Broader indices put good show in truncated week; outperform in FY24

BSE Mid-cap Index added 1.3 percent supported by Max Healthcare Institute, Supreme Industries, Aurobindo Pharma, Indian Bank, Indian Hotels Company, Max Financial Services, while losers were Rajesh Exports, Solar Industries India, Schaeffler India, Delhivery, ICICI Securities, IDFC First Bank.

In the holiday-shortened week, the broader indices performed in line with the main indices amid volatility. The support from FIIs narrowed the current account deficit in Q4, and mixed global cues led equity indices to finish near record highs on the final day of the FY24.

This week, BSE Sensex gained 819.41 or 1 percent to end at 73,651.35 and the Nifty50 index added 260 points or 1 percent to finish at 22,326.90.

Among broader indices, the BSE Small-cap, Mid-cap and Large-cap indices rose 1.8 percent, 1.4 percent and 0.6 percent, respectively.

On the sectoral front, the Nifty Realty index gained 5 percent, Nifty Oil & Gas was up 2 percent and Nifty Auto and Healthcare indices added 1.7 percent each. In comparison, Nifty Media index shed 3 percent and Nifty Information Technology index added a loss of 0.8 percent.

Foreign institutional investors (FIIs) turned net buyers in this week as they bought equities worth of Rs 2368.76 crore, while Domestic institutional investors (DIIs) continued their support as they bought equities worth Rs 8,913.49 crore.

In FY24, BSE Mid, Small and Largecap indices surged 63 percent, 60 percent and 32 percent, respectively. On the other hand, BSE Sensex and Nifty rose 25 percent and 28.6 percent, respectively.

“FY24 marked a rewarding period for the Indian market. The upgrade in FY24 economy growth loaded it, as the Indian GDP forecast was uplifted on a QoQ basis from 6.4% to 7.3% during the year. There was a rampage in corporate earnings growth, like with the 23-24% YoY EPS forecast for the Nifty50 index. Retail inflows remained robust, supported by direct investments and investments through MFs. The number of trading accounts held by domestic investors reached 16.7cr, underscoring increased market participation. Additionally, FIIs exhibited improved net buying activity, buoyed by India’s economic outperformance relative to other EMs experiencing slowdowns,” said Vinod Nair, Head of Research, Geojit Financial Services.

“However, the year ended on a subdued note, with substantial selling pressure till the 20th of March. Nevertheless, there has been some relief in the market in recent trading sessions as the pressure from leveraged selling has eased and buying activity has improved, albeit at lower volumes.”

Story continues below Advertisement

“In the coming first week of April, there is a flurry of significant data releases expected, like PMI in the US and India, factory orders, and unemployment data in the US. Additionally, market participants will closely monitor signals regarding policy rates, particularly from the RBI. Moreover, attention will be on India’s Q4FY24 result forecasts, which are expected to indicate a healthy performance.”

“As we move on to a new financial year, we express optimism towards sectors such as Pharma, Capital Goods, and Infra, as we see them as key growth drivers, supported by both domestic and external demand. Although some sectors like FMCG and IT are facing challenges due to subdued demand at present, we anticipate a turnaround, driven by expectations of a normal monsoon and increased US demand following the Fed’s rate cut. However, the focus is on large caps, as the premium valuation of Midcaps could have a hiccup in the short to medium-term,” he added.

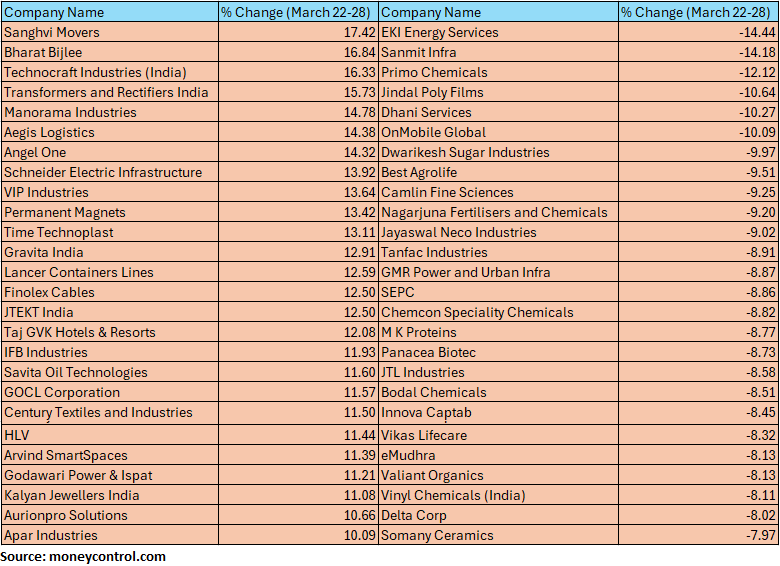

The BSE Small-cap index added nearly 1 percent with 26 stocks gave double digit return including Sanghvi Movers, Bharat Bijlee, Technocraft Industries (India), Transformers and Rectifiers India, Manorama Industries, Aegis Logistics, Angel One, Schneider Electric Infrastructure, among others. However, EKI Energy Services, Sanmit Infra, Primo Chemicals, Jindal Poly Films, Dhani Services and OnMobile Global fell between 10-14 percent.

Where is Nifty50 headed?

Rupak De, Senior Technical Analyst, LKP Securities

The Nifty rallied significantly, surpassing the 22,500 mark after maintaining momentum beyond 22,100. Furthermore, there’s a clear breakout in consolidation on the daily timeframe, signaling rising optimism. Nevertheless, the Nifty encountered initial resistance near its previous swing high of 22,526. Consequently, to sustain a continued rally, it must surpass the 22,525 level decisively. On the downside, 22,200 could serve as short-term support.

Prashanth Tapse, Senior VP (Research), Mehta Equities

While markets may witness wild fluctuations due to valuations of benchmark indices being in an expensive zone, the undertone still remains bullish as investors are willing to bet big on equity assets for the next financial year too. While focus will shift to full year earnings from next month, sectors like banking and IT companies will be in focus going ahead. Although corrections at every interval will provide investors an opportunity to revisit mid & small-cap stocks, large-cap stocks could attract more attention going ahead.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1296348323-44c7aca2cbb14d2f84b65b393fec649a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-171349083-062edb8f4c13435797d038746c27422f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-21669937071-728bfabe684b4c8aa17fc9c47255a740.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1338457868-a84a285627f64532a38b290e15fc48ea.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1440361960-8ba9445e90a74d6d9177d1c88bd6608b.jpg)