400 smallcap stocks deliver double-digit returns amid broader market rally

Among the broader indices, the BSE Small-cap, Mid-cap and Large-cap indices gained 7 percent, 4 percent and 1 percent, respectively.

Broader indices continued the last financial year outperformance in the first week of April (FY25) as Indian benchmark indices witnessed volatility amid mixed cues including geopolitical tension, rising crude oil prices, FIIs selling, inline RBI policy outcome and likely delay of rate cut by Fed going ahead.

In this week, BSE Sensex rose 596.87 or 0.81 percent to finish at 74,248.22 and touched record high of 74,501.73. Nifty50 index gained 186.8 points or 0.83 percent to close at 22,513.70 and touched new high of 22,619.

Among the broader indices, the BSE Small-cap, Mid-cap and Large-cap indices gained 7 percent, 4 percent and 1 percent, respectively.

Nifty Midcap 100 index crossed 50,000 mark for the first time and touched new high of 50,152.35.

Among sectors, Nifty Media index jumped 6.7 percent, Nifty Metal added 5.3 percent and Nifty PSU Bank up 4.2 percent and Nifty Realty index rose 4 percent.

Also Read | Market hits fresh record high amid volatility; rupee gains

Foreign institutional investors (FIIs) sold equities worth of Rs 3,835.75 crore.

“The market boarded on a strong trajectory at the onset of the new financial year, where Mid & small caps outperform with 4 & 7%, respectively. The banks provided a return of 2.4%, aided by robust deposit & credit growth data. However, towards the end of the week, volatility rose due to a surge in US bond yields and crude oil prices, along with escalating geopolitical tensions. Despite the RBI’s policy meeting aligning with expectations, concerns surrounding food inflation and alerts of a heat wave tempered market sentiment,” said Vinod Nair, Head of Research, Geojit Financial Services.

