U.S. and China trade divisions threaten a ‘reversal’ for global economy, IMF official warns

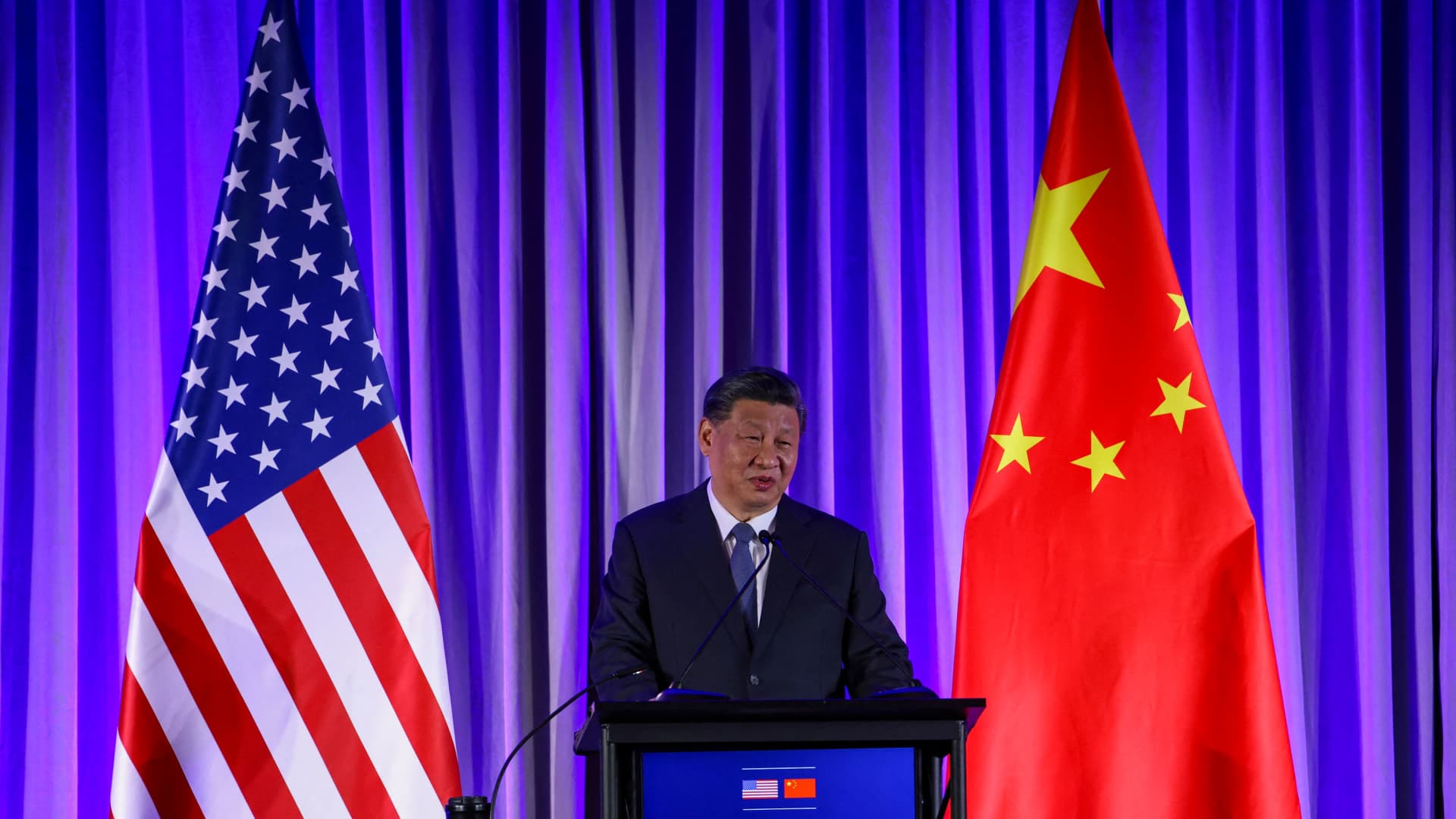

China’s President Xi Jinping speaks at an event held by the National Committee on US-China Relations and the US-China Business Council on the sidelines of the Asia-Pacific Economic Cooperation (APEC) Leaders’ Week in San Francisco, California, on November 15, 2023.

Carlos Barria | Afp | Getty Images

Differences between U.S.-led Western and China-aligned economic blocs threaten global trade cooperation and economic growth, a top official with the International Monetary Fund warned on Tuesday.

IMF Deputy Managing Director Gita Gopinath said in a speech at Stanford University that events such as the global pandemic and Russia’s invasion of Ukraine have disrupted global trade relations in ways not seen since the Cold War.

“Increasingly, countries around the world are guided by economic security and national security concerns in determining who they trade with and invest in,” she said, adding that this has resulted in countries increasingly picking sides between China and the U.S.

While strengthening economic resilience is “not necessarily bad,” the trend of fragmentation threatens a move away from a “rules-based global trading system” and a “significant reversal of the gains from economic integration,” Gopinath said.

Tensions between Washington and Beijing have been rising as the U.S. ramps up trade restrictions and sanctions on China, citing national security concerns, while worries over Beijing’s advances in the South China Sea and the rhetoric around Taiwan have also soured sentiment.

The increasing tension between the world’s two largest economies has been reflected globally, with over 3,000 trade restrictions imposed by countries worldwide in 2022 and 2023, more than triple compared with 2019, according to data compiled by the IMF.

Trade between the China and U.S. blocs has declined compared with trade among countries within the groupings, Gopinath said. The U.S. bloc mainly includes Europe, Canada, Australia and New Zealand, while China-leaning countries include Russia, Eritrea, Mali, Nicaragua and Syria.

Since the invasion of Ukraine, trade between the blocs has dropped by about 12% and foreign direct investments are down by 20% compared with those within the bloc’s constituents.

China, in particular, has struggled to maintain foreign investment amid increased tensions with the West. Foreign direct investment flows into the country reportedly fell 26% in the first three months of 2024 compared with the same period a year earlier.

Future impact

While economic fragmentation has yet to reach the same levels as the Cold War, its potential impact is much greater due to the global economy’s higher dependence on trade, according to Gopinath.

If divisions are not bridged, the IMF estimates the economic costs to the world’s GDP could be as high as 7% in the extreme fragmentation scenario. GDP will be hit by about 0.2% in case of mild divisions.

Low-income countries are likely to be hit the hardest due to their greater reliance on agricultural imports and foreign investment from more advanced economies, according to the IMF.

However, despite trends of fragmentation in the world economy, the ratio of total goods trade to global GDP has been relatively stable over the past two decades, said Gopinath.

One reason is that the impact of fragmentation has been cushioned by a group of countries neutral to the U.S. and China, such as Mexico and Vietnam, which act as “connector” economies through which trade and investment can be rerouted.

By using their “economic and diplomatic heft,” these non-aligned countries can play a bigger role in keeping the world integrated, Gopinath said.