F&O Manual | Nifty falls near support, may extend fall; Bank Nifty stares at 47,300-47,800 expiry range

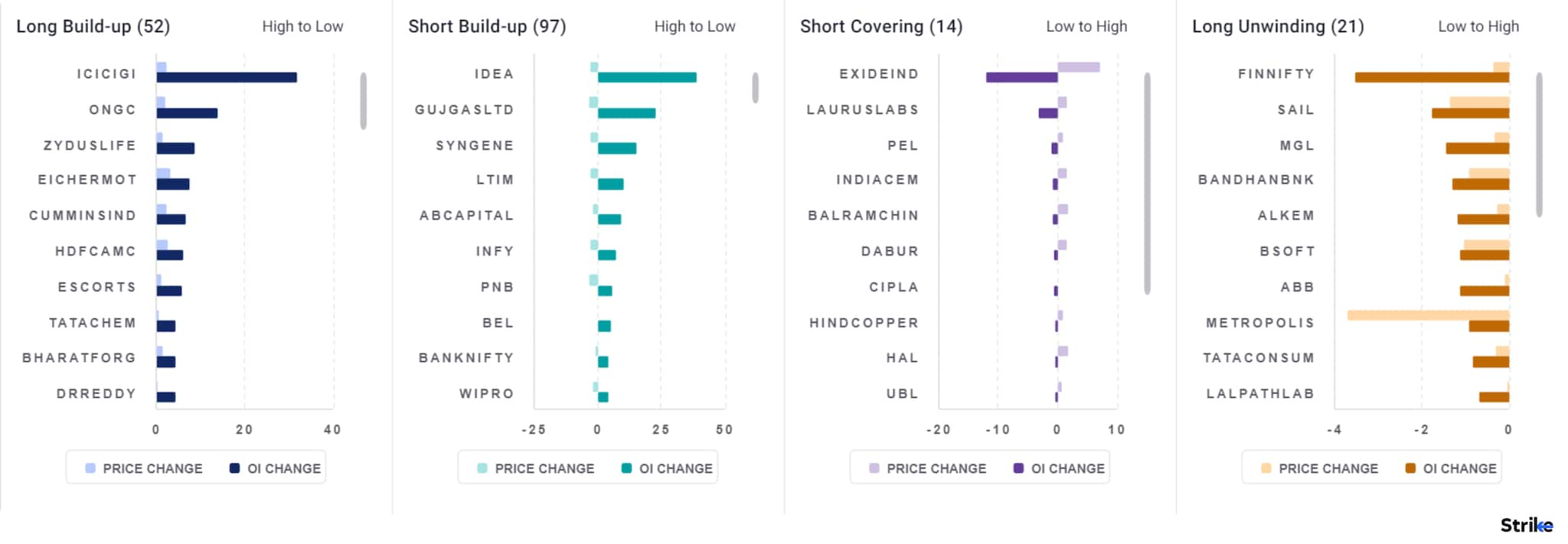

Among individual stocks, long build up is observed in ICICI GI, ONGC, Zydus Life and Eichermotors

Benchmark index NSE Nifty fell on April 16 way below the key resistance levels for the day, and may soon test a support level, below which it could extend fall further. In the afternoon trade, Nifty was at 22,125, down about 150 points, or 0.66 percent, from the previous close.

Experts said the index could retest levels of 22,030-21,980 on the downside, if it falls below 22,120. On the other hand, any sustainable move above the level of 22,430 will lead to an extension of the rally towards 22,600-22,700 in the short term

At 1 pm, the Sensex was down more than 600 points, or 0.84 percent, at 72,790 points. On NSE, about 2,207 shares advanced, 958 shares declined, and 83 shares were unchanged.

