F&O Manual | Indices trade sideways, Nifty sees call writers dominant with max pain at 21,900

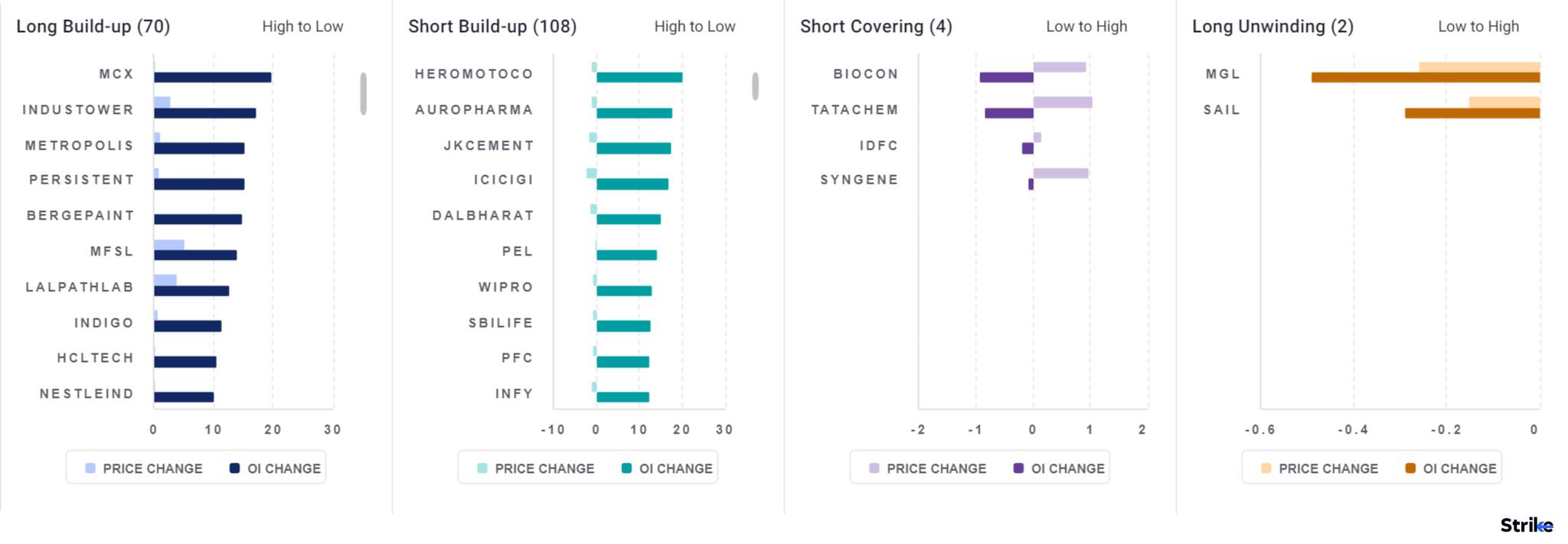

Among individual stocks, long build up is observed in MCX, Industowers, Metropolis and Persistent

The benchmark Indian indices traded within a range as volatility returned on the Street. The Nifty continued to be in a no man’s land, stuck between 21,800 and 22,200 for days. Bulls and bears have attempted breakouts with no success. A close above 22,200-250 is needed for bulls to take control, while immediate support lies at 21,850; a break below would favor bears again, according to experts.

FII activity

In the F&O segment, FIIs closed some short positions in both index futures and call options amid high volatility. In last week’s market recovery, net short positions have decreased to 72,000 from nearly 95,000 seen during the week. In the stock futures segment, significant stock-specific activities were seen as FIIs picked up nearly 11,700 crores. However, despite significant volatility in index options, they have sold more than 82,000 crores.

At 9:55am, the Sensex was down 226.41 points or 0.31 percent at 72,605.53, and the Nifty was down 52.50 points or 0.24 percent at 22,044.30.

