Dalal Street Week Ahead: US GDP data, macro fundamentals, F&O expiry and all that will dictate D-St next week

Market likely to be volatile given monthly F&O expiry next week.

The market rebounded to close higher in the week ended March 22 on the back of a smart recovery in the second half amid a dovish Fed policy and strong buying by domestic institutions.

The recovery in Indian markets dared a selling spree of foreign institutional investors (FIIs). The market was cautious in the first half of the week ahead of the FOMC meet outcome, but the mood turned in favour of bulls after the US Federal Reserve raised the economic growth forecast for CY24 to 2.1 percent from 1.4 percent earlier, and maintained interest rates in 5.25-5.5 percent range, indicating three rate cuts this calendar year despite inflation above its long-term target of 2 percent.

In the truncated week ahead, the market is expected to be rangebound and volatile given the monthly derivative contracts expiry, and the volume may be a bit low due to couple of holidays, experts said, adding the focus would be on the US GDP numbers.

The BSE Sensex gained 0.3 percent to close at 72,832 and the Nifty 50 rose 0.3 percent to 22,097, while the broader markets rebounded after severe corrections in the previous week, as the Nifty Midcap 100 index was up 1.3 percent and Smallcap 100 index climbed 1.4 percent.

Most of the sectors, barring technology and FMCG, participated in the market swing.

“Next week being a truncated week and the derivatives’ monthly expiry, we might see some volatility, while the Nifty is likely to consolidate at higher levels,” Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services, said.

Also, the US GDP data and other key economic data would keep investors busy, he added.

Besides, Ajit Mishra of Religare Broking feels the market participants will continue to take cues from the global indices, especially the US markets, which are moving from strength to strength with every passing week.

Story continues below Advertisement

He reiterated preference for index majors & large midcaps and suggests utilizing rebound in the smallcap space to reduce positions.

The market on March 25 will remain shut for Holi and March 29 for Good Friday.

Let’s check out the 10 key factors that will keep Dalal Street abuzz next week.

US GDP

Globally, investors will keep an eye on the quarterly US GDP (gross domestic product) final data due on March 28. As per the second estimates, the US economy grew 3.2 percent in October-December quarter of year 2023 (against advance estimates of 3.3 percent), against 4.9 percent growth in previous quarter, and as a result, full year (2023) growth comes at 2.5 percent, compared to 1.9 percent in previous year.

The speech by the Federal Reserve Chair Jerome Powell on March 29 will also be watched and the focus area will be the timing of rate cuts and inflation outlook.

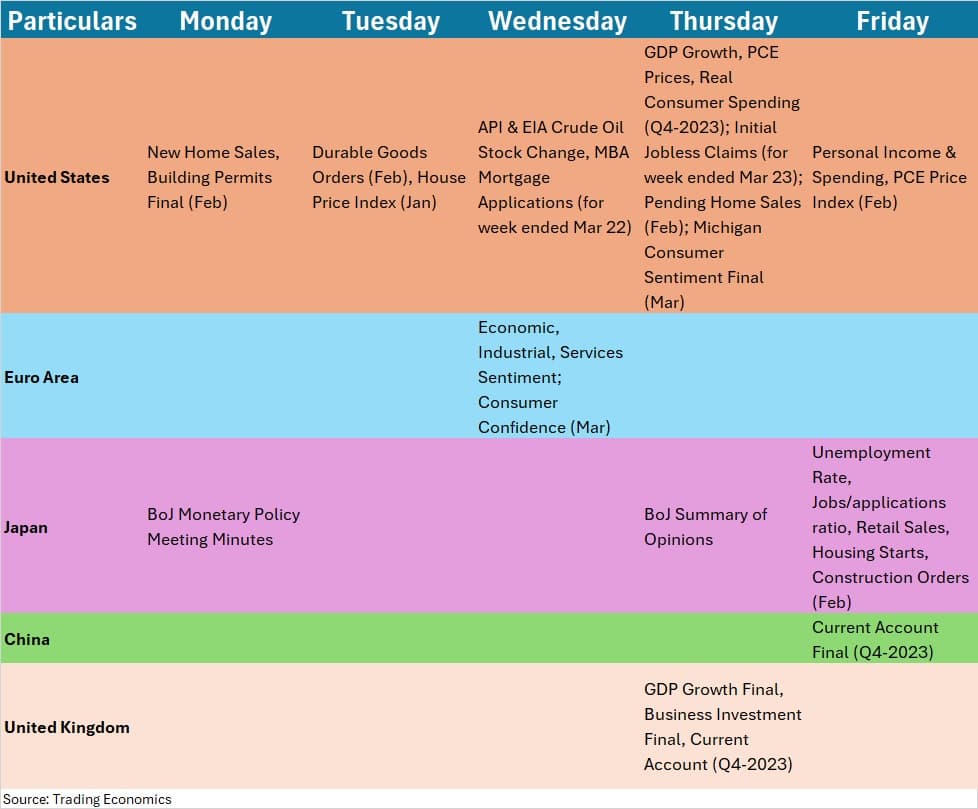

Global Economic Data

Apart from GDP numbers, the participants will also focus on new home sales, durable goods orders, jobs data, PCE prices, and personal income & spending data from the US next week.

In addition, Bank of Japan’s monetary policy meeting minutes, UK GDP numbers for Q4-2023 and China’s current account data for Q4-2023 will also be watched.

Domestic Economic Data

On the domestic front, the street will focus on current account and external debt numbers for Q3FY24 which is scheduled to be released on March 28.

Further, fiscal deficit and infrastructure output data for February, and foreign exchange reserves for week ended March 22 will be released on March 29.

