10X AI Stocks? The Clock’s Ticking

We’ll cut right to the chase. We’re at the start of a technological surge that could mint fortunes faster than the internet did in the late 1990s…

Back then, investors piled into nascent dot-coms. Many lost everything. Only those who caught the right companies – like Amazon (AMZN), eBay (EBAY), and PayPal (PYPL) – turned small stakes into life-changing wealth.

The Nasdaq quintupled between 1995 and 2000 before crashing 77%. But the survivors went on to dominate trillion-dollar industries.

Today, AI is following the same explosive curve – except adoption is happening faster, products are already delivering profits, and analysts estimate it could add up to $16 trillion in market value within a few years. (And that’s just within the S&P 500…)

This isn’t just hype. ChatGPT reached 100 million users in two months: the fastest adoption of any consumer technology in history. Now companies across the S&P are embedding AI, with earnings already reflecting the leap.

The breakout phase has started, and the charts prove it.

Let’s take a look at some of the biggest AI stock winners so far – and how this boom is creating vertical moves investors haven’t seen since the early internet.

5 AI Stocks That Turned Small Stakes Into Life-Changing Wealth

We don’t have to imagine what AI’s breakout looks like. It’s already here, and the stock market has been littered with triple- and quadruple-digit winners in just the past few years.

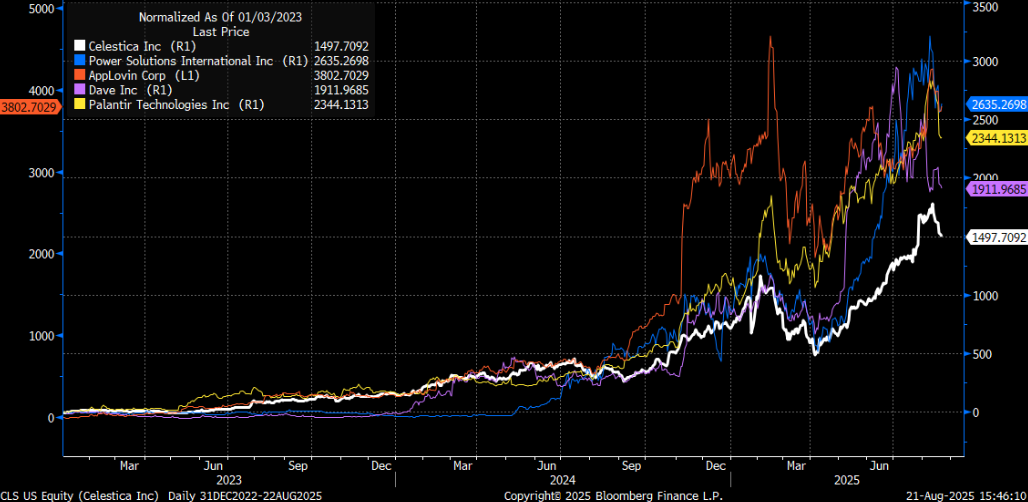

- Celestica (CLS) is leveraging AI to optimize supply chains and automate electronics manufacturing. Its stock has soared nearly 1,500% since late 2022.

- Power Solutions (PSIX) is using AI-driven analytics to boost industrial performance and predictive maintenance across critical systems. PSIX stock is up more than 2,600% since late 2022.

- AppLovin (APP) has supercharged its AXON ad-targeting algorithm with AI, revolutionizing mobile advertising and sending profits rocketing higher (343% year-over-year in fiscal year 2024). APP stock has exploded 3,800% since late 2022.

- Dave (DAVE) employs AI to enhance fraud detection and personalized financial tools, making its neobank platform more competitive. DAVE has soared more than 1,900% since 2022.

- Palantir (PLTR) has transformed enterprise decision-making with its AIP platform, embedding AI into logistics, finance, defense, and healthcare. PLTR has popped 2,300% since late 2022.

This isn’t a once-in-a-blue-moon phenomenon. These moves are happening left and right. We’ve seen dozens of them in just the past year.

Now, imagine capturing even a fraction of these events…

A $10,000 stake in CLS in late 2022 would be worth nearly $160,000 today. The same in PSIX would be almost $275,000 today. And for APP? Nearly $400,000.

That means that if you had invested $10,000 each into Celestica, Power Solutions, and AppLovin back in late 2022, your initial $30,000 would be worth more than $800,000 today.

This is the power the AI Boom holds.

Make Moves Before AI’s Growth Phase Fizzles

AI isn’t just another tool; it’s a multiplier.

It boosts efficiency, decision-making, marketing, product development, customer engagement – everything. Companies that adopt AI don’t inch forward. They leap.

On Wall Street, that shows up as sudden bursts of hypergrowth, aka Phase 2.

Phase 1 is build-and-experiment. Phase 2 is when AI drives results – and where the biggest gains tend to happen.

AI itself is in Phase 2 now, so this window won’t stay wide-open forever. Soon, we’ll move into Phase 3: Maturity – and, eventually, Phase 4: Decline.

In other words, today’s easy triple-digit runs will get rarer, likely within a year.

That’s why I built Nexus, a proprietary behavioral-analytics system that spots when a stock is about to enter Phase 2. It cuts through hype to flag real-time breakouts across sectors (especially what I call “AI Income Events”: those monster, triple-digit moves when a stock goes vertical). And most investors miss them.

When Nexus lights up, behavior is shifting: Traders pile in, institutions move money, and Wall Street wakes up. If you’re positioned, you can ride the wave – potentially to 200%, 300%, even 400%-plus gains.

Volatility doesn’t have to be a threat. With the right system, it’s your edge.

The AI Income Challenge: Targeting $30K in Gains

With Nexus, you can participate in the most powerful technological revolution of our lifetimes – and capture the wealth creation that comes with it.

In fact, I have a challenge for you…

Generate $30,000 in the next six months by targeting AI Income Events.

I want you to see how these events can transform your portfolio over the next six months. Using my Nexus system, you’ll get alerts on exactly which stocks are entering Phase 2 and when to act.

I just put together a special free broadcast going into far more detail on Nexus – and how this strategy beats dividends, bonds, options, or any other “traditional” income strategy by 40X.

Click here to join me in the AI Income Challenge and start targeting your first $30,000 in cash.