Buzzing Stocks: Auto stocks, HDFC Bank, Zomato, RVNL, HAL, Torrent Power, IOC and others

- Hot Stocks

admin

- April 1, 2024

- 0

- 130

- 35 minutes read

Stocks to watch: Check out the companies making headlines before the opening bell today, on April 1, 2024.

Auto stocks in focus: Auto stocks including Tata Motors, Maruti Suzuki India, Hero MotoCorp, Mahindra & Mahindra, TVS Motor Company, Ashok Leyland, Eicher Motors, Escorts, and Bajaj Auto will be in focus ahead of their March sales data on April 1.

HDFC Bank: The private sector lender, said the board has appointed Sumant Rampal as Group Head, Mortgage Business, with effect from March 28. Rampal, who is appointed in place of Arvind Kapil, was the Group Head-Business Banking Working Capital, Rural Banking Group, and Sustainability Livelihood Initiative at HDFC Bank.

Rail Vikas Nigam: The state-owned railway company has emerged as the lowest bidder for the upgrade of the electric traction system for the Kharagpur section of the Kharagpur division of South Eastern Railway to meet the 3,000 MT loading target. The cost of the work is Rs 148.27 crore. Further, the company also emerged as the lowest bidder for the project worth Rs 95.95 crore from NFR-Const HQ-Electrical/NF RLY Construction. Meanwhile, RVNL’s joint venture with Salasar Techno Engineering emerged as the lowest bidder for a project worth $7.15 million from Energy Development Corporation, wherein RVNL shares are 49 percent and Salasar shares are 51 percent.

Infosys: The IT services company has received orders from the Income Tax Department, for assessment years 07-08 to 15-16, 17-18 & 18-19 during the March quarter. As per the orders, the company expects a refund of Rs 6,329 crore (including interest). Also, the company has received assessment order for assessment year 22-23 with a tax demand of Rs 2,763 crore (including interest), and for assessment year 11-12 with a tax demand of Rs 4 crore (including interest).