The inflow from foreign institutional investors remained subdued in the passing week, which capped the major market upside, but having a consistent big buying by domestic institutional investors lifted the market mood and has been providing a great support to the market. Hence, the street will focus on both flows going forward.

FIIs have net sold Rs 8,365.53 crore worth of equity shares during the week ended March 22, but DIIs significantly compensated for the FII outflow, buying 19,351.62 crore worth of shares during the same period. DIIs monthly buying in March at Rs 47,398 crore was highest since May 2022, while FIIs net inflow in current month stood at Rs 946 crore.

Oil Prices

The cooling down in oil prices in later half of the week amid hopes of easing geopolitical tensions also supported the Indian equities a bit, but Brent crude futures, the international oil benchmark, still traded above all key moving averages and above downward sloping resistance trendlines on the weekly basis. Overall, experts remain bullish on the oil prices in the short to medium especially after dovish Fed policy, though there was a profit booking during the week passing by.

Brent crude futures during the week reached to the highest level since November 2023, but finally ended 0.6 percent down for the week at $84.83 a barrel after US Secretary of State Antony Blinken expressed optimism regarding talks in Qatar aimed at reaching a Gaza ceasefire agreement between Israel and Hamas.

The primary market will be super busy next week due to significant action in SME segment. In the mainboard segment, SRM Contractors will be the only initial public offer hitting Dalal Street next week during March 26-28 with fund raising plan of Rs 130 crore, but there will be total 12 IPOs opening for subscription next week with two listings in the SME segment.

Five companies namely Trust Fintech, Vruddhi Engineering Works, Blue Pebble, Aspire & Innovative Advertising, and GConnect Logitech and Supply Chain will be launching IPOs during March 26-28, while Radiowalla Network and TAC Infosec public issues will be opened for three days on March 27.

Further, five IPOs from Yash Optics & Lens, Jay Kailash Namkeen, K2 Infragen, Aluwind Architectural, and Creative Graphics Solutions India will be launched on March 28.

Vishwas Agri Seeds from the SME segment will close its IPO on March 26 and Naman In-Store (India) on March 27. Chatha Foods will list its equity shares on the BSE SME March 27, and Omfurn India on the NSE Emerge on March 28.

Technical View

Technically, the Nifty 50 may remain rangebound unless it decisively breaks 22,200 on the higher side, with immediate support at 21,950 and key support at 21,700 level. The index has formed bullish candlestick pattern with long lower shadow on the weekly scale, indicating buying interest at lower levels, after long bear candle in previous week, but still consistently holding 10-week EMA (21,950) on closing basis.

“As long as the support level of 21,700 holds, a buy-on-dips stance is advisable. However, a breach of 21,700 could potentially lead the index towards the 21,600 – 21,500 range,” Jigar S Patel, senior manager – equity research at Anand Rathi said.

On the upside, the levels of 22,200 – 22,450 are anticipated to pose strong resistance in the coming week, he feels.

F&O Cues

In the coming week, the market is expected to be volatile given the monthly F&O expiry scheduled on March 28. The monthly options data indicated that 21,900-21,800 is expected to be support area for the Nifty 50, with hurdle on the higher side at 22,100-22,300 zone, followed by 22,500 mark.

On the Call side, the maximum open interest was seen at 23,000 strike, followed by 22,500, 22,700 and 22,000 strikes, with meaningful writing at 22,500 strike, then 22,600 & 23,000 strikes. On the Put side, 22,000 strike owned the maximum open interest, followed by 22,100 & 21,500 strikes, with writing at 22,100 strike, then 22,000 & 21,900 strikes.

India VIX

The sharp fall in volatility also caused strength in the market. Experts feel if it sustains at current levels, then that may give some more comfort for bulls going ahead. India VIX, the fear gauge, fell 10.74 percent during the week to 12.22, the lowest level since November 20-24 (2023) week.

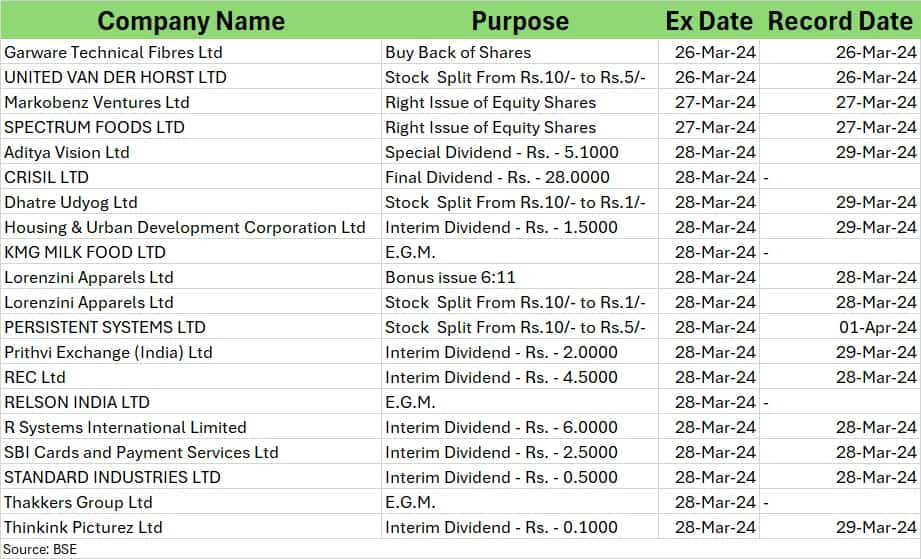

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1180036854-bd92321f0ee641728f625256956e8a54.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2007594509-ba97533a0736449eb4661aa3324f7d5b.jpg)