F&O Manual | Nifty to see dead cat bounce; heavy call writing at 22,400-22,500

At 10:58 hrs IST, the Sensex was up 42.40 points or 0.06 percent at 72,986.08, and the Nifty was up 35.80 points or 0.16 percent at 22,183.70.

The Indian benchmarks traded higher intraday amid volatility on April 18. According to experts, the Nifty’s move below 22,200 in the last trading session suggests the possibility of a dead cat bounce of 150-200 points, reaching the 22,300-22,350 zone.

Fresh long positions for a significant directional move of 400-500 points are recommended only above 22,400.

At 10:29am, the Sensex was down 8.20 points or 0.01 percent at 72,935.48, and the Nifty was up 21.90 points or 0.10 percent at 22,169.80. About 2181 shares advanced, 884 declined, and 107 traded unchanged.

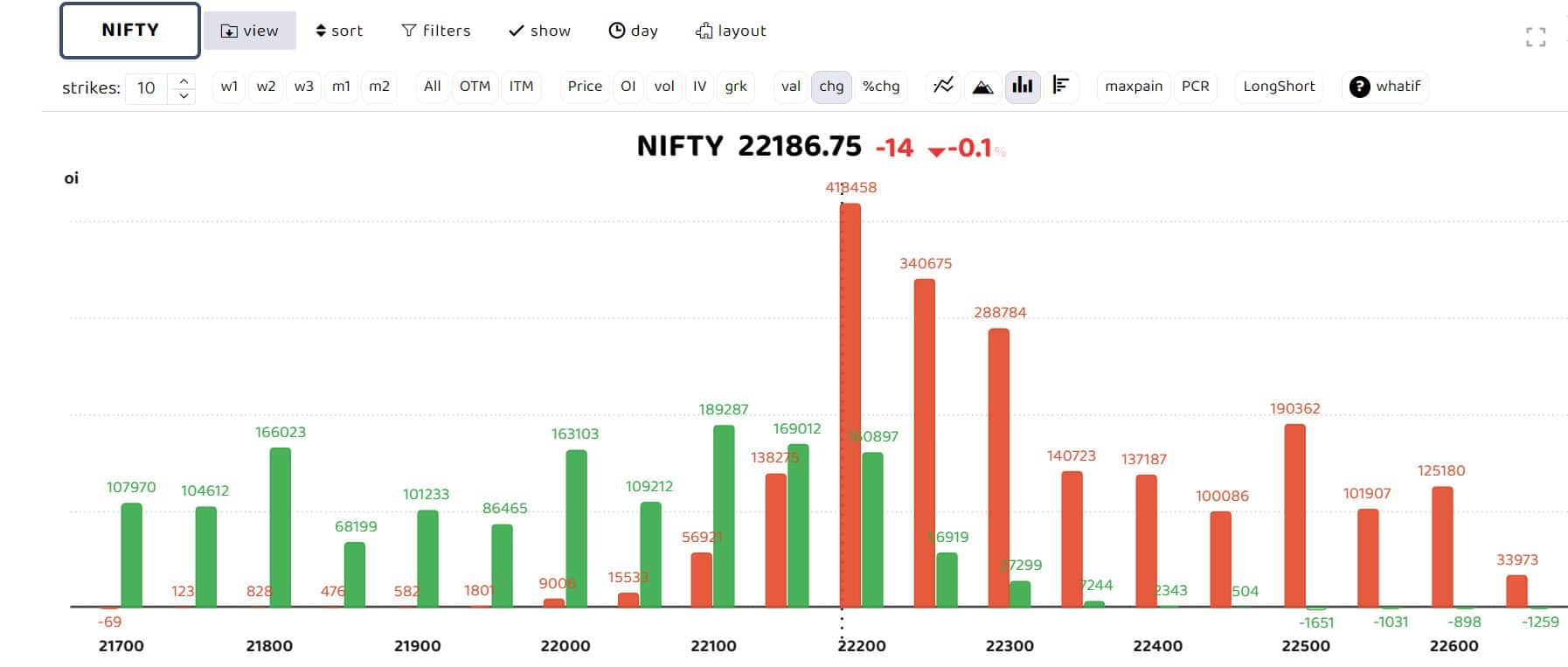

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data reveals heavy call writing at the 22,400 and 22,500 strikes, forming resistance for the day. “We expect to see a dead cat bounce of 150-200 points, reaching the 22,300-22,350 zone within a day or two. However, selling pressure is likely to resume at those levels due to heavy call writing observed at the 22,400 and 22,500 calls. Fresh long positions for a significant directional move of 400-500 points are recommended only above 22,400. Until then, hedged spread trades are recommended to capture smaller dead-cat bounces,” Avani Bhatt, senior vice-president of derivative research at JM Financial, said.

