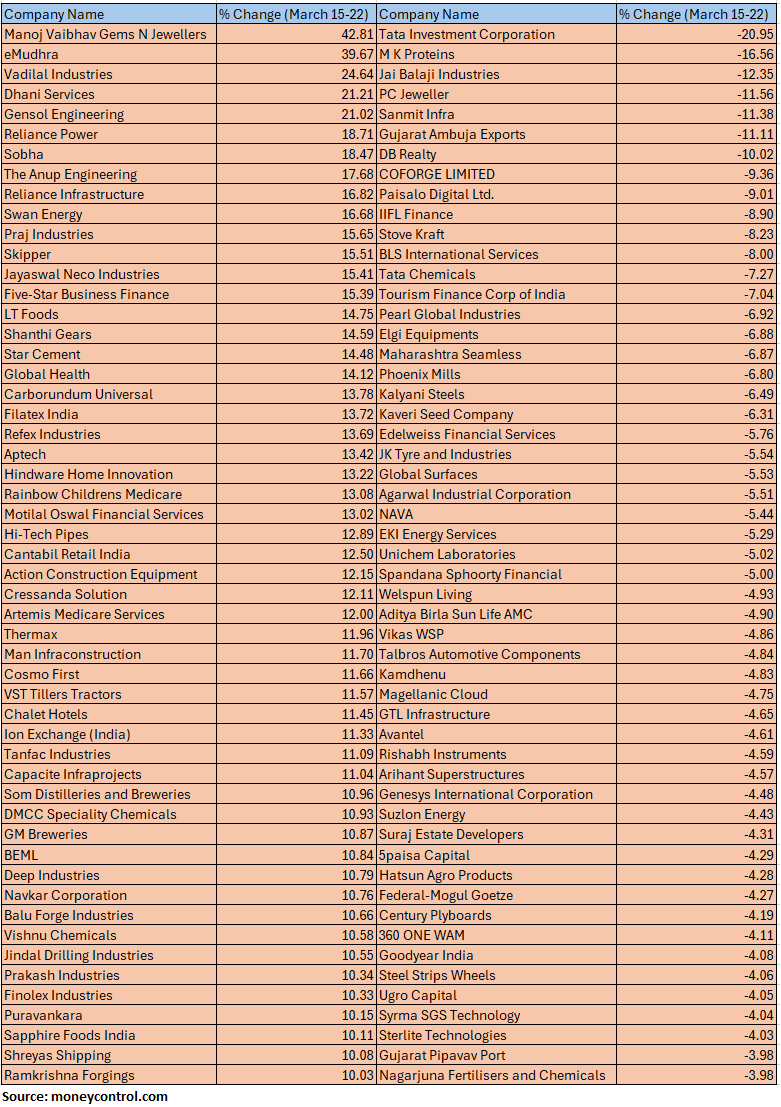

The BSE Small-cap index added nearly 2 percent with Manoj Vaibhav Gems N Jewellers, eMudhra, Vadilal Industries, Dhani Services, Gensol Engineering, Reliance Power, Sobha, The Anup Engineering, Reliance Infrastructure, Swan Energy, Praj Industries, Skipper, Jayaswal Neco Industries and Five-Star Business Finance added between 15-42 percent.

On the other hand, Tata Investment Corporation, M K Proteins, Jai Balaji Industries, PC Jeweller, Sanmit Infra, Gujarat Ambuja Exports and DB Realty lost 10-20 percent.

Where is Nifty50 headed?

Rupak De, Senior Technical Analyst, LKP Securities

On Friday, Nifty witnessed two days of recovery following a doji formation on the daily chart, indicating a bullish reversal. Moreover, the Nifty has reclaimed the critical 55-day exponential moving average.

However, Nifty needs to cross over 22,100 to witness a clear rally towards the all-time high of 22,525.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

On the daily charts, we can observe that the index is in the process of retracing the fall it has witnessed from 22526 – 21710. The key retracement levels are placed at 22118 – 22214. The dip found buying interest at 21900 – 21880 where the 20-hour moving average was placed. The retracement process is still not complete and hence the rally can continue.

The daily and hourly momentum indicators provide a divergent signal which can lead to consolidation. The range is likely to be 22,200–21,900. Stock-specific action is likely to continue during this period.

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services

Next week being a truncated week and the derivatives’ monthly expiry, we might see some volatility while Nifty is likely to consolidate at higher levels. Also, US GDP data, and other key economic data would keep investors busy.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.