Bank Nifty gains after RBI holds rates: Use this long call strategy with low risk, limited loss if index falls

RBI maintains a stance of ‘withdrawal of accommodation’

Bank Nifty gained 144.2 points or 0.3 percent in the afternoon trade on April 5 to trade at 48,205, following the Reserve Bank of India’s decision to maintain the repo rate at 6.5 percent, in line with the Street expectations. The banking index is expected to jump in the April series.

“With the RBI keeping the key rates unchanged, which was the expected stance, Bank Nifty does not seem to have any barriers for a small bump on the upside,” said Rahul Ghose, derivatives expert and CEO of Hedged.in.

He advises traders to take protected positions if the view does not play out, as the Nifty 50 index is in a slightly overvalued territory.

Ghose advises a low-risk bullish-to-neutral trade, which is protected on the downside, on Bank Nifty for the April series. He suggests a Modified Call Butterfly strategy.

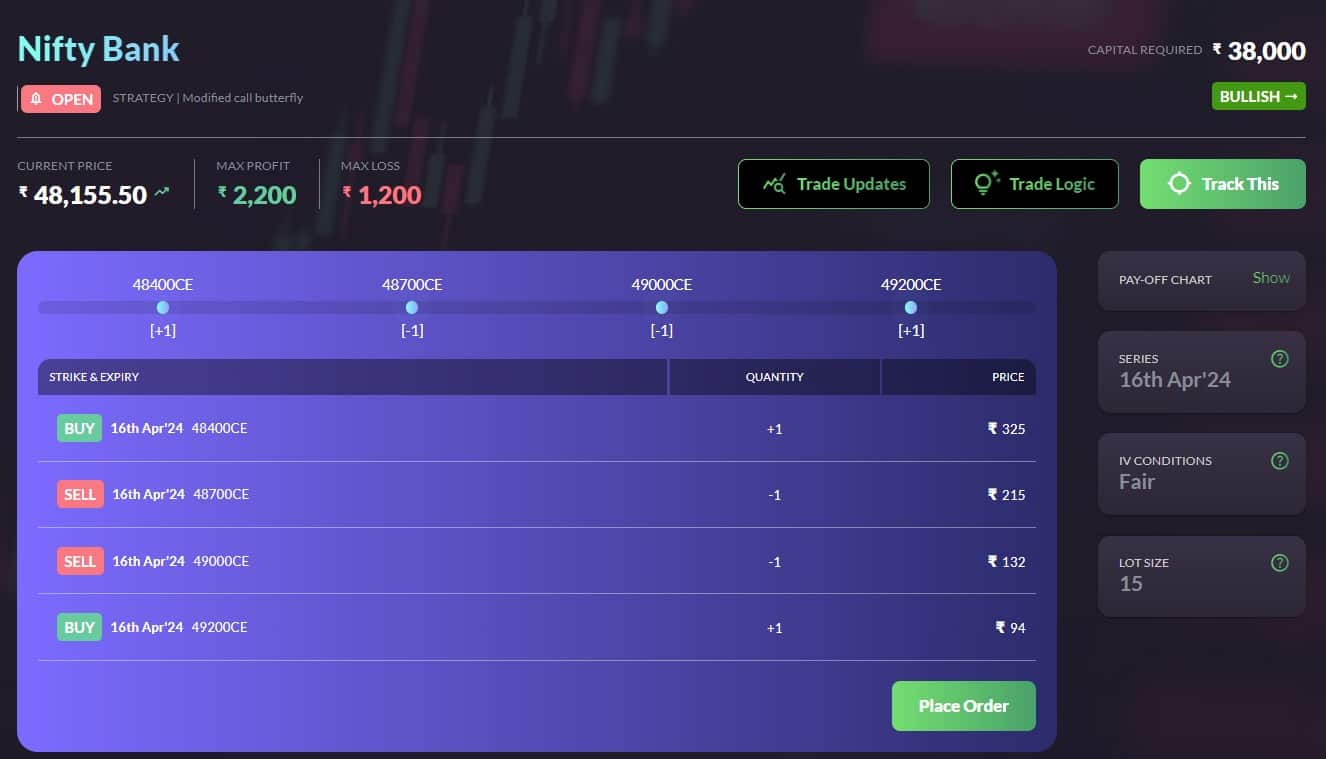

Derivative Strategy recommended by Rahul Ghose: Bank Nifty Modified Call Butterfly

Bank Nifty modified call butterfly strategy strikes and expiry |Source: Hedged.in

Bank Nifty modified call butterfly strategy strikes and expiry |Source: Hedged.in

– Buy Bank Nifty 16 April 48400CE

– Sell Bank Nifty 16 April 48700CE

– Sell Bank Nifty 16 April 49000CE– Buy Bank Nifty 16 April 49200CE

Capital Required for the entire strategy: Rs. 39,000 per lot

Story continues below Advertisement

Maximum Risk in the strategy: Rs. 1200

Possible Trade Modifications:

If Bank Nifty falls below 47,400 or weakens, traders must roll down the last two legs. They should sell 48800 CE and buy 48900 or 49000 CE to cover the debit. This adjustment needs to be done only if Bank Nifty falls below 47300 levels.

When will the strategy make money:

The strategy will make money if Bank Nifty goes above 48500 to any value above.

Also read: Option strategy of the day | Bull call spread in Shriram Finance following crossover

Rationale

“This strategy carries very low risk and can be used by traders on a monthly basis, as the maximum loss is only Rs. 1200 in case Bank Nifty goes down,” said Ghose.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/Primary-Image-capital-one-cd-rates-april-2023-7480645-ac2144f5c5fc440a8543da6907f96ae8.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1448623832-52fc53ba20034936aaabf25ee6cff828.jpg)