Bank Nifty gains on monthly derivatives expiry day, rollovers data shows long bets for April series

Bank Nifty crucial resistance is placed in the zone of 47,000-47,200.

Bank Nifty was trading 0.5 percent up on March 27, also the monthly derivatives expiry day. Bank Nifty rollovers were at 76 percent, suggesting that the long bets were being rolled over to the April series.

At 11 am, Bank Nifty was trading at 46,812, up 208 points or 0.45 percent, from the previous close.

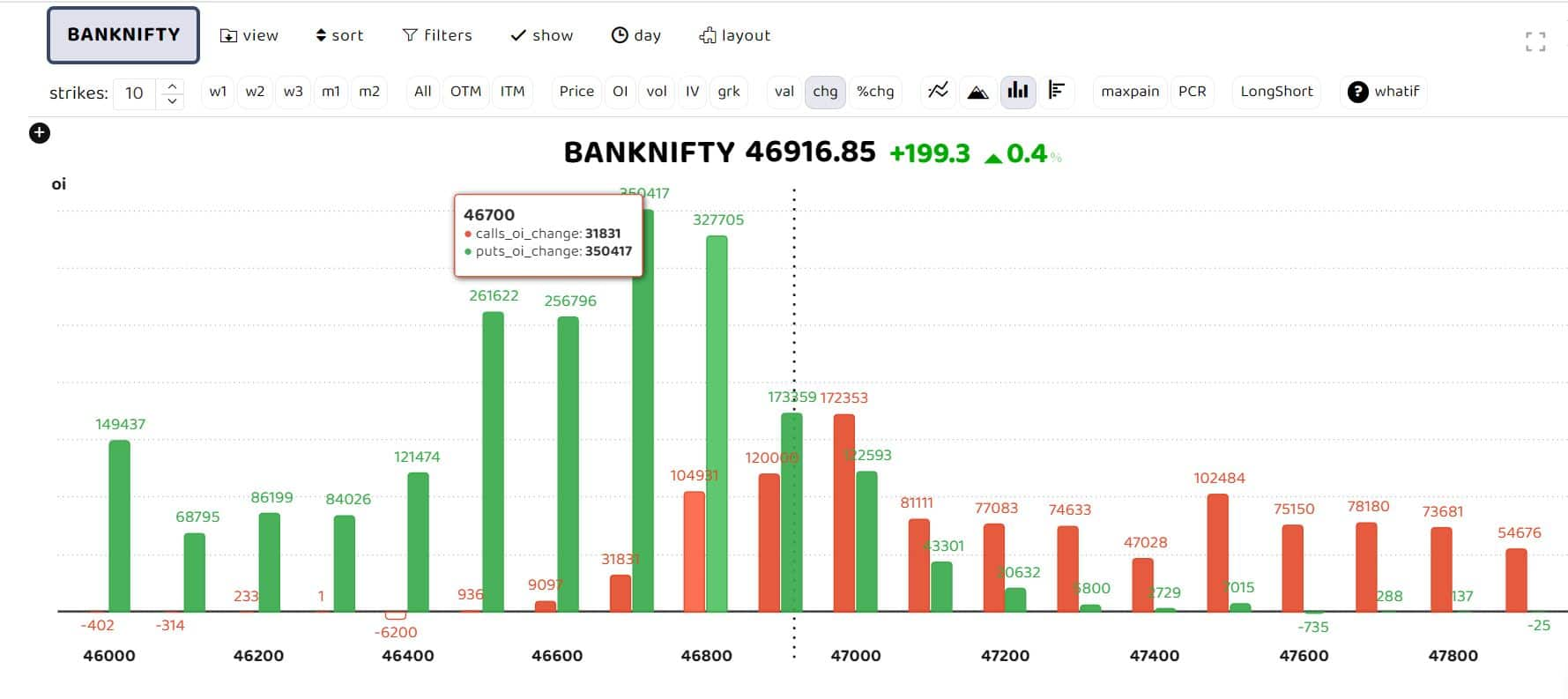

The red bars show the change in open interest (OI) of call writers and the green the change in OI of put writers

The 47,000 strike has significant call open interest followed by the 47,200 strike. On the put side, 46,600 has significant open interest followed by the 46,700 strike. It indicates that the zone of 46,600-46,700 will act as immediate support for the banking index. While the crucial resistance is placed in the 47,000-47,200 zone.