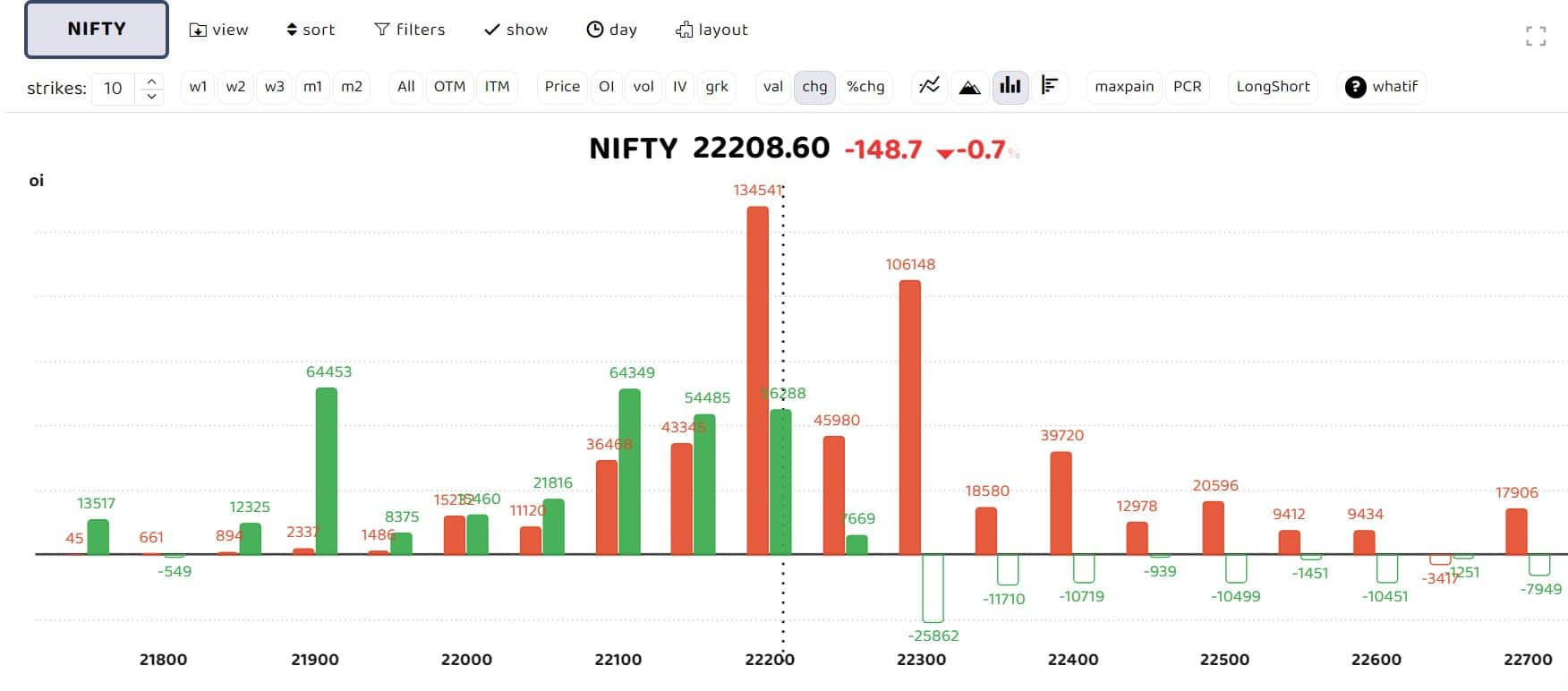

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests that highest call open interest can be seen at 22,300 strike, forming crucial resistance for the day. As per Sudeep Shah, DVP and head of derivative and technical research at SBI Securities, “Meaningful call writing is witnessed across 22300-22400 strikes, while significant put writing was witnessed in 22200-22000 strikes.”

“The overall range for the coming few sessions could be 22430 on the upside and 21980 on the downside,” said Shah.

Bank Nifty

Story continues below Advertisement

Aggressive OI additions were seen in all major strikes from 48,000 CE till 48,500 CE. On the put side, some OI additions were seen in 47,500 PE, but the banking index was trading below this level in the afternoon. Bank Nifty fell 333 points to 47,440 points on April 16, ahead of the weekly expiry.

“Bank Nifty has broken below crucial support of 48,200/48,000 levels, and even closed below it yesterday. Now these levels (48,200 / 48,000) will act as resistances,” said Soni Patnaik, Assistant Vice president derivatives research at JM Financial.

Patnaik believes that the expected expiry range for today is between 47,300 and 47,800 for Bank Nifty.

Among individual stocks, long build up is observed in ICICI GI, ONGC, Zydus Lifesciences and Eicher Motors. While short build up is observed in Idea, Gujarat Gas and Syngene.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.