F&O Manual| Nifty rangebound with bullish undertone, investors await US CPI inflation data

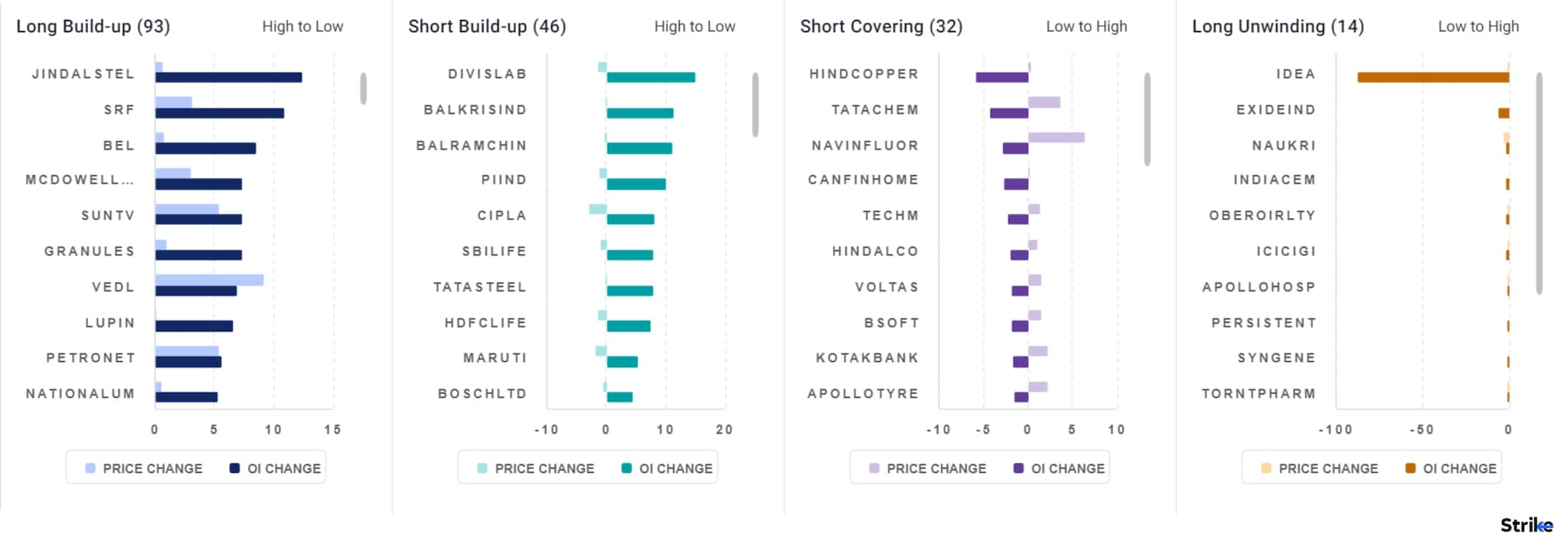

Among individual stocks long build up is seen in BEL, SRF and Jindalsteel. While short build up is seen in Divislab, PIIND, Cipla and SBI Life.

The benchmark indices traded sideways as the global investors might prefer to wait ahead of the US CPI inflation data. The Nifty is expected to remain sideways today with resistance zone placed at 22,700-22,750.

At 1:08pm, the Sensex was up 196.49 points or 0.26 percent at 74,880.19, and the Nifty was up 55.40 points or 0.24 percent at 22,698.20. About 1639 shares advanced, 1580 shares declined, and 81 shares unchanged.

