Google Ruling Sends a Signal: Courts Favor Behavioral Tweaks, Not Breakups

Earlier this week, Alphabet (GOOGL) did something extraordinary: It won a landmark U.S. antitrust ruling that Wall Street feared could cripple the company for years.

The Justice Department had been gunning for Google – painting it as the monopolist of monopolists, with default search contracts, Chrome dominance, and Android power all stacking the deck against rivals. The specter of a forced breakup, or at least sweeping divestitures, loomed large.

And then the judge said, eh.

Yes, Google will have to stop signing exclusive default search deals (like the one it had with Apple) and is required to share some search data and indexing access with competitors. But the court stopped miles short of ordering any structural changes. Google gets to keep Chrome, Android, and its crown-jewel search business intact: no restructuring necessary.

Wall Street’s verdict? Hallelujah. GOOGL shares ripped more than 8% higher in after-hours trading.

But here’s the bigger story: this ruling isn’t just a “Google thing.” It’s a Big Tech thing. It sends a crystal-clear signal to markets and regulators alike – U.S. courts are reluctant to dismantle dominant technology firms in an era of rapid, AI-driven disruption.

And that, my friends, is the buy signal we’ve been waiting for…

Court Says AI Disruption Makes Google Breakup Excessive

At the heart of Judge Amit Mehta’s ruling is an important acknowledgment: the technological landscape is changing too quickly to warrant radical remedies.

With the rise of generative AI search rivals like OpenAI’s ChatGPT, Perplexity, Anthropic’s Claude, and others, the idea that Google is an unassailable monopoly looks weaker by the day.

In effect, the court is saying: why break up a company when the market itself is reshaping around it?

This implies that regulators can bark, but they’ll find it harder to bite. Even if the DOJ or Federal Trade Commission files aggressive complaints against Apple (AAPL), Amazon (AMZN), Meta (META), or Microsoft (MSFT), the courts will likely favor behavioral tweaks over amputation or structural reconfiguration.

And that precedent is exactly what Wall Street has been desperate to see.

Why This Is Bullish for Google

Let’s start with the obvious winner. Google just dodged a bullet.

Its core advertising business – the search engine monopoly that prints hundreds of billions in revenue ($71.3 billion in the second quarter of 2025 alone) – remains intact. Its software ecosystem – Chrome, Android, Gmail, and YouTube – remains under one roof. And its competitive advantages – data scale, distribution, and user loyalty – remain untouched.

Sure, losing exclusive search defaults with Apple stings. But many users re-select Google anyway. And as long as the brand is synonymous with search, Google’s share will stay sky-high.

Meanwhile, the requirement to share some search data with rivals is annoying but hardly destructive. With Google’s lead in AI-driven search and YouTube’s video empire as a reinforcement mechanism, its moat is deep enough to absorb these blows.

Yes, even in this new Age of AI, Google Search remains a juggernaut. According to AInvest:

“Despite the growth in chatbot usage, Google continues to be the primary gateway to online news, information, and products. A study by Similarweb revealed that Americans visited news websites 9.5 billion times from using web search engines like Google, compared to 25 million times from ChatGPT between January and May 2025.”

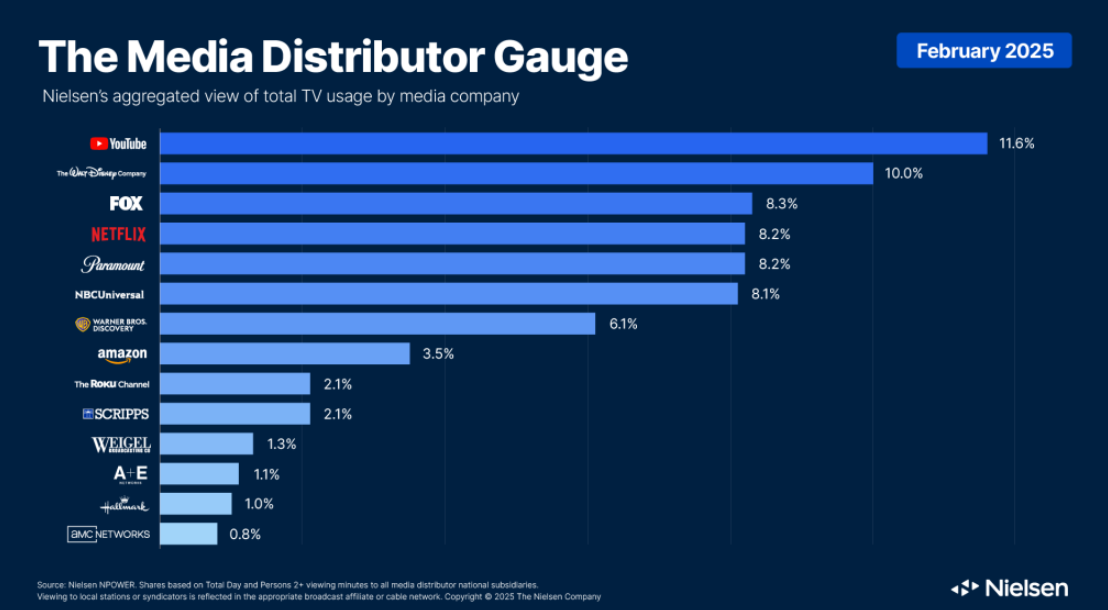

The resilience is just as strong for YouTube. In fact, in February of this year, “YouTube achieved its highest market share to date across TV screens in the United States, outperforming traditional TV distributors and even major streaming competitors like Netflix and Hulu,” as noted by Campaign Now.

