Sensex @ 75,000: These stocks missed the 5,000-point run through 82 days

BSE Sensex reached a record high, surpassing the 75,000 mark on April 9, achieving the latest 5,000-point gain in just 82 days.

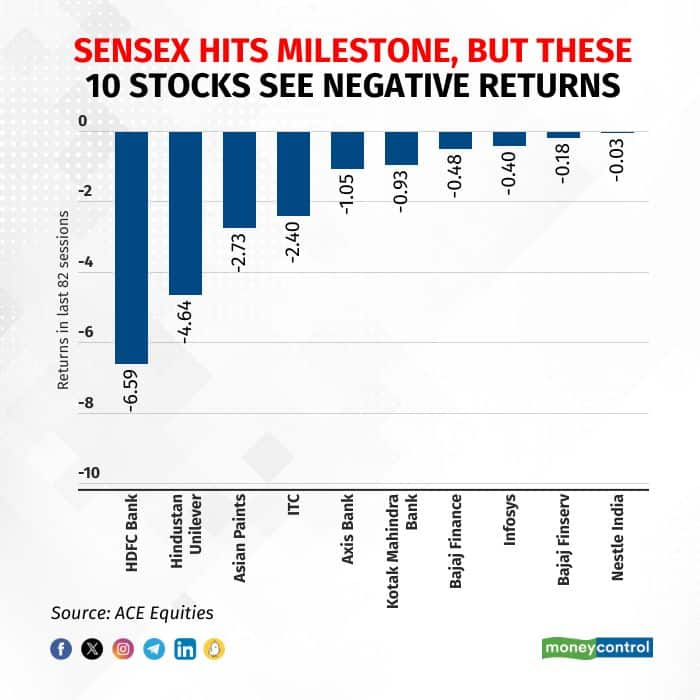

The benchmark BSE Sensex reached a record high by surpassing the 75,000 mark on April 9, achieving the latest 5,000-point gain in just 82 days. However, during this period, 10 out of the 30 stocks in the index gave negative returns.

The biggest loser among these stocks was HDFC Bank, declining around 6.6 percent. Other notable declines include Hindustan Unilever and Asian Paints, falling around 4.6 percent and 2.7 percent, respectively. Stocks such as ITC, Axis Bank, Kotak Mahindra Bank, Bajaj Finance, Bajaj Finserv, Infosys, and Nestle India also saw declines ranging from 0.2 to 2.4 percent

HDFC Bank faced significant losses following disappointing fiscal third quarter earnings, with concerns over underperforming net interest margins (NIM), sluggish deposit growth, and slower-than-expected retail growth.

Both Bajaj Finance and Bajaj Finserv have underperformed since the beginning of the year, with analysts highlighting the impactful demerger of Jio Financial from Reliance Industries, signalling heightened competition affecting players like Bajaj Finance.

HUL stock suffered due to poor rural demand and unpredictable monsoon, while Kotak Mahindra Bank faced challenges in earnings, resulting in a 1 percent decline in its stock price. Asian Paints lost 2.7 percent amid concerns about increased competition and waning demand.

ITC fell approximately 2.4 percent due to excess supply from a stake sale by British American Tobacco (BAT) and other factors such as slowdown in tobacco volume growth. Infosys experienced flat returns attributed to a challenging macro environment, including delayed deal conversions and reduced IT spending, despite optimism regarding potential improvements in the sector’s outlook.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Story continues below Advertisement

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.