F&O Manual | Bank Nifty under selling pressure, struggles to hold above 48,000

Bank Nifty index must surpass the 48,000 mark decisively for next leg of rally

The Indian equity benchmarks were trading higher in the afternoon on oril 4 after remaining range-bound earlier in the day. Bank Nifty was hovering around the psychological mark of 48,000, with selling pressure emerging from higher levels.

There is still a lack of underlying relative strength in the bullish intraday momentum, making it difficult for the index to cross 48,000 with strength, experts said.

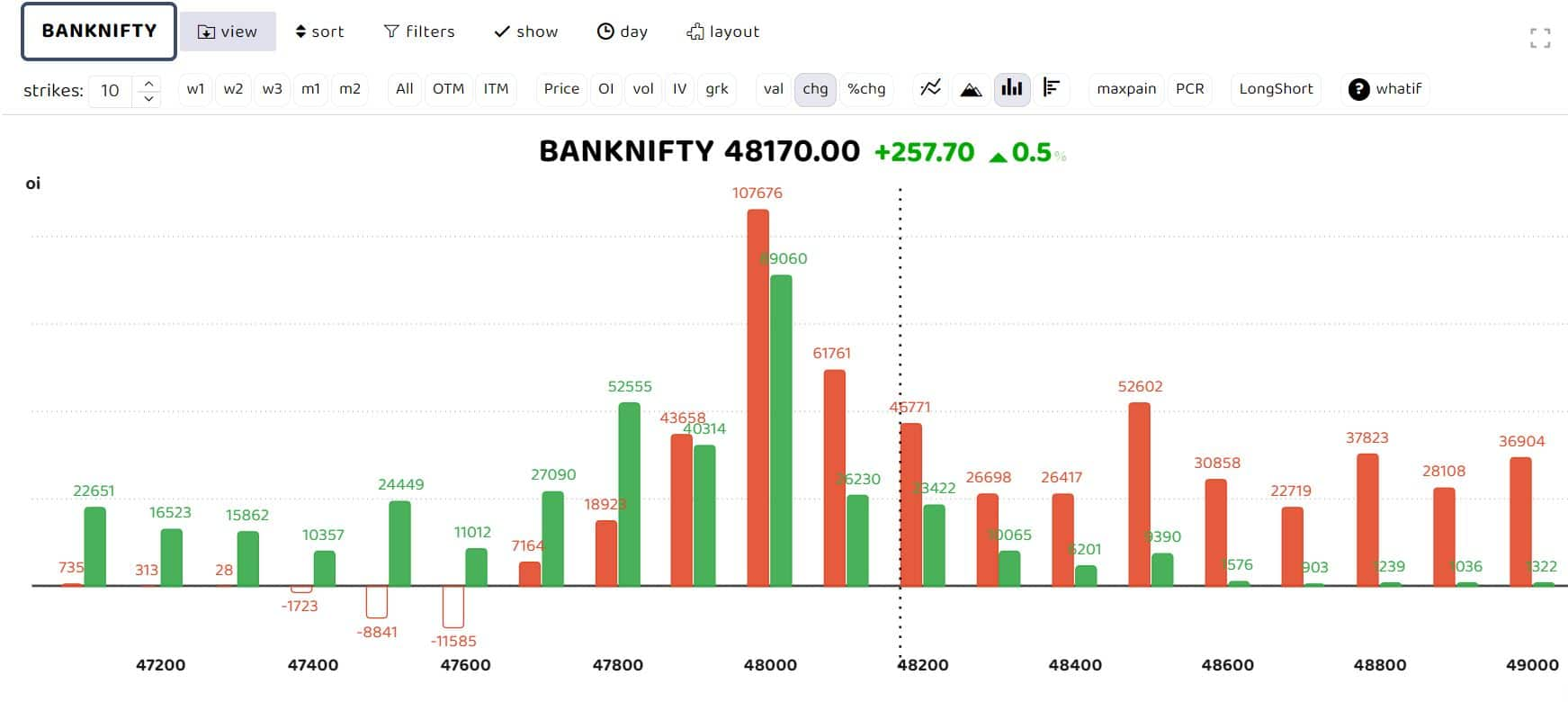

Bars in the red indicate the change in the open interest (OI) of call writers, while the green show the change in OI of put writers

Bars in the red indicate the change in the open interest (OI) of call writers, while the green show the change in OI of put writers

Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox, said Bank Nifty is facing extensive selling pressure around the 48,000 mark, particularly with the 48,100 CE and 48,200 CE witnessing writing pressure. “Although both of these CEs (48,100 & 48,200) are seeing a long build-up, the strength and momentum are not favoring the bullish bias.”

“While the overall trend appears to be scaling higher levels with a positive bias, the index must surpass the 48,000 mark decisively. It needs to provide consecutive closes to initiate a bullish stance,” he added.

He recommends taking derivative positioning based on below two risk profiles:

Situation 1: For Aggressive traders

Aggressive traders may opt for taking 47900 PE around 280 – 370 levels, holding 200 as SL and aiming for 400 and 450 level intraday.

Story continues below Advertisement

Situation 2: Neutral

If Bank Nifty manages to hold above 48000 for 15 minutes, aggressive traders may go long in 48000 CE around 310 -300, holding 240 as SL and aiming at 450 levels.

HDFC Bank

HDFC Bank was among the top gainers, up 3 percent and trading at Rs 1,530. Technically, the price has reached its immediate hurdle range of 1,520-1,530, where the 100-day moving average (DMA) is located. For the rally to continue, the price action must see robust volumes around these levels, Bagkar said. The next hurdle is at 1,550, its 200-DMA. “Only by surpassing these levels can the price break out on the upside and potentially rally to the 1600 mark,” Bagkar said.

“Derivative data indicates that writers are closing positions in the 1500 CE, resulting in the highest Open Interest (OI) structure. On the higher side, the 1520 CE and 1550 CE are showing a build-up of long positions, ” Bagkar said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1296348323-44c7aca2cbb14d2f84b65b393fec649a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-171349083-062edb8f4c13435797d038746c27422f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-21669937071-728bfabe684b4c8aa17fc9c47255a740.jpg)