For Bank Nifty, immediate hurdle is at 47,000, which, if crossed, can take the 12-pack index to 47,250-47,350 levels, Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox, said. The trend suggests a move in that direction, however, the confirmation will comes only once the price surpasses the key hurdle, he said.

On the downside, if the index slips below 46,750, the trend may favour bears with price slipping to 46,600-46,450,

Traders should watch these levels before initiating any positions, Bagkar said. If the index trades sideways, the premium around the corner may start to deplete exponentially due to theta decay.

Story continues below Advertisement

Akshay Bhagwat, senior vice president of derivative research, JM Financial, said the pivotal level for Bank Nifty is at 46,500, with a margin of 100 points in either direction. “A sustained move in either direction will dictate the trading trend,” he said.

Rollover data

“Bank Nifty rollovers were at 76 percent. The rollover data shows that the long bets are being rolled to the April series,” Bhagwat added.

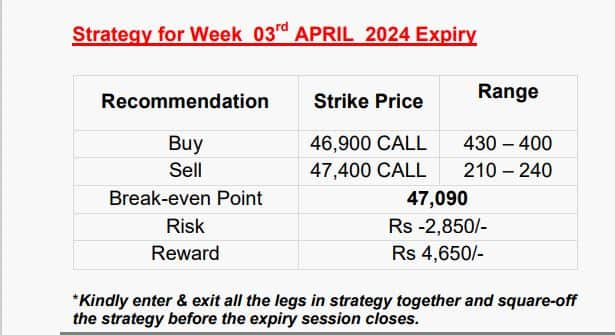

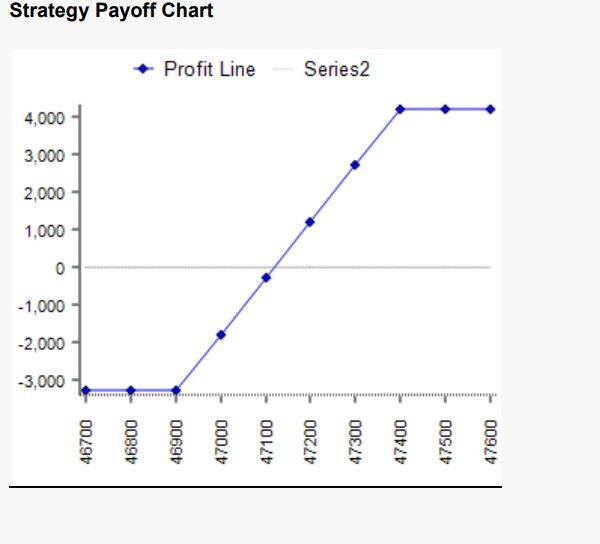

Moderately bullish stance; bull call spread recommended by Axis Securities

Axis Securities has a moderately bullish stance on Bank Nifty. For April 3 expiry, the brokerage advises traders to consider initiating a call spread strategy.

This strategy offers the potential for modest returns with limited risk and reward. The suggested spread involves buying one lot of the 46,900 strike Call option and simultaneously selling one lot of the 47,400 strike Call option.

(Charts source: Axis Securities)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/business-financial-and-forex-concept--hipster-young-woman-freelancer-thinking-about-her-job-and-using-computer-laptop-showing-trading-graph-with-the-stock-exchange-trading-graph-screen-background-807201430-5be77acc46e0fb002ddbfe70.jpg)