F&O Manual| Indices consolidate at higher levels, Nifty sees support at 22,425

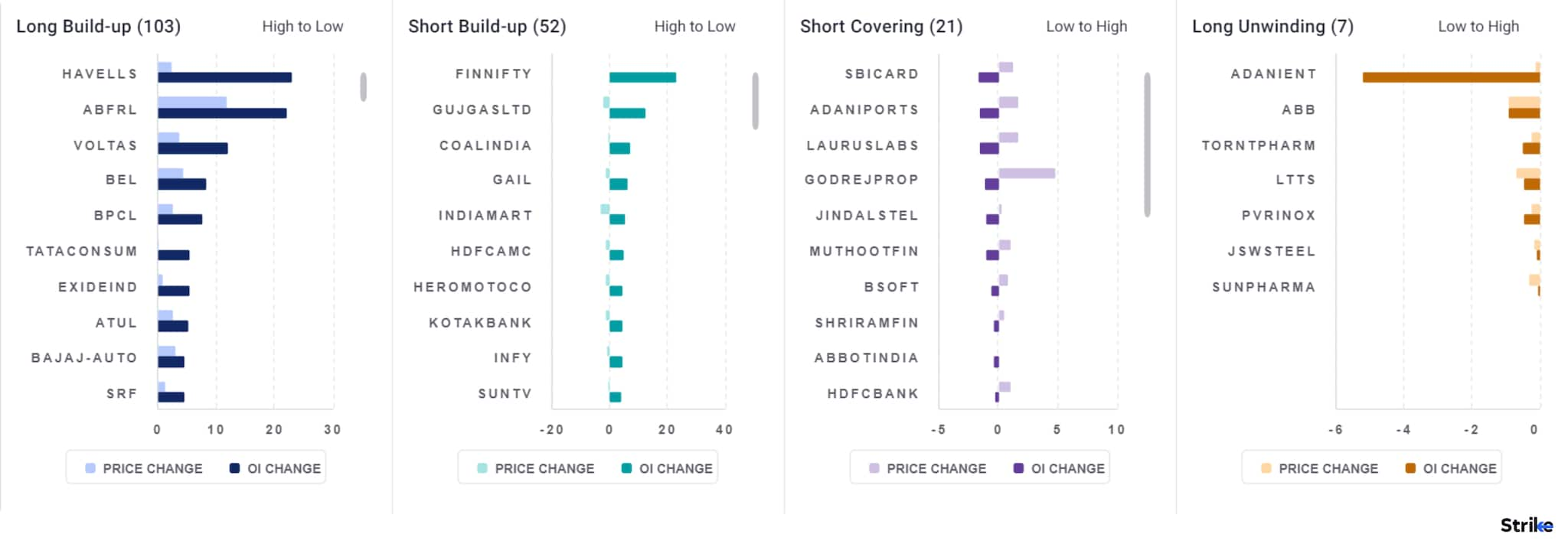

Among individual stock, long build up is observed in Havells, ABFRL, Voltas and BEL. While short build up is witnessed in GujGas and Coal India.

The bellwether market indices traded within a range around mid-day on April 2 as consolidation near all-time-high levels begins. The Nifty faced a lot of resilience around 22,500-22,530 levels, the previous all-time high, for the past couple of days on an immediate basis. A level of 22,425 is an immediate support to watch out for in the NSE benchmark.

At 11:47 am, the Sensex was down 190.64 points or 0.26 percent at 73,823.91, and the Nifty was down 43.80 points or 0.19 percent at 22,418.20. About 2380 shares advanced, 902 declined, and 80 stayed unchanged.