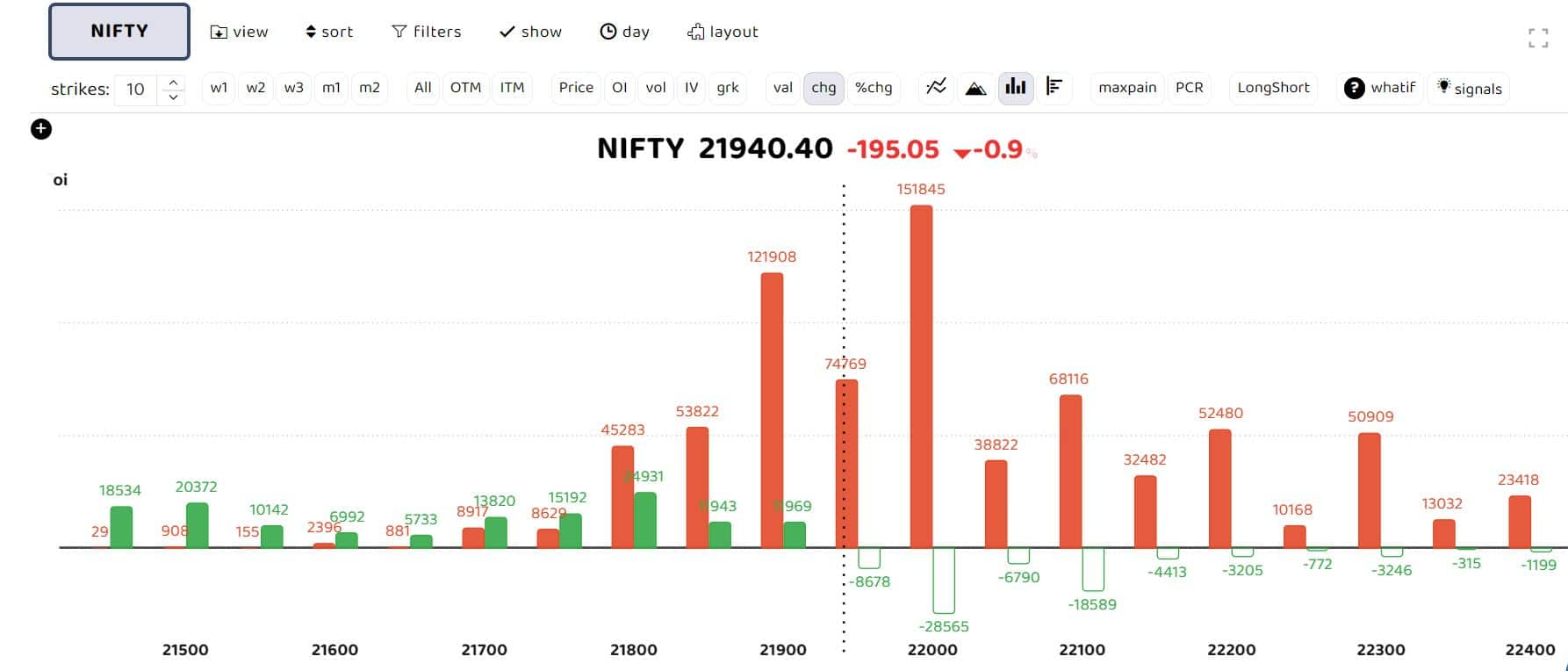

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggest that call writers are dominant for the day with heavy call writing at 22,000 and 22,100 strikes. The max pain point is placed at 21,900 level.

“The Nifty has opened marginally in the negative based on global cues. During last week, the Nifty retraced the recent correction by 50 percent which would be seen as resistance around 22,100, while 21,800 is the immediate support. We expect the market to trade within this range. Traders can look to trade in index with strategies such as short straddle which could be beneficial if index remains rangebound, ” said Ruchit Jain, lead research at 5Paisa.com.

“The Nifty has been stuck within the 21,800-22,200 zone. It seems only on a close above the resistance zone of 22,200-250 will the bulls be in complete control of the set-up. Till then one will have to be very stock specific and look at long trades in some of the outperforming stocks/sectors only,” Tejas Shah, senior vice-president of technical research at JM Financial, said.

Story continues below Advertisement

“Immediate support seen at 21,850, a break of which would again tilt the set-up in favor of the bears. One needs to take an open-minded approach in such a scenario. Supports for the Nifty are now seen at 22,000 and 21,800-850 levels. On the higher side, immediate resistance for Nifty is at 22,200-250 levels and the next resistance is at 22,500-550 levels.”

Among individual stocks, long build-up is seen in MCX, Indus Towers, Metropolis and Persistent. While short build-up is seen in stocks like JK Cement, ICICIGI, Dalbharat and PEL.