Advertisement

Advertisement

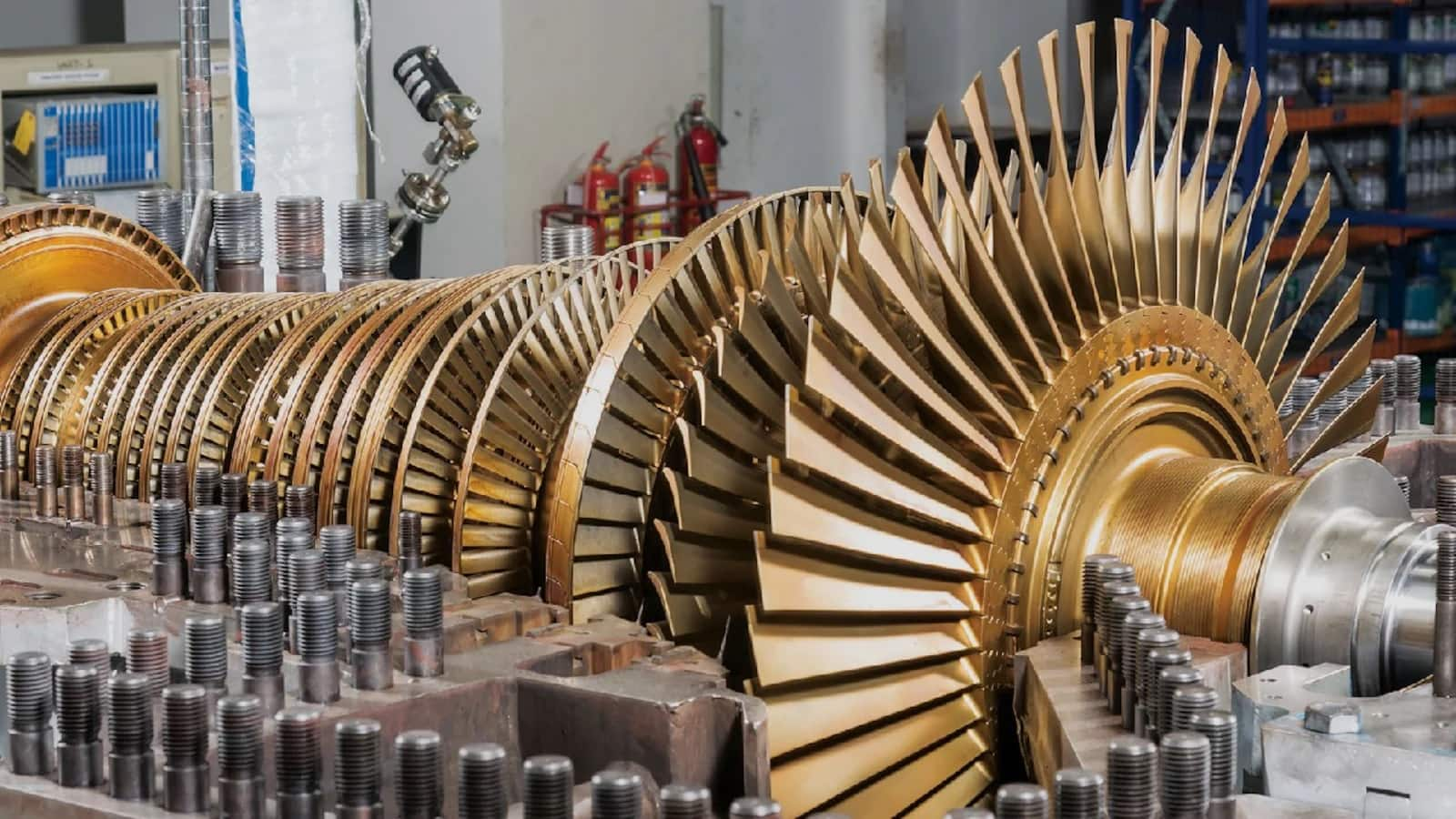

Hindustan Aeronautics: The state-owned defense company has signed a contract worth Rs 1,173.42 crore with Cochin Shipyard, Kochi, for the supply of six sets of LM2500 gas turbines (GT) and GT auxiliaries (GTAE), spares, and tools for the Indian Navy Next Generation Missile Vessei (NGMV) Project.

Torrent Power: The company has received a letter of award from Torrent Power Limited-Distribution Unit for setting up 150 MW (RE Power) grid-connected wind and solar hybrid projects under the greenshoe option. The project will be commissioned within 24 months of the power purchase agreement, and the contract period will be 25 years from the commissioning of the project.

Indian Metals and Ferro Alloys: The company has received board approval for withdrawal of the Scheme of Amalgamation of Utkal Coal with itself from the BSE and the National Stock Exchange of India. The scheme of amalgamation documents were filed with the exchanges on November 21, 2023. The board has also given approval for the acquisition of the remaining shares of Utkal Coal and the write-off of doubtful interest income on a loan issued to Utkal Coal amounting to Rs 110.75 crore and an impairment provision of Rs 111.42 crore against the investment value made by the company in Utkal Coal. Further, the board approved a Rs 200 crore investment into the ethanol business and its allied by-products and declared a special dividend of Rs 15 per share for FY24.

Asian Paints: The paint manufacturing company has received board approval for the subscription to 4.79 crore equity shares of subsidiary Asian Paints International, Singapore, for SGD 32.1 million (Rs 200 crore). These shares will be issued and allotted at SGD 0.67 per share.

Advertisement

Advertisement

Zomato: The food delivery giant has received an order for demand of GST of Rs 11.27 crore, along with applicable interest and penalty totaling to Rs 23.26 crore, from the Assistant Commissioner of Commercial Taxes (Audit), Karnataka. The company believes that it has a strong case to defend the matter before the appellate authority and does not expect any financial impact.

PNC Infratech: The infrastructure company has received payment of Rs 250.3 crore in terms of the Settlement Agreement executed between the company and the National Highways Authority of India under the Vivad Se Vishwas II (Contractual Disputes) Scheme of the Government of India.

Kolte-Patil Developers: Vinayak Jogdeo, Vice President-Liasioning and senior management personnel of the Pune-based real estate company, has decided to take an early retirement from the services and accordingly resigned on January 9, 2024. The company relieved him of the services on March 30.

