The August Jobs Report Spooked Wall Street, But History Says Buy

Stocks just got crushed. The culprit? The August jobs report.

Long story short, it was dreadful. Hiring stalled. Unemployment jumped to a four-year high. Wage growth cooled. And the government quietly revised June and July job gains lower, too. It was the ugliest jobs report since the COVID crash, and it spooked investors right out of stocks.

But this terrible, awful, no-good jobs report is actually exactly what the stock market needed…

Because it wasn’t so bad that we’re suddenly staring down a full-blown recession. Instead, it was just bad enough to guarantee that the Federal Reserve is about to unleash a full-blown rate-cutting bonanza.

And if you’ve been around long enough, you know that non-recessionary rate-cut cycles are the stuff bull markets are made of.

In other words: this latest crash is shaping up to be a fabulous investment opportunity…

Breaking Down the Labor Market Weakness

As we said, the most recent labor data was just plain bad.

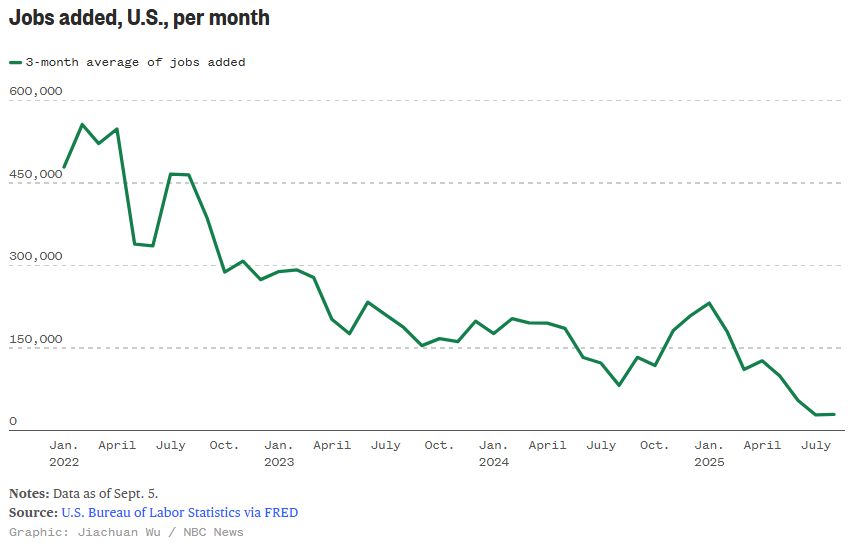

The U.S. economy added just 22,000 jobs in August. Wall Street was looking for something closer to 75,000, as July reflected around 79,000 jobs added to the labor market.

These are weak numbers all around. And they’ve been that way for a while. Over the past six months, average monthly job creation has slowed to about 60,000 jobs. That’s the weakest six-month average since 2010, excluding the COVID collapse.

Unemployment climbed to 4.3%, the highest since 2021. Wage growth slipped from 3.9% to 3.7%, while inflation is running at 2.8%. That means real wages are barely growing at +0.9%. And the revisions shaved another 21,000 jobs off the June and July totals.

That’s ugly any way you slice it.

Historically, whenever job growth slows this much for this long, the economy is either already in or is about to fall into recession.

But here’s the silver lining.

Job growth is still positive. Unemployment, while higher, is still comfortably below 5%. And wages are still rising at nearly a 4% clip.

This is a labor market that’s weakening, yes, but not collapsing.

And that matters – because the Fed has the tools to stabilize a labor market that’s on the brink. Rate cuts don’t cure outright recessions. But they can prevent borderline weakness from snowballing into something worse.

That’s exactly the setup we have today: an economy flashing yellow lights – weak enough to force the Fed’s hand, yet strong enough to recover once that stimulus arrives.

Why This Jobs Report Isn’t All Doom and Gloom

Wall Street wasted no time recalibrating expectations after this latest data.

Futures markets are now pricing in 100% odds of a quarter-point rate cut later this month. There’s even a 15% chance the Fed goes bigger with a half-point cut. And investors expect this is just the beginning, with another cut in October, followed by another in December. That’s three cuts before year-end.

And it won’t stop there. Current market pricing implies six total cuts between now and the end of 2026.

Six rate cuts in 15 months would open the floodgates, so to speak.

When the Fed cuts rates, money gets cheaper. Credit loosens. Liquidity builds. And that liquidity has to go somewhere.

Some of it goes into real estate. Some goes into business expansion. A lot of it ends up in stocks.

That’s why history is so clear on this point: outside of recessions, rate cuts are rocket fuel for equities.

- In 1995, the Fed cut rates as job growth softened. Stocks surged 25%-plus over the following year.

- After the Asian financial crisis and the Long-Term Capital Management scare, the central bank cut rates in 1998. The Nasdaq went on to post its best year ever, nearly doubling in 12 months.

- In 2019, the Fed cut rates after trade war fears slowed growth. Stocks soared in 2020 (right up until the COVID-19 crash). The S&P 500 returned nearly 30% in a single year.

The pattern is consistent: weak data sparks rate cuts, rate cuts spark liquidity, liquidity sparks rallies.

And right now, we’re at the beginning of that cycle.

Weak Jobs Data Can Fuel Bull Markets

To be blunt, today’s jobs report was the “Goldilocks bad” that investors secretly wanted.

It was bad enough to force Fed Board Chair Jerome Powell & Co. to pull out the scissors and start cutting rates – but not so bad that we need to start pricing in a brutal recession…

Perhaps the perfect setup for a 12-month meltup.

Just consider the present backdrop:

- Corporate earnings are still solid, especially in AI-powered tech.

- Inflation is moderating, running comfortably below 3%.

- The Fed is primed to cut multiple times.

- The subsequent liquidity boom will flow into financial markets, with stocks likely being the biggest beneficiaries

That’s how bull markets are born.

If history is any guide, the next 12 months could be spectacular.

The Bottom Line: August Jobs Spark Fed-Driven Opportunity

Yes, the August jobs report was ugly; the weakest in years. Stocks crashed because traders panicked in response to the headlines.

But the silver lining here should shine brightly enough for all to see.

This jobs data was weak enough to guarantee aggressive Fed rate cuts without signalling a recession. That’s the sweet spot: a setup that has powered every major non-recessionary bull market over the past 40 years.

So, we don’t think you should fear this week’s selloff. Rather, embrace it. Understand that it means we’re likely about to get multiple rate cuts, more liquidity, and more upside pressure on stocks.

The last time the Fed did this in 1998, the Nasdaq doubled in a year.

We may not see that exact outcome this time. But the direction is clear. A new bull market is brewing. August’s ugly jobs report just lit the fuse.

And if you want to make the most of the upside that’s coming, there may be no opportunity greater than that in robotics stocks.

According to Morgan Stanley, this could become a $30 trillion market over the next few decades… larger than the entire e-commerce and cloud computing sectors combined.

Why? Because humanoid robots won’t just generate videos or write code. They’ll do the jobs. Real, physical tasks in factories, on farms; in homes, hospitals, and warehouses. Every job the global economy depends on could be automated, accelerated, and made profitable at scale.

And clearly, it’s all happening faster than most expect.

See our top AI and humanoid robotics plays for 2025 and beyond.