With the nightmare scenario – a forced divestiture – now dead, Google’s reign continues unchallenged. That’s why the stock took off.

The Ruling Sets a Precedent for All Big Tech Defendants

Here’s where it gets fun. The broader read-through is that the courts have Big Tech’s back.

- Apple: Fears that its search deal with Google could become an antitrust liability are less worrisome now. Regulators might ban exclusivity, but Apple’s cash cow ecosystem isn’t going anywhere.

- Amazon: The FTC may gripe about “self-preferencing” in its marketplace, but the idea that courts will order Amazon Web Services (AWS) spun off from retail? Unlikely.

- Meta: Concerns that regulators could force divestitures of Instagram or WhatsApp just got weaker. Courts aren’t in the breakup business anymore.

- Microsoft: Its investments in OpenAI and the bundling of Teams with Office 365 may face scrutiny, but the precedent here suggests any remedies will be tweaks, not extensive restructuring.

This is the opposite of the 1990s Microsoft saga, when a court actually ordered a breakup before it was overturned on appeal. Today’s courts look more deferential to business models, more skeptical of sweeping remedies, and more attuned to the reality that AI is already disrupting the competitive landscape.

In short: Big Tech’s existential risk premium just evaporated.

AI Isn’t Just Growth for Big Tech – It’s Legal Armor, Too

Here’s the kicker. AI isn’t just a growth driver for Big Tech – it’s now a defensive moat against regulators.

Think about it. The very reason Judge Mehta rejected drastic remedies is that the AI revolution is already reshaping search competition. If new AI models can chip away at Google, why should the government break it apart?

That logic applies across the board:

- Amazon argues that AI-driven logistics competitors are emerging.

- Meta points to AI-powered social rivals and creator platforms.

- Microsoft cites the explosive proliferation of AI productivity tools.

- Apple highlights the upcoming wave of AI-enhanced devices.

In other words, the faster AI evolves, the harder it is for regulators to justify breakups. The future is too dynamic. Courts don’t want to play referee in a game where the rules keep changing.

That’s why AI is not just an opportunity but a shield. It’s the perfect legal argument: we don’t need a breakup because the market will disrupt us anyway.

Treat Big Tech Pullbacks as Buying Opportunities

For investors, the lesson couldn’t be clearer.

Big Tech is simultaneously the biggest growth story on the planet and the safest regulatory bet in decades. That’s a potent mix.

- These companies are at the epicenter of the AI boom, raking in revenue from chips, cloud, ads, software, and devices. Their scale gives them the best data, the best models, and the best distribution.

- The courts just telegraphed that breakup risk is minimal. Future cases will likely follow the Google template: no exclusivity, some data sharing, but no structural dismantling.

Combine those two forces, and you get an asset class with outsized upside and limited downside.

That’s why Wall Street piled into GOOGL after the ruling. And it’s why any weakness in the broader Big Tech complex should be seen as a buying opportunity.

So, how do we act?

- Own the Magnificent 7: Google, Apple, Amazon, Meta, Microsoft, Tesla, and Nvidia. The antitrust clouds just parted, and the AI sun is shining.

- Add on weakness: Whenever macro jitters knock these stocks down, treat it as a gift. The ruling proves their long-term moats are intact.

- Double down on AI leaders: Nvidia (chips), Microsoft (enterprise AI), Google (search and ads), Meta (AI-driven engagement), and Amazon (AI-enhanced cloud) are the backbone of the AI revolution.

- Stay patient: The compounding here is massive. These companies are printing cash, reinvesting in AI, and now face reduced regulatory risk.

Long Live Big Tech: The AI Megatrend Shields Monopoly Risk

The Justice Department framed this as the “most important antitrust trial in decades.” And yet, when the dust settled, Google walked away intact; stronger, even, because the market just realized that breakup risk is basically off the table.

If Google, the poster child of alleged monopoly power, can dodge structural remedies, then Apple, Amazon, Meta, and Microsoft are in the clear, too.

Add the fact that AI is simultaneously fueling growth and acting as a shield against regulators, and you get one simple conclusion: Big Tech’s reign isn’t ending anytime soon.

The AI megatrend is only accelerating, and every pullback in these names is proving to be a gift for investors who act fast.

But here’s the catch: The real fortunes in every tech revolution have gone not to those who chased the giants… but to those who spotted the next wave of winners early.

That’s exactly what my colleague, legendary investor Eric Fry, has spent his career doing – and now, he’s taken it a step further. After delivering more than 40 separate 1,000%-plus winners, Eric has built Apogee: a breakthrough AI-powered system designed to pinpoint the exact moment a stock is ready to skyrocket.

In back testing, Apogee would’ve flagged Apple before its 4,331% surge… Nvidia before its 3,587% explosion… and Amazon before its 1,115% rally.

Now, this same system has identified five brand-new stocks that have quietly entered the “10X Zone” – and Eric is revealing all five names for free.

Join him next Wednesday, Sept. 10 at 10 a.m. Eastern to get the scoop on those five potential monster winners – and learn how Apogee can help you turn $1,000 into $10,000.