Why investors must track US markets today

In February 2024, the US core consumer price inflation rate reached a nearly three-year low of 3.8 percent but was above market forecasts of 3.7 percent

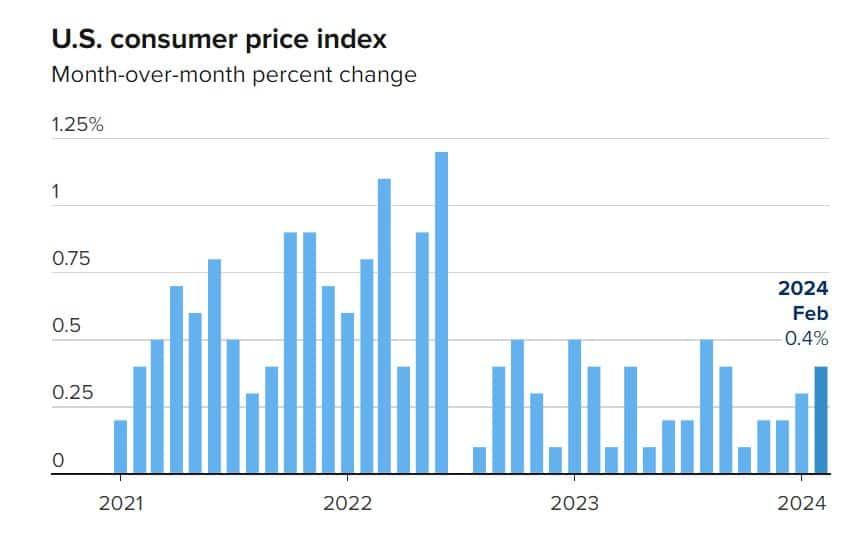

All global investors must have taken note of the US inflation data for March, which has come hotter than expected. The Bureau of Labor Statistics released March 2024 CPI data on April 10, 2024, the consumer price index rose 0.4% last month after advancing by the same margin in February.

US stocks may fall with S&P 500 contracts falling over 1% after the consumer price index underscored the bumpy path for the US Fed in bringing inflation back to the 2% target. Treasury 10-year yields approached 4.5% — hitting a fresh high for 2024.

During an event organized by the Stanford Graduate School of Business, Federal Reserve (Fed) Chairman Jerome Powell mentioned that the policy rate was likely at its peak in this cycle but added that they were in no rush to reduce rates. Powell stated, “It’s too soon to say whether recent inflation readings are more than just a bump,” emphasizing that the Fed has time to let incoming data guide policy decisions.

In February, the consumer price index increased by 3.2 percent year on year (YoY), surpassing the January rate of 3.1 percent. In February 2024, the US Consumer Price Index rose by 0.4 percent, marking the highest increase in five months, compared to the previous month’s 0.3 percent increase.

The core inflation data, which excludes food and energy, also showed stickiness. In February 2024, the US core consumer price inflation rate reached a nearly three-year low of 3.8 percent but was above market forecasts of 3.7 percent. Additionally, core inflation on a monthly basis also came in above expectations. US core consumer prices increased by 0.4 percent in February 2024, exceeding market expectations of 0.3 percent.

Headline CPI in the United States has significantly decreased, dropping from a high of 9.1 percent YoY in June 2022 to a low of 3 percent in June 2023. Since then, inflation has hovered around the 3 percent mark but is now showing signs of a trend reversal.

However, in the 12 months through March, the CPI increased 3.5% also as last year’s low reading dropped out of the calculation. That followed a 3.2% rise in February.

Story continues below Advertisement

Some market experts expect the upcoming CPI report to reveal a surge in overall inflation, while the core inflation measure is expected to decrease, thereby potentially delaying Fed rate cuts.

Ahead of today’s US CPI data, Gaura Sengupta, Economist at IDFC FIRST Bank had said, “The last two US CPI prints were higher than expected with core CPI inflation rising by 0.4 percent MoM in January and February. In the US, a large part of the disinflation was driven by reduction in goods inflation as commodity prices eased and supply chains normalized. The last mile move towards the 2 percent target will require services inflation to ease. However strong US labour market has kept services inflation sticky, complicating the outlook on Fed monetary policy.”

“In case core CPI inflation turns out higher than expected, it could keep the Fed on pause for longer, ” added Sengupta.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.