Bank of India: The Income Tax Department, Assessment Unit, has imposed a penalty of Rs 564.44 crore on the public sector lender for various disallowances made pertaining to Assessment Year 2018-19. The bank is in the process of filing an appeal before the Commissioner of Income Tax, National Faceless Appeal Centre (NFAC), against the said order within the prescribed timelines. The bank believes that it has adequate factual and legal grounds to reasonably substantiate its position in the matter and expects the entire demand to subside. As such, there is no impact on the financial, operational, or other activities of the bank. Meanwhile, the bank also received a demand notice for Rs 1,127.72 crore from the Assessment Unit, Income Tax Department, pertaining to Assessment Year 2016–17.

NTPC: The state-run power generation company has discontinued operation of NTPC Barauni thermal power station Stage-I (2×110 MW), with effect from March 31. The said thermal power station was comprised of two units (Unit 6 and 7) of 110 MW each.

JSW Steel: JSW Vijayanagar Metallics, a wholly-owned subsidiary of the company, has commissioned its hot strip mill (HSM) at the steel plant in Vijayanagar with a capacity of 5 MTPA and has made its first dispatch.

Yes Bank: The bank has received Rs 366 crore from a single trust in the Security Receipts Portfolio pertaining to the sale of the NPA portfolio to J.C. Flower Asset Reconstruction on December 17, 2022. Meanwhile, the bank has received a reassessment order from the National Faceless Assessment Unit, Income-tax Department, raising additional demand for tax liability (including interest) on various income-tax disallowances, amounting to Rs 112.81 crore.

Macrotech Developers: The real estate developer has acquired 50 percent of the paid-up equity capital of Siddhivinayak Realties under a Share Purchase Agreement for Rs 250.72 crore.

Metro Brands: The footwear retailer has extended its partnership with Crocs India. The partnership has granted Metro Brands exclusive rights to operate and own Crocs full-priced stores across the western and southern states of India. Further, Metro Brands will have the right to continue, renew, and operate all existing stores that are currently operational in the northern and eastern states of India.

Karnataka Bank: The lender has signed an agreement with ICICI Lombard General Insurance Company to distribute their general insurance products to the customers of the bank. Meanwhile, the bank has approved the allotment of Rs 600 crore worth of equity shares under qualified institutional placement (QIP) at a price of Rs 227 per share to domestic and foreign institutional investors, including Morgan Stanley, HSBC Mutual Fund, SBI Life Insurance Company, Franklin India, and Max Life Insurance Company.

IDFC First Bank: Foreign investor Cloverdell Investment exited the bank by selling its entire shareholding of 15,88,53,018 equity shares (2.25 percent stake) at an average price of Rs 75.24 per share, valued at Rs 1,195.21 crore.

Greenply Industries: The joint venture unit of the company has commenced manufacturing activities and commercial production at Vadodara, Gujarat. The production at the said facility will be ramped up in three phases over the next three years. Greenply incorporated a 50:50 joint venture company in India, Greenply Samet, for manufacturing and selling functional furniture hardware.

Canara Bank: The public sector lender has received board approval to dilute a 13 percent stake in Canara Robeco Asset Management Company via an initial public offering, which is subject to the approval of the RBI and the Department of Financial Services.

Indian Oil Corporation: For the transition to clean energy in India, IOC has signed a binding term sheet with Panasonic Energy to draw up a framework for the formation of a joint venture for manufacturing cylindrical lithium-ion cells in India. The joint venture is in anticipation of expanding demand for batteries for two- and three-wheel vehicles and energy storage systems in the Indian market.

Garden Reach Shipbuilders & Engineers: The state-owned warship builder has achieved an annual turnover of Rs 3,400 crore (provisional and unaudited) for FY24, the highest ever in the history of the company, growing 33 percent over the previous year.

IFB Industries: The board has appointed Soumitra Goswami as the interim CFO and key managerial personnel of the company, with effect from April 1, 2024, until the time a new CFO is appointed. Prabir Chatterjee has retired as whole-time- director and CFO of the company, with effect from March 31.

Indian Hume Pipe Company: The company has received a tax demand order of Rs 93.44 crore for the assessment year 2022-2023 from the Income Tax Department.

Thangamayil Jewellery: The company has received a notice of tax demand of Rs 70.18 crore, including interest, from the Income Tax Department. The said order is appealable before appellate authorities. The company will file its appeal within the specified period. The company, as per law, is required to make up to 20 percent of the demanded amount, amounting to Rs 14.04 crore, which has no material impact on the financials as well as on operations or other activities of the company.