Story continues below Advertisement

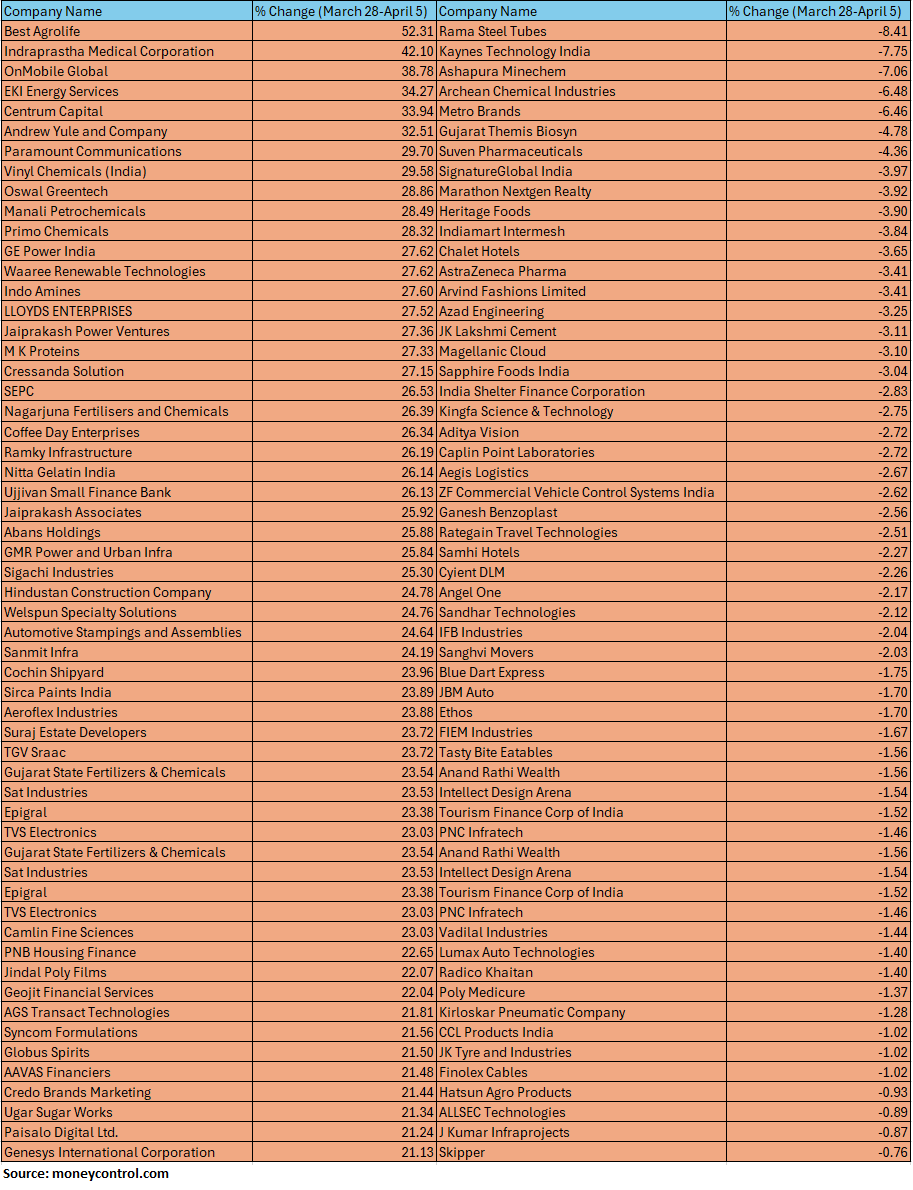

400 Small-cap stocks gain 10-52 percent and among them Best Agrolife, Indraprastha Medical Corporation, OnMobile Global, EKI Energy Services, Centrum Capital, Andrew Yule and Company, Paramount Communications, Vinyl Chemicals (India), Oswal Greentech, Manali Petrochemicals, Primo Chemicals, GE Power India, Waaree Renewable Technologies, Indo Amines, Lloyds Enterprises, Jaiprakash Power Ventures, M K Proteins, Cressanda Solution, SEPC, Nagarjuna Fertilisers and Chemicals, Coffee Day Enterprises, Ramky Infrastructure, Nitta Gelatin India, Ujjivan Small Finance Bank rose 25-52 percent.

On the other hand, losers included Rama Steel Tubes, Kaynes Technology India, Ashapura Minechem, Archean Chemical Industries, Metro Brands, Gujarat Themis Biosyn, Suven Pharmaceuticals, SignatureGlobal India, Marathon Nextgen Realty and Heritage Foods.

Also Read | India’s Hot Summer Creates Winners in Its Pricey Stock Market

Where is Nifty50 headed?

Rupak De, Senior Technical Analyst, LKP Securities

The index has remained sideways throughout the session, reflecting a pause in the market trend following the formation of a hanging man pattern. The sentiment may continue to remain sideways due to the lack of a directional breakout or pattern formation. At the higher end, 22650 might prove to be a crucial resistance level. A fresh rally is not anticipated as long as the index remains below 22650. On the lower end, support is evident at 22300; if breached, the index might decline towards the 22000-21900 range.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty opened on a weak note and consolidated during the day. On the daily charts we can observe that the Nifty consolidated and traded within the range of the previous trading session. The Nifty appears to be consolidating after a sharp run-up which is a healthy sign. We expect the consolidation to breakout on the upside and thus minor degree corrections should be bought into. On the upside we expect levels of 22700 which is the upper end of the rising channel. On the downside crucial support is placed at 22400 – 22350.

As far as Bank Nifty is concerned, it has been outperforming and we expect the outperformance to continue. On the upside the immediate hurdle is placed at 48636 and above that the rally is likely to continue till 49300. The zone of 47700 – 47500 shall act as a crucial support zone from short term perspective. On the downside 48000 is the crucial support from short term perspective.

Ajit Mishra, SVP – Technical Research, Religare Broking

The recent consolidation in Nifty amid weak global cues indicates time-wise correction and traders should maintain a positive bias until the Nifty holds 22,200 level. However, stock selection is tricky in the prevailing scenario due to a mixed trend across sectors so traders should maintain extra caution on that part. Besides, one shouldn’t go overboard and restrict positions in quality midcap and smallcap names.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/Primary-Image-capital-one-cd-rates-april-2023-7480645-ac2144f5c5fc440a8543da6907f96ae8.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1448623832-52fc53ba20034936aaabf25ee6cff828.jpg)