Is the cement sector overvalued? Here’s what market experts say

Most analysts and fund managers Moneycontrol spoke to advised caution on the segment, adding, however, that there were ‘pockets of opportunity’.

Regarding recent market trends, Nuvama analysts observed a March 2024 upswing in cement demand, though pricing remains weak due to volume-driven strategies.

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

Is the cement sector’s value stretched? Is there room for investment in the sector, or will its lofty valuations and issues with pricing and raw material availability continue to keep investors on edge?

In an April 15 report, analysts at Kotak Institutional Equities said they were “baffled” over the market’s perennial optimism regarding the sector’s profitability, despite recurrent earnings downgrades. According to most analysts and fund managers Moneycontrol spoke to, a cautious stance prevails, with selective optimism towards certain segments of the sector— “pockets of opportunity”.

The Kotak Institutional Equities report raised some concerns on how the sector was being valued. Despite low asset turnover ratios, the market has assigned high price-to-earnings multiples, the report noted, and instead suggested a reassessment, proposing that cement stock multiples should be halved from their current levels, typically ranging from “very high” 2.5-5X FY2025E BV.

Also read: Could cement stocks see a 50% downside? Kotak analysts warn of gross overvaluation

What the market says

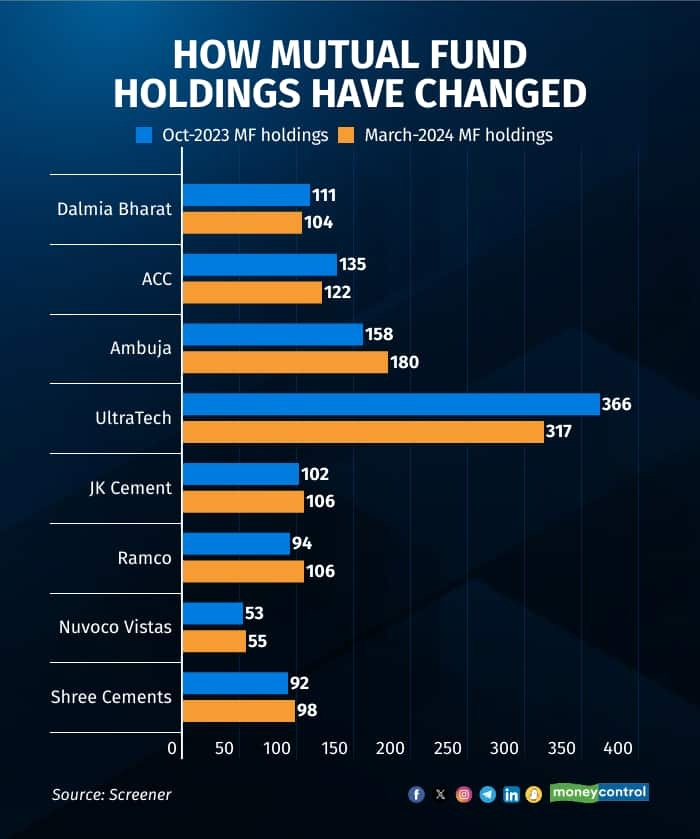

In the past six months, most mutual funds have trimmed their exposure to cement stocks, particularly larger, pan-India players, while regional firms like Ramco, Shree Cement and Nuvoco Vistas have seen gains. Currently, most funds have minimal exposure to the segment, averaging around 6 percent—this includes both diversified funds as well as thematic infrastructure funds. The outlier here is commodity-focused funds like ICICI Prudential’s Commodities Fund, where the total weightage of cement stocks is around 29 percent (including names such as UltraTech Cement, JK Cement and Grasim Industries), the second highest behind steel products and manufacturers at 40 percent.

Satyadeep Jain from Ambit Capital echoes the overall cautious sentiment, saying, “Historically, we’ve found every single cement company to be expensive.” The market, Jain explained, has a tendency to base calculations on projected future capital allocation efficiencies. The result is elevated valuations even when return on capital employed (ROCE) falls short. This trend leads to companies trading at high multiples despite inadequate ROCE generation.

Story continues below Advertisement

Also read: Why Ambuja Cements’ entry into the southern market won’t be disruptive yet, according to Nomura

Historically, he added, they have preferred UltraTech over others, stating, “The mathematics is simple, a company which has higher EBITDA (earnings before interest, taxes, depreciation and amortisation) per tonne and higher ROCE will trade at a higher valuation.”

Sreeram Ramdas from Green Portfolio pointed out that most cement companies’ price-to-earnings ratios hover around 39-40x, and are seemingly overvalued given the projected industry growth of 8 percent over the next three years. Despite this, he identifies potential in smaller players like Udaipur Cements and Shiva Cements, citing their capacity and revenue expansion prospects.

Regarding recent market trends, Nuvama analysts observed a March 2024 upswing in cement demand, though pricing remains weak due to volume-driven strategies. Price increases have been implemented across regions, yet their sustainability amid competitive pressures remains uncertain.

Stock performance

While most of the stocks within the cement segment have seen improved performance and the broader market has reached new heights, they have continued to underperform against the broader index on a relative returns, noted Samco Securities’ Sanjay Moorjani. Over the last one year, large players like ACC and Ambuja Cement have gained around 37 percent and 61 percent, respectively. Even some region-focused players like Barak Valley Cement and Mangalam Cement have gained around 92 percent and 207 percent, respectively, over the last year. On the other hand, stocks like Bheema Cement and Gujarat Sidhee Cement have declined around 65 and 27 percent.

Overall, Moorjani said that the sector has demonstrated strong volume growth. “Although margins for the current quarter are anticipated to show a healthy year-on-year increase, a sequential decline is expected,” he added.

Samco Securities’ Moorjani said that they are bullish on Dalmia Bharat, as at a 20 percent price correction, it offers a buying opportunity to investors with valuations providing comfort.

Optimism still prevails

While there are sceptics, not all view the sector as a crash-and-burn case. Nirvi Ashar from Religare highlights reduced raw material costs and forthcoming capacity expansions as positive factors. She recommends considering stocks like UltraTech and Dalmia Bharat, alongside regional players like Ramco.

Despite maintaining a cautious stance, Moorjani too believes that the growth narrative remains compelling, supported by robust housing demand and increased infrastructure spending.

For Uttam Kumar Srimal from Axis Securities, other reasons for one to be upbeat about the segment include government initiatives, premiumisation trends and green energy transitions. He favours stocks like UltraTech and JK Cement, anticipating strong performance ahead.

Analysts also note a decline in fuel prices, offering some relief to manufacturers. However, Sumit Agarwal from Bandhan Mutual Fund underscores the sector’s vulnerability to volatile raw material prices, favouring diversified players over regional ones in such market scenarios. Agarwal manages Bandhan’s Large Cap Equity Fund and is underweight on the sector (2 percent against total NAV).

Is there an investment case for cement?

Despite challenges, some analysts noted that some companies could have benefited from lower diesel and raw material costs but add that the sustainability of price hikes remains a key factor to watch.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2149947737-31f2bf94593d4383be90a5cacebaa988.jpg)