Man Industries: Ashok Gupta, the Chief Financial Officer of the company, has superannuated on March 31 after a long career stint with MAN Group. Hence, Sanjay Kumar Agrawal has been appointed as the Chief Financial Officer of the company, with effect from April 1.

Triveni Turbine: The company has received approval from the board members for the re-appointment of Dhruv M. Sawhney as Managing Director for five years, with effect from May 10. Dhruv is designated as the chairman and managing director of the company. Further, the board has appointed SN Prasad as Chief Executive Officer and Sachin Parab as Chief Operating Officer of the company, with effect from April 1.

Globus Spirits: The company has commenced commercial production of additional capacity at two of its existing units at Singhbhum, Jharkhand, and Burdwan, West Bengal. With this expansion, the capacity of the units increased from 140 KLPD to 200 KLPD in Jharkhand and from 240 KLPD to 300 KLPD in West Bengal. The additional capacity will be used for various products, including ENA and ethanol. The expansion has been completed with a total investment of Rs 142 crore.

Suzlon Energy: The National Faceless Assessment Centre, Income Tax Department, has issued orders for FY16 and FY17 levying penalties on Suzlon in respect of disallowance of a claim of depreciation on goodwill. There will be an impact of Rs 260.35 crore on the financial, operational, or other activities of the company.

Vimta Labs: The company has received approval from the board of directors for the merger of its subsidiary Emtac Laboratories with itself. The scheme of amalgamation is subject to the approval of the National Company Law Tribunal.

Century Enka: The company has commissioned the SSP and polyester spinning capacity to be used in polyester tire cord fabric (PTCF). The company will now start the process of approving PTCF with tire companies. With this project completion, all projects approved under the aforesaid capex stand completed.

Indian Terrain Fashions: Vidyuth Venkatesh Rajagopal has expressed his intention to step down from the position of Joint Managing Director of the Company with effect from March 31.

Syngene International: The pharma research company has received an order for tax demand of Rs 16 crore from the Income Tax Department for the Assessment Year 2022–23. The company is in the process of analyzing the order and will take the next course of action.

Muthoot Microfin: The microfinance institution has raised $75 million through external commercial borrowings. Participants in the deal included Standard Chartered Bank, Doha Bank, RakBank (National Bank of Ras Al Khaimah), Union Bank of India (UK)., and Canara Bank, GIFT City.

India Pesticides: The first block of the company’s wholly owned subsidiary, Shalvis Specialities at Hamirpur, Uttar Pradesh, has commenced its commercial production.

Great Eastern Shipping: The company has contracted to buy a medium-range product tanker for about 51,486 dwt. The 2013-built vessel is expected to join the company’s fleet by Q1 FY25.

Vishwas Agri Seeds: The company will list its equity shares on the NSE Emerge on April 1. The issue price is Rs. 86 per share. Its equity shares will be available for trading in the trade-for-trade surveillance segment.

Rategain Travel Technologies: Promoter Megha Chopra has sold 25.2 lakh equity shares (equivalent to 2.13 percent of paid-up equity) at an average price of Rs 715.25 per share, valued at Rs 180.24 crore. However, Europe-based financial services firm Societe Generale acquired 9,33,222 equity shares in the company at an average price of Rs 715 per share.

Cartrade Tech: ICICI Prudential Mutual Fund, through its ICICI Prudential India Opportunities Fund, bought 5,92,805 equity shares in the company at an average price of Rs 640 per share via open market transactions. However, foreign investor Springfield Venture International sold 6,31,107 equity shares (1.34 percent of paid-up equity) of the company at an average price of Rs 640.04 per share.

Navisha Joshi

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

`);

}

if (res.stay_updated) {

$(“.stay-updated-ajax”).html(res.stay_updated);

}

} catch (error) {

console.log(‘Error in video’, error);

}

}

})

}, 8000);

})

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1296348323-44c7aca2cbb14d2f84b65b393fec649a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-171349083-062edb8f4c13435797d038746c27422f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-21669937071-728bfabe684b4c8aa17fc9c47255a740.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1338457868-a84a285627f64532a38b290e15fc48ea.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1440361960-8ba9445e90a74d6d9177d1c88bd6608b.jpg)