Option strategy | Bear put spread for Axis Bank

On the derivatives front, Axis Bank has seen good short addition this week

The Axis Bank stock have broken from its crucial support of Rs 1,020, breaking from descending triangular pattern. On the derivatives front, the stock has seen good short addition this week, indicating a short-term downtrend.

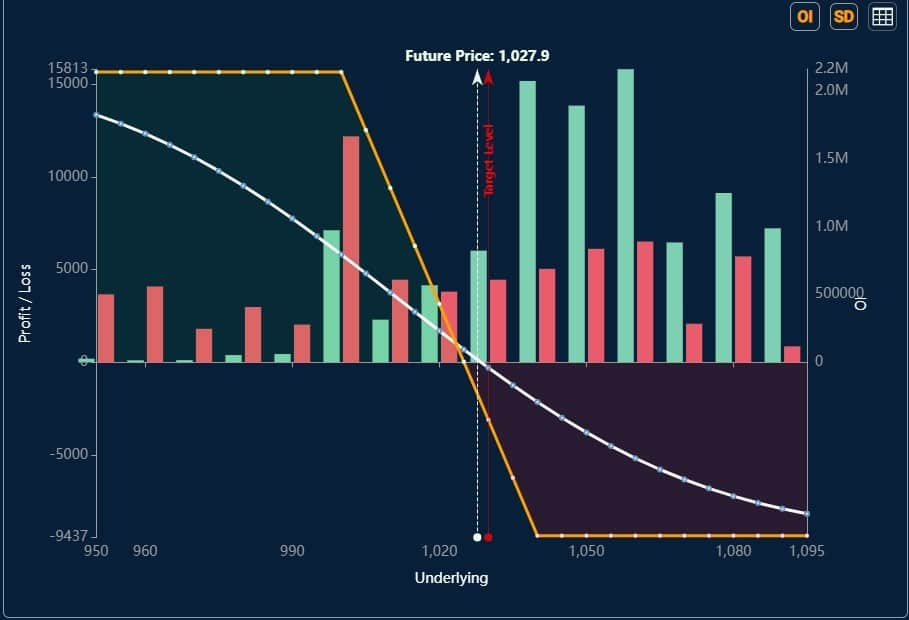

To capture this bearish momentum in Axis Bank, Jay Thakkar, Head of Derivatives research at ICICI Securities, suggests taking a Bear Put Spread options strategy.

Thakkar said in the short term, there can be some bounce on account of oversold readings in the overall market. “However, once the bounce is over the market as well as Axis Bank can witness selling pressure until the end of April series Expiry.”

Bear put spread strategy by Thakkar

Position:

Buy one lot of in the money (ITM) 1040 PE at Rs 24.2 and

Sell one lot of OTM 1000 PE at Rs 9.2

Story continues below Advertisement

Holding period: Till monthly expiry

“The overall outflow will be of 15 points which is maximum loss if in case if it closes above 1025, however, at 1000 or below there will be maximum profit of 25 points, hence the risk to reward is more than 1:1.6. The breakeven point for this strategy is 1025 level, ” Thakkar sold.

Technical View

Thakkar said Axis Bank has broken down from its crucial support of Rs 1,020. The next support is 980 and then 950. On the upside, until 1040 level is not taken off, the overall trend remains negative. The momentum indicator MACD has also turned bearish which indicates that in the short term the trend is likely to remain bearish.

Derivatives data

As per Thakkar, “On the derivatives front, the stock has seen good short addition this week indicating a short-term downtrend as well as there has been good call writing seen from higher levels, on the put side there is some addition seen at 960 levels, so the expiry is likely to be within 950-1000 level.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.