How to Survive and Thrive as AI Compounds America’s Wealth Chasm

The robber barons of the 19th century built their fortunes on steel and oil. Today’s digital dynasties are built on something far more potent: artificial intelligence – a technology that doesn’t just create wealth. It compounds it at speeds that would make even Carnegie and Rockefeller dizzy.

Just 50 years ago, a factory worker and a company executive might have seen their fortunes rise and fall together. But now, as AI drives productivity gains that would have once seemed impossible – sending AI stocks to the moon – gains are flowing almost exclusively upward…

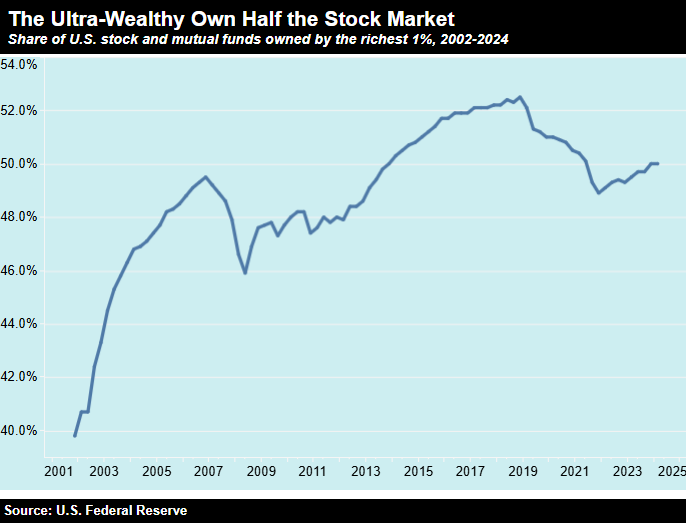

As the Institute for Policy Studies’ Inequality.org points out: “America’s top 1 percent…holds more than half the national wealth invested in stocks and mutual funds. Most of the wealth of Americans in the bottom 90 percent comes from their homes – the asset category that took the biggest hit during the Great Recession.”

That means that the monster runs we’ve seen in AI stocks are contributing to a wealth chasm that makes previous economic inequalities look quaint by comparison.

In fact, between March 18, 2020 and December 3, 2024, the combined wealth of America’s top 12 billionaires increased by more than $1.3 trillion – a nearly 200% rise.

Who’s in that cohort? Elon Musk, Jeff Bezos, Mark Zuckerberg, Jensen Huang, Rob and Jim Walton… Some of the biggest proponents of AI and the buildout of an autonomous future.

In other words, AI is creating fortunes at warp speed. And for some, it’s multiplying them.

But if you’re feeling left behind, perhaps fearful for your financial future in this new technological era, all hope is not lost…

AI Redraws the Market Map

Of course, we understand why you’d feel that way. The Age of AI hasn’t lifted all boats but has instead changed the playing field (though, it certainly hasn’t been leveled).

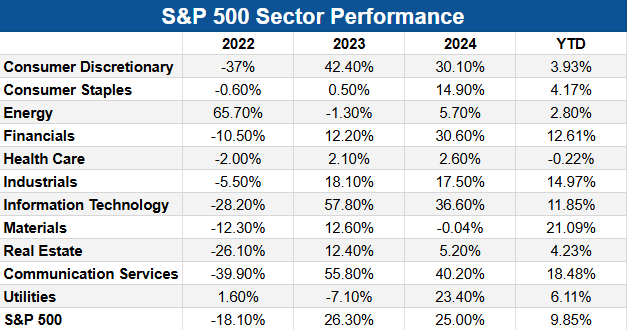

Since ChatGPT’s breakout debut in late 2022, the S&P 500 has fractured. Certain sectors have surged ahead, supercharged by AI’s rocket fuel. Yet, ‘safe stocks’ – like consumer staples, healthcare, and utilities – have barely moved.

To get a sense of this, let’s take a closer look at the impact of AI in each of the sectors surging ahead:

Information Technology:

- Tech companies are heavily investing in AI and building the infrastructure for it; chipmakers like Nvidia (NVDA) and Google’s parent company, Alphabet (GOOGL), are at the forefront here.

- Firms in this sector are using AI to develop new products, manage data, and bolster cybersecurity.

Communication Services:

- AI is used to optimize networks, manage traffic in real-time, and enhance customer service with personalized interactions and chatbots.

Financials:

- AI analyzes transactions in real-time to flag fraudulent activity at a much faster pace than human auditors.