“The crucial support for the series stands at 22,000. A breach of this level will open up doors for lower levels of 21,800-21,700. The weekly expiry range for the day is expected to be between 22,050 and 22,220.”

In anticipation of a dead cat bounce, Bhatt recommends a bull call spread strategy for the monthly 25th April expiry:

– Buy 22,200 CE @ 158-162

– Sell 22,400 CE @ 75-80

Story continues below Advertisement

Target: 100-150 points

Stop Loss: Below 21,980 (Spot level)

Bank Nifty

“Bank Nifty currently has arrived near the important 50EMA level of 47170 zone with bias remaining cautious and major support zone maintained near 46700 levels of the important 100 period MA as of now. Banknifty would have a daily range of 47100–47800 levels,” brokerage house Prabhudas Lilladher said.

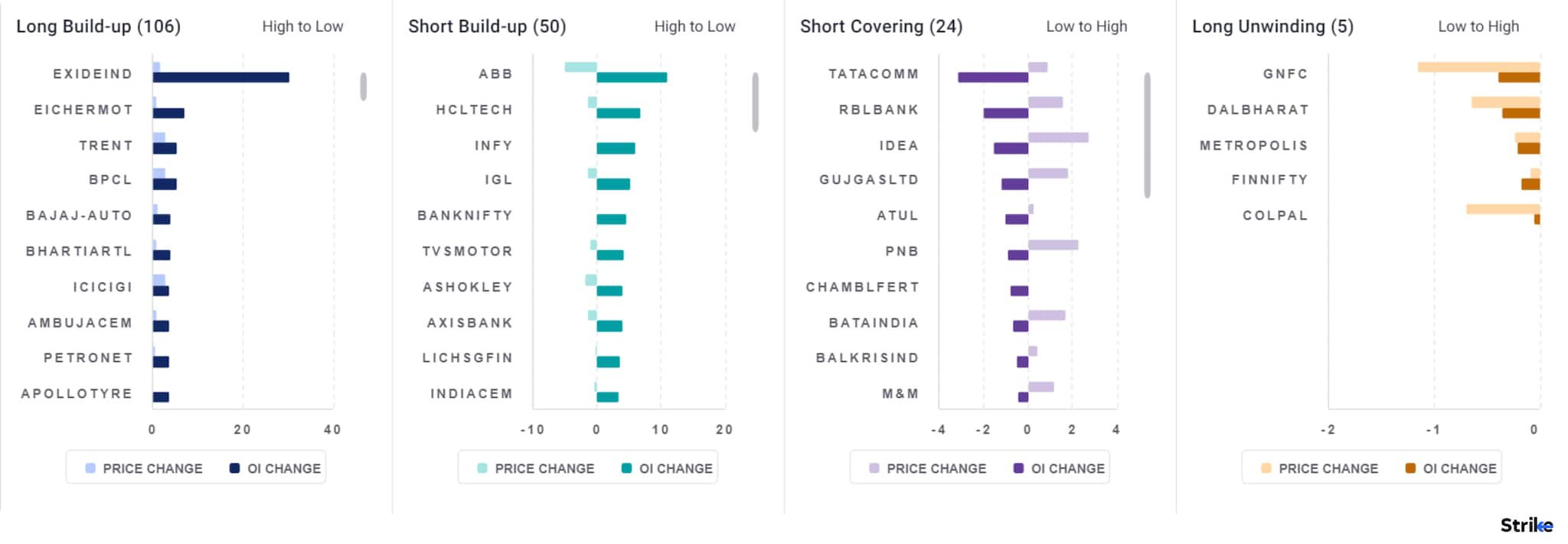

Chart showing F&O stock built up at 10:41 Am on April 18| Source: web.strikemoney.com

Chart showing F&O stock built up at 10:41 Am on April 18| Source: web.strikemoney.com

Among individual stocks long build up is seen in Exideind, Eichermotors, Trent and BPCL. While short build up is seen in ABB, HCL Tech and Infosys.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/Foreclosed-House-Spencer-Platt-Staff-Getty-Images-56a5804c5f9b58b7d0dd3030.jpg)