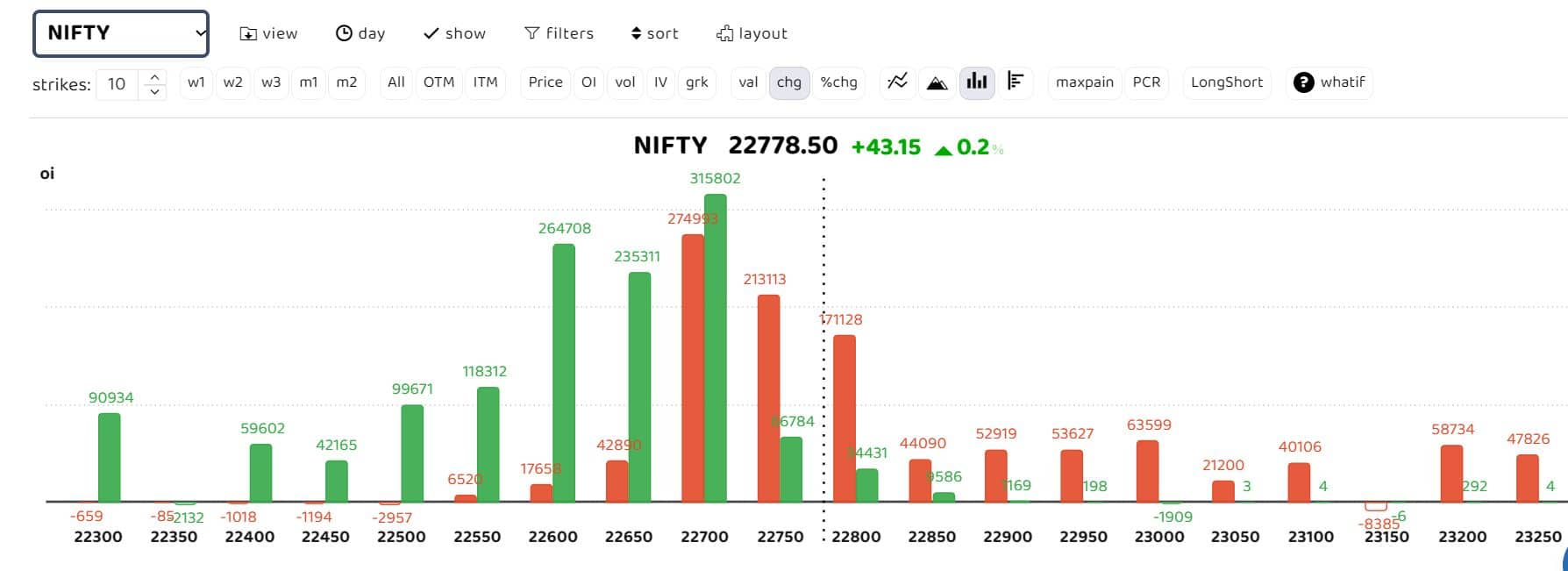

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data shows heavy put writing at 22,550 and 22,500 strikes. As per Rupak De, Senior technical analyst at LKP Securities, “Market is likely to remain sideways today as the global investors might prefer wait ahead of the US CPI inflation data. Resistance zone is place at 22700-22750; while a support is placed at 22,600.”

Sudeep Shah, DVP and Head of Technical and Derivative research at SBI Securities believes that while Indices are in an overall uptrend, it’s important to be cognizant of the fact that Election dates are now approaching closer, and with Brent Crude oil prices, steadily inching up warrants some caution.

Also read: Option strategy of the day | Bull call spread after MCX ascending flag pattern breakout

“Going forward, hence one should keep trailing their long positions with key support levels in mind. Strong support lies around 22520-22540, which is the swing high of March 2024 and until this zone holds, the upmove could extend upto 22850-22890 levels on the upside. Any sustainable move above the level of 22890 will lead to an extension of the rally towards 22980-23030 in the short term., ” Shah added.

Story continues below Advertisement

Among individual stocks long build up is seen in BEL, SRF and Jindalsteel. While short build up is seen in Divislab, PIIND, Cipla and SBI Life.

Among individual stocks long build up is seen in BEL, SRF and Jindalsteel. While short build up is seen in Divislab, PIIND, Cipla and SBI Life.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.