Which stocks and sectors will be in focus in April Series as per rollover data?

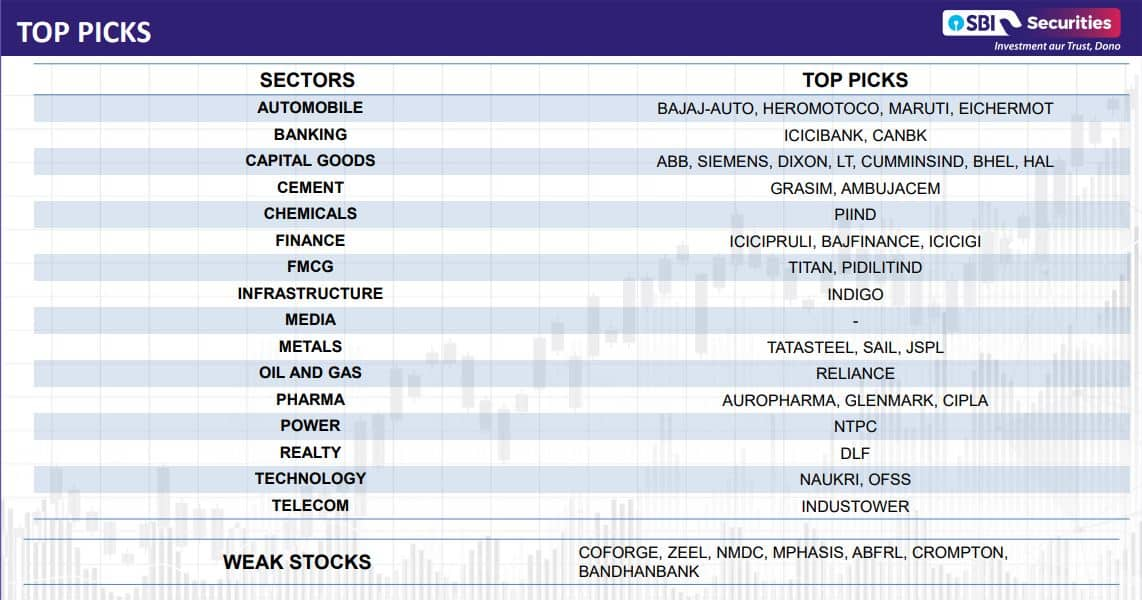

SBI Securities’ top picks in April series includes Jsw Steel, HindCopper, Canara Bank, LT, ABB, HAL, DLF, Maruti and Ambuja Cement.

The April series has begun with optimism as the Nifty touched a fresh all-time high of 22,529 in the morning of the first day of FY25, while Bank Nifty traded at 47,500, up 400 points or 0.93 percent. Data shows that highest rollovers were seen in banking, cement, finance, metals, and capital goods, whereas a short squeeze was seen in automobile, pharma, chemicals, and realty sectors. Weak rollovers were observed in FMCG, media and textile. A mixed bag of sentiment was felt in power and technology stocks.

According to Soni Patnaik, Assistant Vice President at JM Financial, stock futures rollovers stand at 93 percent, which is in line with its three-month average of 93 percent. “Strong rollovers were seen in IndiGo (92 percent), Abbott (94 percent), Mfsl (98 percent), Tata Motors (93 percent), Bajaj Auto (94 percent), Canara Bank (97 percent), Bank of Baroda (97 percent), Ambuja Cements (97 percent), Godrej Consumer Products (97 percent), ICICI General Insurance (97 percent), Adani Ports (96 percent), National Aluminium (97 percent), Gail (97 percent), Glenmark (99 percent), Lal Path Labs (97 percent), Zydus Life (96 percent), Tata Power (97 percent), Indian Hotels (97 percent), Ofss (95 percent), and Indus Towers (90 percent).”

Patnaik’s top long picks for the April series include Tata Power, MFSL, Canara Bank, National Aluminium, Abbott, Indian Hotels, Zydus Life, while in large caps, it includes HDFC Bank and ICICI Bank.

According to Nuvama research, the NSE Auto index was up by 4.93 percent in March expiry. Long build-up was seen in Bajaj Auto, and short-covering was seen in Eicher Motors, Hero MotoCorp, Maruti and Tata Motors.

The NSE Metal Index was up by 4.23 percent in March expiry. Long build-up was observed in JSW Steel and Tata Steel, and short-covering was seen in Hindalco.

The NSE Pharma Index declined 0.04 percent in March expiry. Short-covering was observed in Apollo Hospital, Cipla, Sun Pharma, and Bharti Airtel.

The Nifty Bank Index was up 2.18 percent in March expiry. Short-covering was seen in HDFC Bank, ICICI Bank, IndusInd Bank and Kotak Bank. While among public sector lenders, short-covering was seen in SBIN.

“The April series typically exhibits a stronger bias towards Nifty Bank, as historical data suggests that 70 percent of the time over the last 10 years, April has delivered an average positive return of 3 percent. Currently, the positioning in banking appears to be heavily short in my opinion, indicating the potential for some covering-led action, which could result in gains of around 2 to 2.5 percent by mid-month. However, around the 48,400 mark, I would consider setting up a short position, as I don’t foresee significant outperformance, and one should approach trades with a 1 percent stop loss,” Abhilash Pagaria, head of Nuvama Alternatives and Quantitative Research, said.

Story continues below Advertisement

“Among specific stocks, HDFC Bank could see a positive uptick of 2-3 percent next week as investors anticipate its March 24 shareholding and the possibility of a weight up in the MSCI index,” Pagaria said.

Pagaria notes that he favours the metal pack, comprising the likes of Vedanta and JSW Steel, and pharma names. “The momentum in auto names remains strong and is expected to continue until signs of frothiness emerge. Conversely, the IT Basket continues to be a short candidate for us, as there are no discernible signals in derivative data to warrant a contrarian bet.”

SBI Securities: Top picks based on rollover data

“Potential outperforming sectors are private banks, PSU banks, capital goods, healthcare, financial services, metals, CPSE and automobile. While in April series, potential underperforming sectors could be IT and media,” Sudeep Shah, DVP and head of technical and derivative research at SBI Securities, said.

“Our top picks include stocks from diversified sectors such as Jsw Steel, Hind Copper, Canara Bank, L&T, ABB, HAL, DLF, Maruti and Ambuja Cement.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.