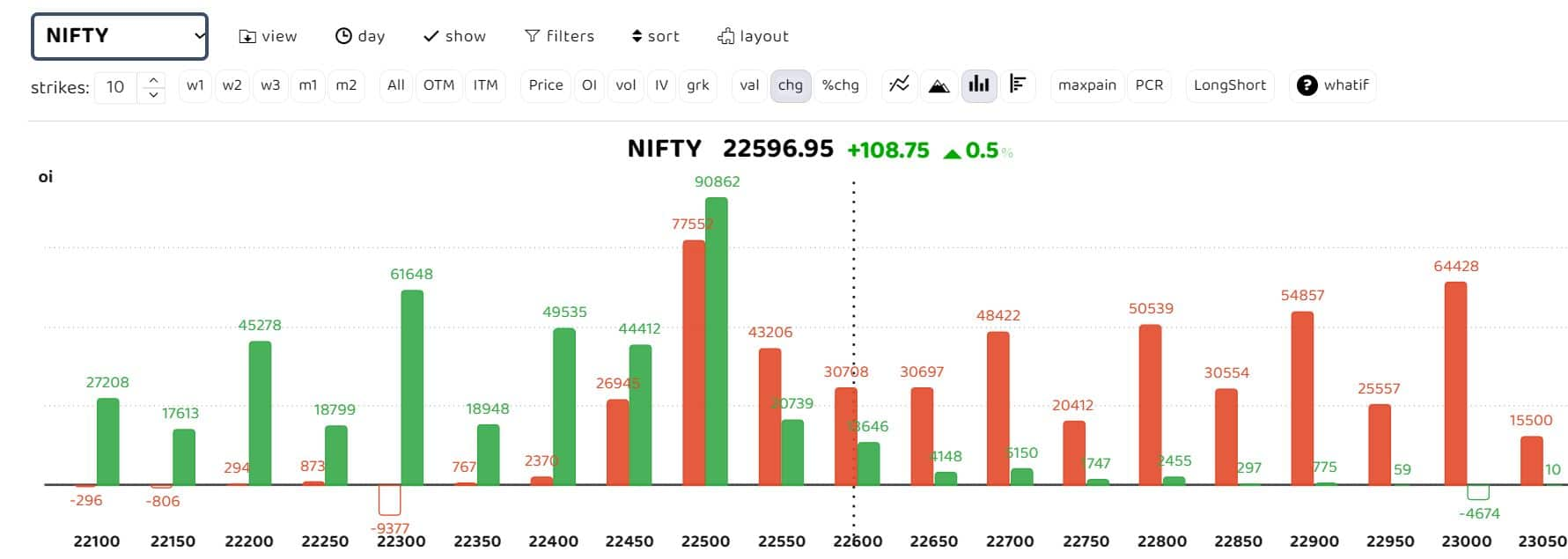

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Option data shows that the Nifty sees key straddle positions formed at the 22,500 strike. “The Nifty is facing a lot of resilience around 22,500-530 levels (Previous ATH) for the past couple of days on an immediate basis. We need to see a decisive close above 22,500-530 levels for further strength in Nifty. The short term moving averages are below the price action and should continue to support the indices on any decline,” Tejas Shah, senior vice-president of technical research at JM Financial, said.

“A level of 22,425 is an immediate support to watch out for in the Nifty, while the bigger area of support zone stands at 22,150-22,200. On the higher side, immediate crucial resistance for the Nifty is at 22,500-22,530 levels and the next resistance zone is at 22,750-22,800 levels,” Shah said.

“While strong support for the Nifty lies around 22,180, the zone of 22,500-22,520 will be the immediate hurdle for the index for the day. Any sustainable move above the level of 22,520 will lead to a short-covering move in Nifty towards 22,650-22,680 in the short term. If in case index slips below 22,180, it will lead to further selling pressure in the index up to the 22,050-22,020 level,” Sudeep Shah, DVP and head of derivative and technical research at SBI Securities, said.

Among individual stock, long build up is observed in Havells, ABFRL, Voltas and BEL. While short build up is witnessed in GujGas, Coal India and GAIL.

Among individual stock, long build up is observed in Havells, ABFRL, Voltas and BEL. While short build up is witnessed in GujGas, Coal India and GAIL.

Story continues below Advertisement

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1198419632-dbbb7237b9374451b941a338fd6e2430.jpg)