Hong Kong stocks reverse losses as investors assess key China data; Nikkei tumbles almost 2%

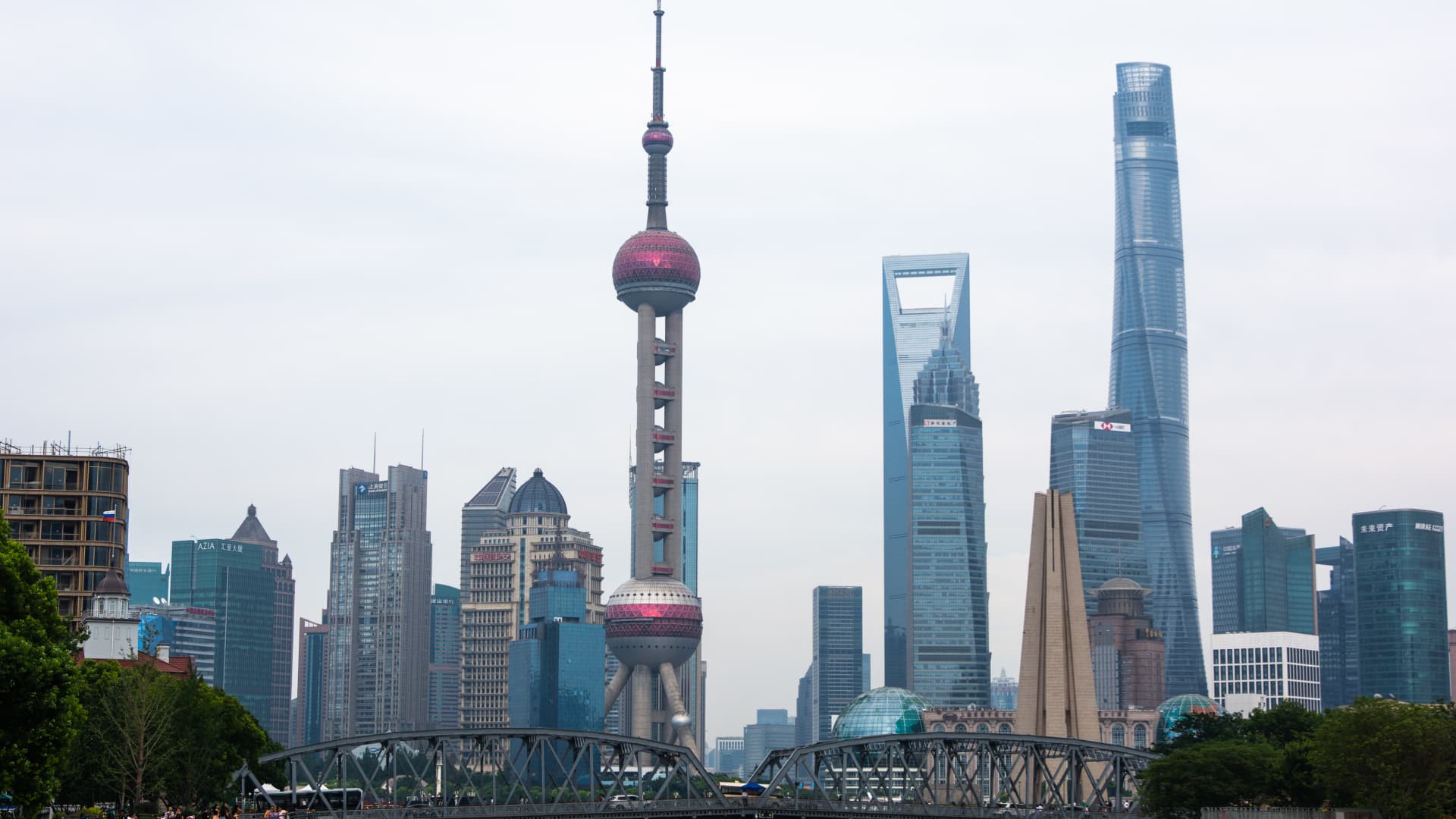

A view of high-rise buildings is seen along the Suzhou Creek in Shanghai, China on July 5, 2023.

Ying Tang | NurPhoto | Getty Images

Asia-Pacific markets are mixed on Monday as the region assesses key economic data out from China.

The world’s second-largest economy released May numbers for its retail sales, industrial output and urban unemployment rate.

China’s retail sales beat expectations in May, climbing 3.7% compared with a year ago, beating expectations of a 3% rise from a Reuters poll of economists.

However, other economic metrics, such as industrial output and fixed asset investment, missed Reuters forecasts. Industrial output grew by 5.6% year-on-year, compared to the 6% increase expected, while fixed asset investment rose 4% compared to last May, just shy of the 4.2% forecast by the Reuters poll.

The urban unemployment rate held steady at 5% in May, unchanged from April, and 0.2 percentage points lower than that of May last year.

Separately, the People’s Bank of China held its one-year medium term lending facility rate at 2.5% on 182 billion yuan ($25.09 billion) worth of loans, as expected.

The central bank also injected 4 billion yuan through seven-day reverse repurchase operations and kept the seven day interest rate steady at 1.8%.

Hong Kong Hang Seng index reversed losses and was up 0.71% after the MLF and data announcement, while the CSI 300 on mainland China slid 0.1%.

Japan’s Nikkei 225 tumbled 1.82%, dragged by energy and real estate stocks, while the Topix also saw a similar loss of 1.49%.

South Korea’s Kospi fell 0.31%, and the small-cap Kospi also was down 0.45%, reversing earlier gains.

Australia’s S&P/ASX 200 slipped 0.13%. Traders will be bracing for the Reserve Bank of Australia’s rate decision on Tuesday.

On Friday in the U.S., the Nasdaq Composite notched a fifth straight winning session, adding 0.12%, while the S&P 500 inched lower by 0.04%, to snap a four-day winning streak.

The Dow Jones Industrial Average slipped 0.15%, to mark four straight days of losses.

— CNBC’s Lisa Kailai Han and Brian Evans contributed to this report.