F&O Manual | Bulls charge Nifty to surpass 22,400 after consolidation breakout

March 28, 2024 / 02:38 PM IST

Analysts predict on the upper end the rally to extend towards 22,650

The benchmark indices traded higher in the second half of March 28 trading session. The Nifty on the monthly expiry day on March 28 surpassed the 22,400 level, up 270 points, on the back of visible consolidation breakout on the daily timeframe.

Going ahead, as per experts, the sentiment may continue to favour the bulls as long as it stays above 22,200.

At 1:07pm, the Sensex was up 880.53 points or 1.21 percent at 73,876.84, and the Nifty was up 282.80 points or 1.28 percent at 22,406.50. About 2,017 shares advanced, 1,290 declined, and 82 stayed unchanged.

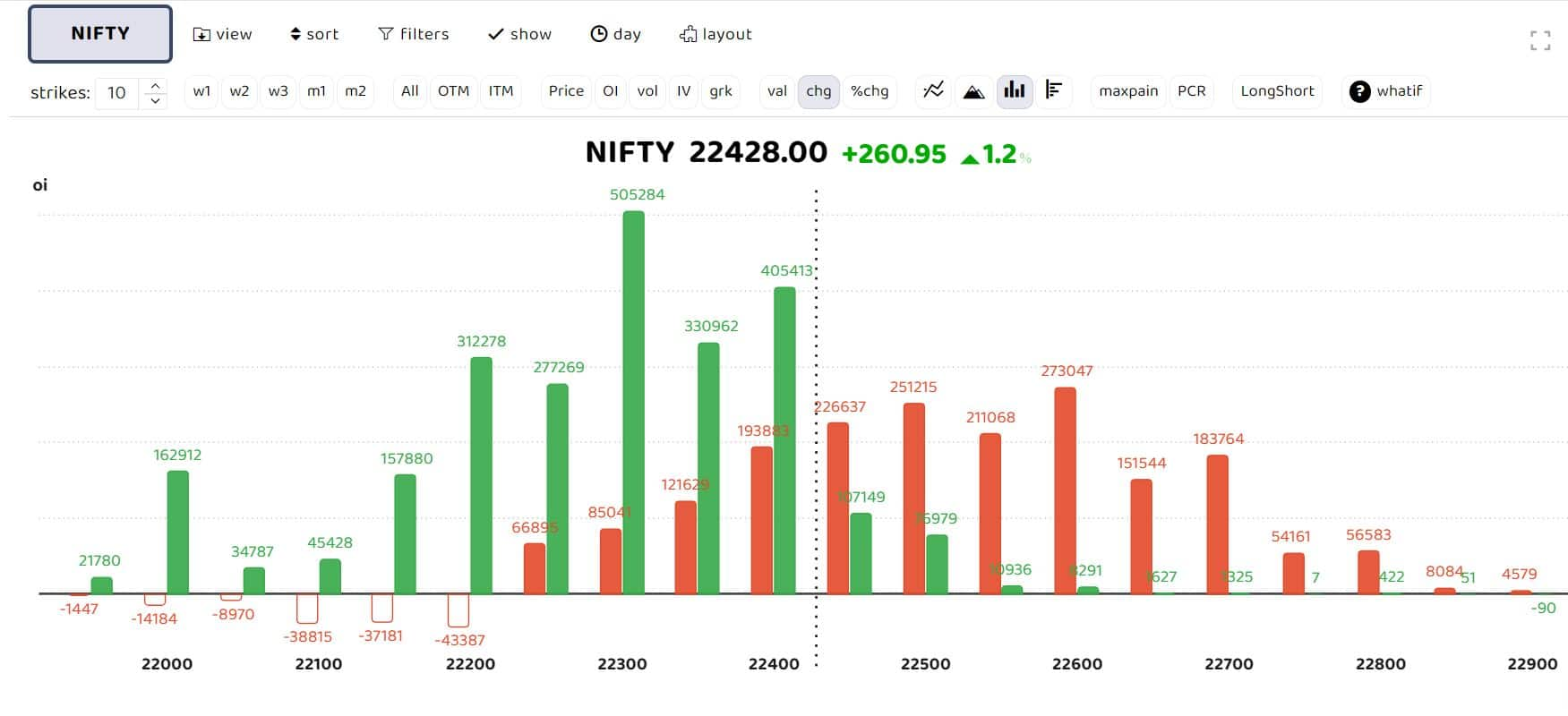

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers.

Options data hints at decent put writing in 22,300 and below strikes. Ruchit Jain, who leads research at 5Paisa.com, believes that the bias remains positive and any dip towards 22,300-22,320 should be used to form long positions in the index.

As per Avdhut Bagkar, derivatives and technical analyst at StoxBox, highlights that the Nifty 50 index has taken out the key hurdle of spot 22,250 on March 28, its monthly expiry day, signifying a positive bias for the following series.

“The trend remains positive till this support is held on a closing bias. A new all-time high over 22,550 could trigger fresh upside for the coming April series and the index may head to the 23,000 mark. So far, the option data reveals addition of longs for April series, with OI gaining closer to 20 percent. The long build-up is assisting the index to aim at crossing the hurdle mark.”

“The Nifty has rallied above 22,400, following a sustained movement beyond 22,100. Moreover, there’s a visible consolidation breakout on the daily timeframe, indicating an increase in optimism. The sentiment may continue to favour the bulls as long as it stays above 22,200. On the upper end, the rally could extend towards 22,650, ” said Rupak De, Senior technical analyst at LKP securities.

Story continues below Advertisement

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.