- Algorithmic systems execute trades at optimal times based on analysis of large data sets

Industrials:

- We’re witnessing the rise of ‘smart factories,’ where AI is improving efficiency, increasing safety, and paving the way for lower labor costs.

- Increasingly, AI-powered collaborative robots, or ‘cobots,’ work alongside human employees, taking on repetitive or physically demanding tasks

As a result, the companies within these sectors have been much more likely to enjoy significant stock gains.

The reason is simple: AI creates exponential gains where it can cut costs, automate labor, and open new revenue streams…

Investing In the New Regime

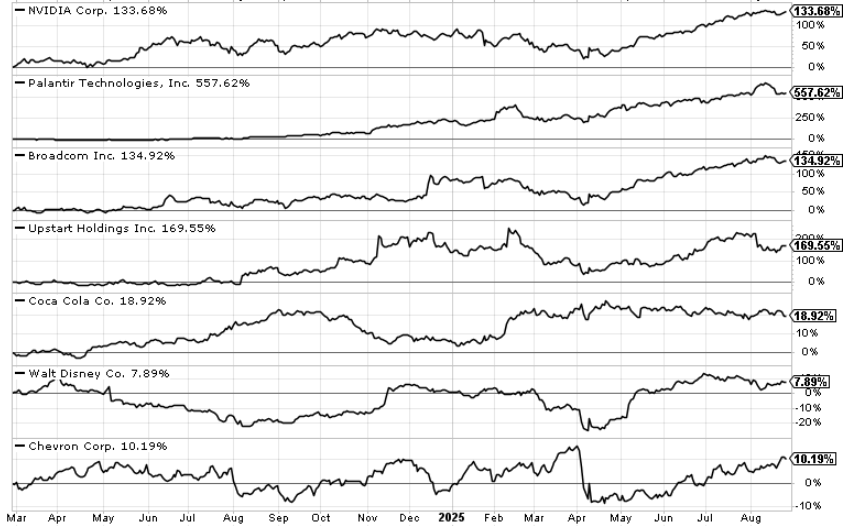

A chipmaker like Nvidia sells the picks and shovels of the AI gold rush.

Banks deploy AI for fraud detection and algorithmic trading, saving billions.

Logistics firms roll out autonomous supply chains.

Each of these sectors compounds value because AI turns every dollar invested into more productive output. While many everyday investors assume reliable income means bonds, dividends, or slow-and-steady index funds, these so-called ‘safe’ stocks do not enjoy that multiplier.

Nevertheless, if they think the big money has already been made – or they’re apprehensive about higher-risk trades – they’re most likely to invest in consumer staples like Pepsi (KO), Disney (DIS), or Chevron (CVX).

Well… guess what? Those ‘safe stocks’ have gone nowhere lately, majorly lagging firms taking an AI-first approach. They face slow growth, sticky input costs, and limited room for disruption.

Investors once found shelter in these stocks during times of market volatility. But in today’s AI-driven economy, that safety now looks more like stagnation.

That means there are just two options here: Either climb aboard the AI Boom Train – or get leveled by it.

The AI Growth Phase Won’t Last Forever

America’s wealth gap is yawning wider every month – not because people stopped working hard, but because AI-linked assets compound faster than traditional ones. Billionaires multiply their fortunes through AI exposure, while everyday investors sitting in ‘safe’ stocks are stuck in neutral.

If you’ve yet to board the AI Boom Train, it’s natural to feel stuck on the wrong side of that divide. But the same forces that are widening inequality can work in your favor – if you know how to spot the shift when skepticism flips into mass belief.

That’s where my Nexus system comes in.

It uses behavioral analytics, not just stock fundamentals, to find early signs of mass investor excitement, institutional buying, and momentum. In other words, it detects the moment when the market realizes a company’s breakthrough is the real deal…

That recognition is what triggers an ‘AI Income Event.’

Every technology (and stock) follows the same arc: Introduction, Growth, Maturity, Decline. Artificial intelligence is in its growth phase now, the same stage where railroads, electricity, and the internet created the largest fortunes of their eras. But this phase doesn’t last forever; and AI is moving through it faster than any technology in history.

Nexus is your bridge across the divide – a tool to help you capture explosive growth while the window is still open.

Don’t wait until Phase 2 closes. Learn how Nexus can help you bridge this AI-driven wealth divide before this boom cycle leaves you behind.