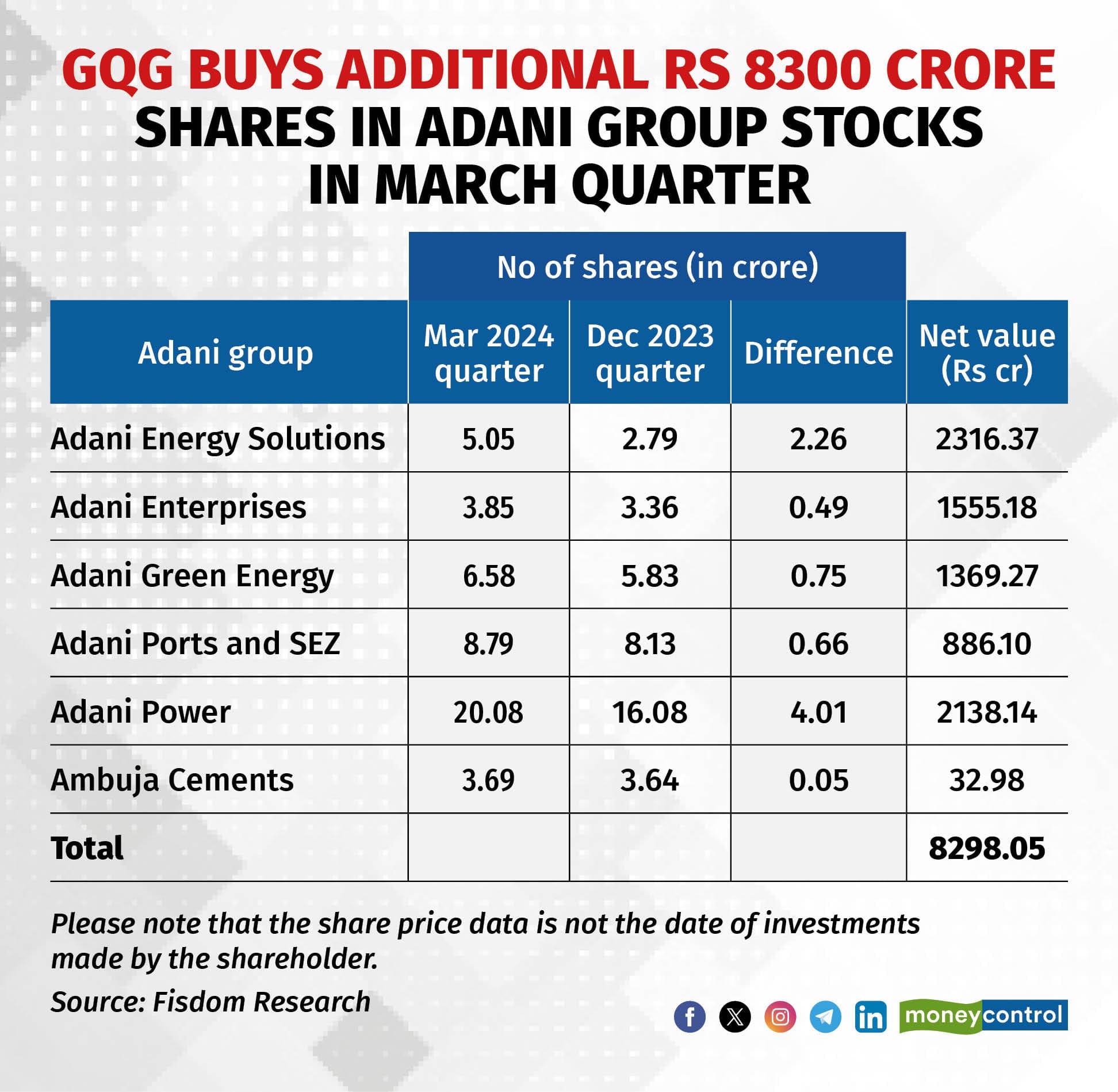

GQG bought additional shares worth Rs 8,300 crore in Adani Group companies in March quarter

Rajiv Jain’s GQG Partners increased its stake in six Adani group companies by around Rs 8,300 crore or $1 billion in the March quarter

Rajiv Jain’s GQG Partners increased its stakes in six Adani group companies by around Rs 8,300 crore or $1 billion in the March quarter, reaffirming confidence in the group after the Supreme Court dismissed the need for a separate investigation prompted by the Hindenburg Research report.

The six companies are Adani Enterprises Ltd, Adani Energy Solutions Ltd, Adani Green Energy Ltd, Adani Ports and SEZ, Adani Power Ltd and Ambuja Cement Ltd.

During the March quarter, Adani Energy Solutions saw the largest stake increase by GQG, worth Rs 2,316 crore, followed by Adani Power Ltd and Adani Enterprises Ltd with stakes worth Rs 2,138 crore and Rs 1,555.18 crore, respectively. GQG bought shares worth Rs 1,369.27 crore in Adani Green Energy, and Rs 886.10 crore in Adani Ports and SEZ. It raised its stake in Ambuja Cement by purchasing additional shares worth Rs 33 crore.

Also Read | GQG’s Adani investment reaches $10 billion as stocks bounce back

GQG now holds a 4.53 percent stake in Adani Energy (valued at Rs 5,183 crore), 3.38 percent stake in Adani Enterprises (valued at Rs 12,298 crore), 4.16 percent stake in Adani Green Energy (valued at Rs 12,067 crore), 4.07 percent stake in Adani Ports and SEZ (valued at Rs 11,792 crore), 5.2 percent stake in Adani Power (valued at Rs 10,719 crore) and 1.9 percent stake in Ambuja Cement (valued at Rs 2,260 crore).

Ajay Bodke, an independent market analyst, said ” GQG and global investors had bought into Adani group companies despite price plunges amid allegations by US-based investment research firm and activist short seller Hindenburg. They had then cited Adani’s world-class infrastructure—assets that were built or acquired—such as ports, airports, and cement plants, with strong moats and operational efficiencies.”

Bodke said that ” The investors saw India’s early-stage economy as a runway for growth for these long-term assets, with concessions lasting for decades. GQG seized the opportunity to invest during the panic selling last year, leading to handsome market rewards and massive outperformance after the Supreme Court dismissed the allegations.”

Story continues below Advertisement

Must Read | Eye on India: We take a bottom-up fundamental approach to stock picking, says GQG

FY24 returns

As of March 2024 quarter, the value of GQG Partners’ stakes in the six Adani Group firms has surged by 33 percent to Rs 54,300 crore over the previous quarter, according to data from Fisdom research.

The portfolio has surged by 149 percent in total from its initial investment of Rs 21,660 crore, reflecting returns from investments made over three phases, starting March 2023. GQG invested in phases in the Adani Group, in March, June, and August 2023.

Meanwhile, LIC’s investment in Adani Group stocks surged 56 percent from a year ago to Rs 61,210 crore as of March 2024 from Rs 39,244 crore as of March 2023.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, said GQG partners sees long-term potential in India’s infrastructure development. Despite pessimism during the Hindenburg story, it invested in Adani Group at low valuations, due to its understanding of the companies’ business models. That leap of faith has yielded strong returns, he pointed out. Wtih India’s infrastructure story unfolding, GQG continues to gradually increase its stakes in the Adani group’s infrastructure and green energy themes.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2150466569-52a85a86f8bf44fb8d2dee9c1f497c40.jpg)